Best UK tax software of 2025

Simplify filing your tax returns

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

We list the best in tax software for the UK, to make it simple and easy to store and manage your tax data.

With new rules and regulations coming into play across the UK to promote better transparency, keeping your accounts in order has never been so important. With MTD around the corner for many of us, we list the best in tax software for the UK, to make it simple and easy to better manage your tax affairs for HMRC.

Working for yourself or as a contractor can be challenging enough at the best of times. There’s no HR officer, accountant or secretary – it’s down to you to juggle all of the roles. The best tax software can help and ensure that you're paying the right amount of tax while making the whole process of bookkeeping slightly less arduous.

To keep your accounts up to date, you’ll need good quality billing and invoicing software or even a complete accounting software package.

Luckily, there are numerous software applications available that have been specifically developed not only to make bookkeeping and tax returns simpler, but to align with HMRC practices.

At the same time, they can also ensure you claim all of your allowances and other tax deductions, which should mean you don't end up paying too much tax.

Be sure to check that the accounting package you’re interested in using is fully compatible with HMRC’s Making Tax Digital vision as this is will be the way you'll need to work moving forwards.

With small business owners, freelancers, sole traders and, in fact, anyone who needs to file a UK tax return set to be affected by Making Tax Digital, this is particularly relevant if you have to submit VAT returns.

Here we'll look at the best in accounting and tax software, both personal and business, currently on the market in the UK.

Reader offer: 90% off for 7 months

QuickBooks' accounting software is HMRC-recognized and offers a range of smart, simple solutions for managing cash flow, sending invoices, and sorting expenses. It connects to your bank for automated real-time feeds, provides cash flow insights, and includes pre-set reports for efficient financial management. Get the deal now.

Preferred partner (What does this mean?)

We’ve also rounded up the best payroll software

The best UK tax software of 2025 in full:

Why you can trust TechRadar

Best UK tax software overall

Reasons to buy

Reasons to avoid

Sage Business Cloud Accounting is just one part of a broader ecosystem from Sage that covers tax, accountants, HR and more, and it’s a very well-known name in the UK. As you’d expect, it’s up to speed when it comes to HMRC’s Making Tax Digital campaign, while offering something for business of all sizes.

It might not be the cheapest, but you get the backing of a trusty brand and fully-featured tiers, plus Sage often has deals available on its packages, so you might be able to save a lot.

The platform provides VAT filing, invoicing, bank reconciliation and even multi-user collaboration, which is handy if there’s more than one of you or if you want to loop your accountant in on what’s going on.

Accessible via web and mobile, Sage also integrates with many UK banks for easier expense monitoring, and there’s a good degree of support too, including online, email and phone.

Read our full Sage Business Cloud Accounting review.

Sage - Best SMB tax solution for multiple users

Sage delivers a slick but simple to use accountancy package that will appeal to small businesses. The British company has been for 40 years or so, and as a result has evolved its software to suit the needs of a very diverse portfolio of customers. The great thing about this package is its flexibility and can be configured so that multiple users can make use of its many and varied accounting tools. Buy now and save 70%.

Best comprehensive UK tax software

Reasons to buy

Reasons to avoid

QuickBooks, which comes from industry giant Intuit (a famous name for US tax filing, too) doesn't just cover one tax solution because it’s actually a brand name that is applied to a variety of digital compliant software option.

There are different models that have been tailored to suit various kinds of user, right from sole traders to large organizations. Crucially, QuickBooks gets updated regularly, with a built-in income tax estimator and a new month-end tool for professional accountants recently added.

Those continuing updates also mean that you can be sure you're using a software package that functions in harmony with the latest developments surrounding tax legislation and so on.

All plans include free award-winning UK phone support, no contract, mobile apps for iOS and Android, plus free and easy data migration. QuickBooks is HMRC recognized and can be integrated with hundreds of add-ons. Then, there’s just how user-friendly the platform is, but you’ll pay the price compared with smaller alternatives.

Read our full QuickBooks review.

QuickBooks - Best tax software for all SMB needs

QuickBooks benefits from having the muscle of Intuit behind it, a large software company that has helped it become one of the leading lights in the world of accountancy software. While there’s cloud-based convenience there are also variations on the theme, depending on what kind of business accounting needs you have. Small and medium-sized businesses will find it comes bristling with lots of features. Get 90% off for 7 months.

Best cloud-based UK tax software

Reasons to buy

Reasons to avoid

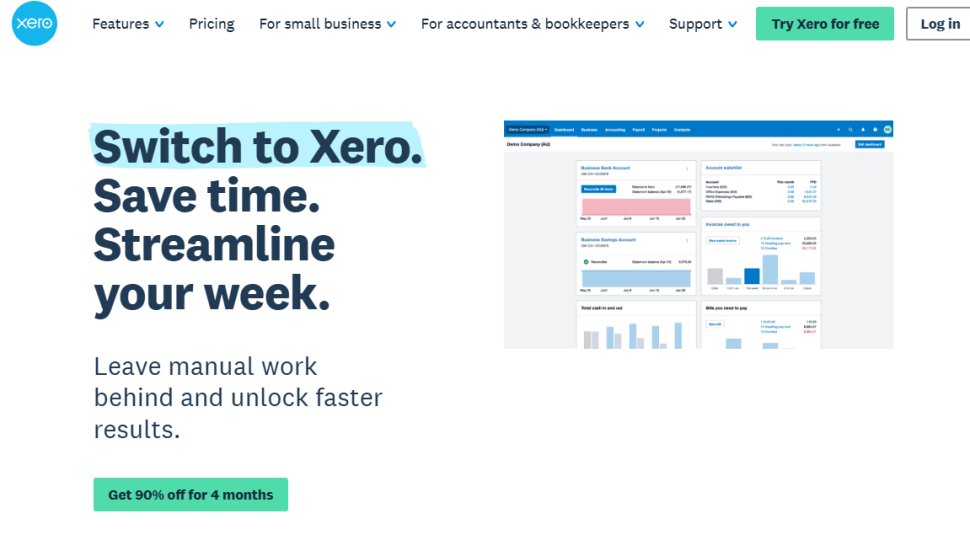

Xero is cloud-based accounting platform that lets you cover many different bases within one package, such as invoicing, inventory control, payroll and even expense claims. Usefully, Xero is also fully compliant with HMRC’s Making Tax Digital strategy, which is especially practical if you’re in the position of having to file VAT returns.

There are three different packages, but lower tiers have limitations in place like restrictions on the number of invoices and quotes you can generate.

At the other end of the spectrum, top-spec editions can handle multiple currencies. However, all versions allow you to submit VAT to HMRC for Making Tax Digital, and Xero can connect to your bank accounts to help you keep your accounting overview dynamically up-to-date ready for tax filing time.

The cloud-based software is intuitive, user-friendly and works via any desktop web browser and on any platform too. Xero also boasts a very good iOS and Android app edition, making it a solid all-round tax software solution.

Read our full Xero review.

Xero - Best SMB tax software for extra features

Xero has built up its cloud-accounting services substantially in recent years and how has an easy to use package that can be tailored to suit the needs of small business owners, accountants and bookkeepers alike. Central to its universal appeal is a simplistic dashboard design that lets multiple users makes use of its many and varied features and functions. The accountancy package is additional appealing thanks to several extra features that include expense and project tracking. Start a 30-day free trial.

Best jargon-free UK tax software

Reasons to buy

Reasons to avoid

FreshBooks is a cloud accounting solution that’s fully Making Tax Digital compliant and is aimed at small business owners of all sizes. As usual, there are a few different packages starting with one aimed at self-employed professionals.

From there, there are solutions for growing small businesses and larger companies that have growing numbers of staff. FreshBooks also has a custom pricing option for businesses that need to scale up their accounting and taxation requirements.

Credit where credit’s due, even cheaper plans are packed with features such as integration with bank accounts, practical tax time reporting and all of the tools needed to meet Making Tax Digital for VAT requirements. Move up through the packages and each one delivers more functionality as your business needs it.

FreshBooks comes with a comprehensive suite of support options, and while it can be used online on any platform via a web browser the mobile app editions for iOS and Android are also very easy to use.

Read our full FreshBooks review.

FreshBooks - Best all round tax software for SMBs

FreshBooks comes packed with great features that allow you to get on top of all your cloud-based accounting and invoicing needs. Business owners will find it easy to use, even if you’re short on accountancy or bookkeeping skills. With an intuitive interface and competitive pricing options this accountancy package can also be used from just about any location and via any kind of device. Now with 50% off for 3 months.

Best UK tax software for integration

Reasons to buy

Reasons to avoid

Zoho Books forms just one small part of a much greater business concern based in India that offers all manner of solutions for anyone and everyone. Think of it as a more affordable alternative to Sage, with a full suite of tools to help you manage your business.

With its clean and simple cloud-based interface the latest incarnation of Zoho Books makes a great cost-effective option if you’re a freelancer, sole trader or someone running a small business.

The benefit with Zoho Books is that it’s also quite scalable, so therefore offers beefier versions for those with larger business concerns, or anyone intent on expanding their operations. While the desktop route is a solid one Zoho Books also has an impressive app presence, making it a good mobile bet too.

Features like automated workflows, VAT filing, bank reconciliation and expense tracking are all there, as is a free trial if you want to try before you buy.

Read our full Zoho Books review.

ZohoBooks - Best tax software with an automated edge

ZohoBooks is just one of many different software packages available from this software publisher. It makes a great choice if you’re a small or medium-sized business owner who needs plenty of features and functions. It’s made even more appealing thanks to a high level of automated functionality. Get the Standard package for just $15 per month.

Best UK tax software for records

Reasons to buy

Reasons to avoid

Freeagent is a fully featured accounting suite that covers tax records as well. It’s a powerful, comprehensive option that suits small to medium businesses or individuals with a lot of records to keep.

You can either opt to manage everything yourself or grant your accountant access to Freeagent, with the software able to make life easier for both of you along the way.

Automatic bank feeds, project time tracking, support for invoices and payroll – they’re all there.

For tax management specifically, Freeagent keeps records of everything as you go, so you know exactly what you owe and why at the end of the year. You can submit your returns directly to HMRC through Freeagent with just a few clicks, but tax forecasting and real-time updates help warn you of any bills ahead of time.

Read our full Freeagent review.

Freeagent - Cost-effective tax plans for SMBs

Simple pricing plans made for small businesses. No hidden costs, cancel at any time. Making Tax Digital-compatible. Limited company pricing includes the option to make an annual SAVING of 45%: £145year + VAT For your first 12 months. £290year + VAT After your first 12 months.

Best UK tax software for tax-only

Reasons to buy

Reasons to avoid

Unlike Sage or Freeagent, GoSimpleTax isn't a complete accounting solution for freelancers and businesses – it focuses specifically on getting your taxes in order, and it does a very good job of this.

It means you might have to do more work that usual to keep your affairs in order, or combine it with extra software to handle other components like invoicing, but as a result it’s on the cheaper end of the scale.

The software takes you step-by-step through the process of filing your taxes, making sure you're using the right terms and preparing the right forms, and looking out for any errors that might be creeping in (which could really cost you). You'll also get suggestions on where you could make some savings, which is always welcome.

Everything slots in neatly with the online HMRC interface, so you don't have to waste time jumping from one app to another. The real benefit is the platform’s simple interface and jargon-free language – it just makes tackling your taxes that little bit more approachable.

Read our full GoSimpleTax review.

GoSimpleTax - Discounted deals on tax software

Shave money off your tax filing tasks by signing up with Gosimpletax. Currently, there's a special offer with 25% off. Start your free trial by clicking 'Get Started' or 'Buy now' on the website.

Best simple UK tax software

Reasons to buy

Reasons to avoid

TaxCalc is on a mission to make filing your taxes as simple as possible, and we'd say it's doing a pretty impressive job of it: the desktop-first software is packed with useful features for getting your documentation in order, and the system is officially recognised by HMRC, so all submissions should go smoothly.

Whether you're an individual, a limited company or an accountancy firm, TaxCalc has a software solution tailored specifically for you, and it can even plug straight into bigger accounting packages such as Xero.

While it’s not the most modern in design, the step-by-step interface guides you through the process of filing your taxes from start to finish – from picking the right form, through entering all the details about how much you've earned, to submitting the form and making sure there are no errors. The tax you owe is calculated in the background as you go.

This isn't the most comprehensive or the most well-designed tax software we've ever come across, but it is friendly, functional and accessible, and comes with all the tools you're going to need to hit that tax deadline.

Read our full TaxCalc review.

TaxCalc - Versatile tax options

You can tailor a TaxCalc package to suit your needs and therefore only pay for what you use. Select one of the options from the available versions, opting in to other features and functions if you need them.

Best basic UK tax software

Reasons to buy

Reasons to avoid

As we said at the outset, tax software packages come in all shapes and sizes, from very basic tools to get you over the line right at the end of the process, to fully fledged accounting suites that include everything you need to run a small business. If you just want some straightforward help as tax deadline day approaches, give ABC Self-Assessment a try.

Whether you're submitting your self-assessment as an individual or a partnership, or you have some other complication to contend with – you're non-resident in the UK maybe – ABC Self-Assessment will point you towards the right form.

While ABC Self-Assessment presents an interface that's not much different to the one you'll get if you log into the HMRC website and do your self-assessment there, it does streamline the process so you only see the questions and fields that are relevant to your circumstances. It's perfect if you don't want to spend much money but find the HMRC site a little overwhelming.

What you don't get are any accountancy or bookkeeping features, so the onus is on you to have kept decent records up until this point. You might find that ABC Self-Assessment works well with your existing financial software (or just your existing Excel spreadsheet).

Read our full ABC Self-Assessment review.

ABC self assessment - Flexible tax software options

Tackle your tax deadlines using the self-assessment package or try the Making Tax Digital VAT bridging software if your requirements are a little more complex.

Best UK tax software for advisors

Reasons to buy

Reasons to avoid

Crunch is an interesting proposition, especially for the likes of freelancers, contractors, those who are self-employed and small business owners, because it combines already very powerful accounting software with real accountants on the other end.

Crunch offers a free tier that allows you to try out the software with a small range of features, but you can pay for a more comprehensive system that brings all-important connections to human accountants.

The Sole Trader package provides simple online accounting software, support, HMRC registration, as well as a Self Assessment submission tool.

It might be a bit pricey, but we recommend Crunch to anyone who might not be the most experienced. Rather than paying for bookkeeping software and employing an accountant, being able to have all of this under one roof does a good job of simplifying things.

Read our full Crunch review.

Crunch - Free to start tax software

Online accounting software that comes with the ultimate feature, real experts! Expert client managers, qualified accountants, time zapping bookkeepers and payroll masters. Take a look at the pricing plans and get started for no outlay.

Best filing-only UK tax software

Reasons to buy

Reasons to avoid

TaxScouts is a super-streamlined self-assessment service that leans heavily on accredited human accountants who are there to give your figures a final look over before they submit them to HMRC on your behalf.

The platform is ideal for individuals with straightforward or mildly complex tasks who have already kept their own records (even if that’s just on a simple system), but throw too many variables at TaxScouts and it becomes less effective.

There are no subscriptions to deal with – just one flat fee for your filing – but the system lacks any sort of bookkeeping tools let alone anything more advanced.

The web interface is clean and user-friendly and there’s an app to keep an eye on notifications, too, where you can link up with your assigned accountant to discuss anything that needs ironing out before the big submission.

Read our full TaxScouts review.

Best pro-style UK tax software

Reasons to buy

Reasons to avoid

No one wants to spend an age getting their tax affairs in order, and few products take you through the process of filing returns as quickly and as simply as Nomi does. Formerly known as Nomisma, it also gives you a variety of basic bookkeeping tools, so if you're looking for something that does more than just taxes, Nomi might be it.

On the business management side, the software lets you track invoices and orders, keep on top of bills and contracts, and produce a variety of reports on the state of your financial affairs (including VAT comparisons where needed). Not only can it save you time, it can save you money by letting you know where everything is at any given point.

In the tax filing and self-assessment components, you'll find the software is fully HMRC compliant and registered with the government, so you can submit your documents without leaving Nomi. A lot of the data you're going to need can be auto-populated from the bookkeeping module, but you can buy the tax module separately if needed.

Throughout, Nomi gives you a clean and modern-looking interface to work with on the web, and if you've got a mobile phone there's an app available for keeping tabs on expenses while on the go. It can also help your accountant calculate the figures at the end of the year, if you've got one.

Read our full Nomi review.

Nomisma - End-to-end solution for business use

Nomi (formerly Nomisma) offers bookkeeping and payroll, through automated accounts and tax, to practice management. Plus end-to-end onboarding with value pricing and proposals. Plus Company Secretarial and AML. All built for practice, not just small business. All interconnected under a lovely single interface, at a lovely monthly price.

Best UK tax software FAQs

Which tax package should I choose?

There are a range of options for every level of complexity, right from very basic tax filing with no bookkeeping all the way up to fully-fledged record-keeping with bank integration and more.

We’ve all got different financial affairs to take care of, so it’s well worth picking through the different tax software packages, but remember to choose based on your needs because not all are made equally.

Using a cloud-based tax software package has become hugely popular as all of your data is stored online. In many cases you can dip in and out of your tax filing, which can be handy if you need to go away and get more information.

Tax software basically emulates HMRC forms and procedures, so that you can easily navigate tax form filling with built-in help and guidance along the way. Some tax software programs offer mobile editions, so you can even work on the go.

How do I choose tax software?

A few factors are worth considering before you pick one to take on your tax matters. If you’re one of the many taxpayers who take the standard deduction and have a relatively straightforward return to file then one of the cloud-based solutions in this guide will certainly help you to get the job done.

Those with challenging tax returns to file will need a little more software muscle, so a cloud-based package armed with more premium features might fit the bill. Again, there are rivals that largely offer the same features and functions, as you’ll see in the overview of each product above.

Factor in whether you need MTD compliance (even if you don’t yet, you will soon, so it’s worth futureproofing your system by getting on board with a compliant system now rather than swapping when the deadline arrives), and whether you need additional features beyond bookkeeping like invoicing and payroll.

Some combine tech with human expertise and real-life accountants, so if having someone to bounce ideas off sounds good, then this is the direction you should head in.

Finally, what sort of budget do you have for your tax software? There are free tax software packages, while others charge you based on the amount of features and functions you’re going to use. Meanwhile, tax software at the top of the pile lets you do everything and anything related to tax affairs, but you’ll probably pay more.

Spend a bit more and you might even benefit from being able to combine cloud-based form filling with real-time tax advice from advisors.

We've featured the best accounting software.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Dave is a freelance tech journalist who has been writing about gadgets, apps and the web for more than two decades. Based out of Stockport, England, on TechRadar you'll find him covering news, features and reviews, particularly for phones, tablets and wearables. Working to ensure our breaking news coverage is the best in the business over weekends, David also has bylines at Gizmodo, T3, PopSci and a few other places besides, as well as being many years editing the likes of PC Explorer and The Hardware Handbook.