TechRadar Verdict

GoSimpleTax lives up to its namesake to provide a truly simple approach to completing a UK tax return, at a modest price. The limitations are that there is no free tier for the simplest returns, and it does not provide further accounting options or integration to other programs to support a small business.

Pros

- +

Free trial

- +

Mobile apps

- +

Scan receipt functions

- +

Modest cost

Cons

- -

No accounting feature

- -

Lacks free tier

- -

Confusing mix of companies

Why you can trust TechRadar

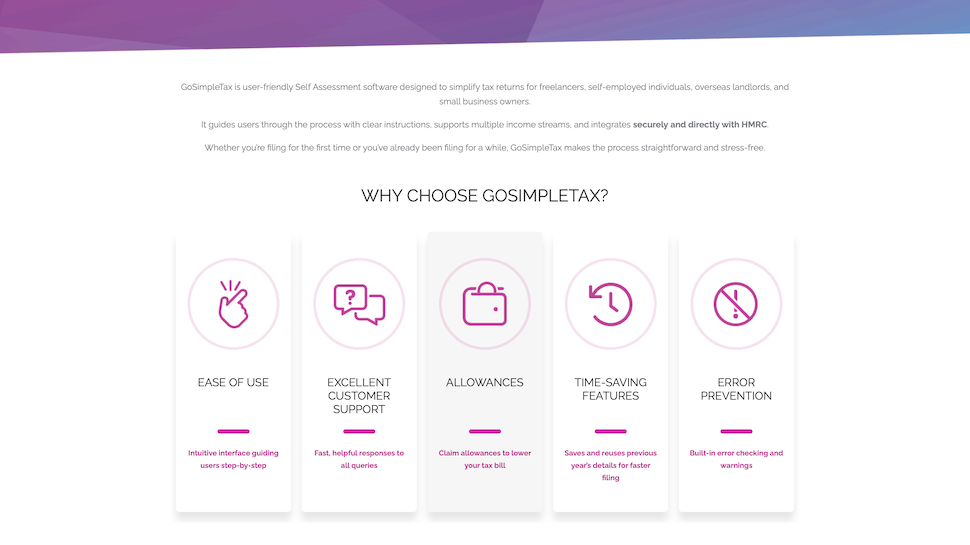

GoSimpleTax is a little different. While some accounting and tax software offerings endeavour to deliver an all encompassing approach to a small business’ finances, being all things to all people (or at least tax filers), GoSimpleTax is more nuanced. Their goal, as their name suggests is simplicity, with a laser focused tool that is designed to be stress free, and allows just about anyone to complete their tax return.

GoSimpleTax is a relative newcomer to the tax scene, having been established in 2013. While the company is a more recent entry to the segment, they are still veterans at taxes claiming over 100 years of accounting industry experience. Its software gets used by over 6,000 individuals and businesses to complete their tax returns without an accountant. Close rivals include the likes of FreshBooks, QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books and Kashflow.

- Want to try GoSimpleTax? Check out the website here

GoSimpleTax: Pricing

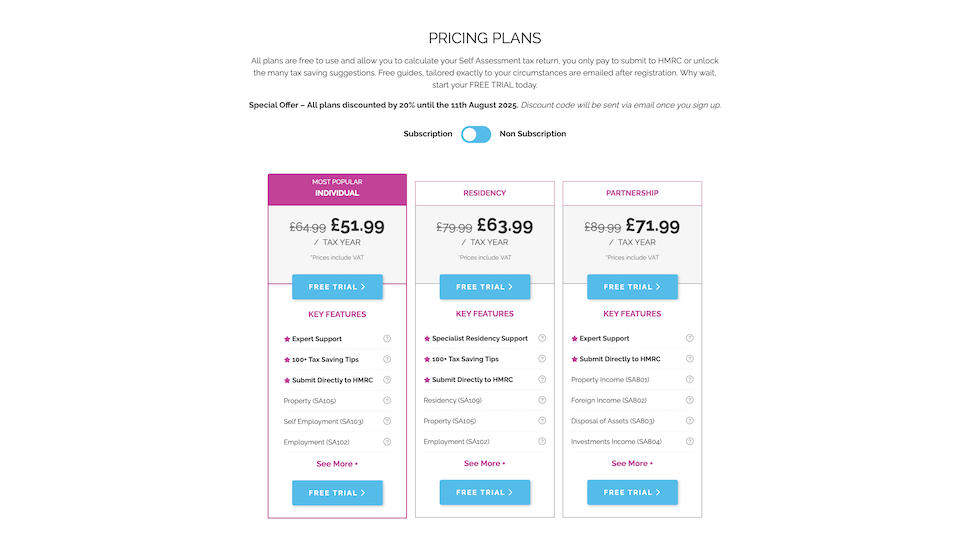

GoSimpleTax explains that it offers plans that are based on an annual subscription for one tax return, while previous or subsequent returns are charged separately. The good news is that GoSimpleTax offers a free, no-obligation trial that can be downloaded for iOS or Android.

Prices, which include VAT, start at £64.99 for the Individual plan, which includes all manner of returns including Property (SA105), Self Employment (SA103), Employment (SA102), Basic Tax Return (SA100), Ministers of Religion (SA102M), Partnership (SA104), Foreign (SA106), Trusts (SA107) and Capital Gains (SA108).

Residency (£79.99) and Partnership (£89.99) are also available, with more submission options and support, priced per tax year.

Users who prefer not to subscribe annually will have to pay £105.99 (Individual), £120.99 (Residency) or £149.99 (Partnership) per year.

There are also options for two (from £96.99) or five (from £147.99) tax returns, as well as previous year returns (£105.99 per return).

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

GoSimpleTax: Features

GoSimpleTax designed its software to accommodate a variety of users'` needs. Platform choices include a cloud-based option via a web browser interface, or apps for both the Android and iOS platforms. A major advantage of this SaaS approach is that the software can be updated at the server, unburdening the end user from worrying about any downloading and installing any updates.

Rather than completing a daunting pile of forms, this software guides a user through the process of entering their tax data into their return, with benefits of time savings, and ease of use.

A large part of filing a tax return are the expenses. Tracking them and entering them can be labor intensive, and many folks go to meet their accountant with a shoebox full of receipts collected over the entire year. One of GoSimpleTax’s innovative features is the ability to scan those receipts.

Once through the scanning process, the receipts are part of your accounting records, and ready to be uploaded to the HRMC. The receipts can also be easily categorized, and the expenditures over the last financial year can be reviewed, applied as expenses, and even can be specified as to what percentage of the costs should be applied as a tax expense, rather than for private use.

We also love live tax-owed calculations and the more than 100 tax-saving suggestions built into the system.

GoSimpleTax also checks the return for errors, ready to give notifications if a potential issue is detected, to avoid any potential penalties. It is also on the lookout for opportunities to lower the tax bill, and can create reports in an automated fashion.

Another burden of tax filing is keeping up with the deadlines to file, and pay, on time. GoSimpleTax incorporates useful reminders to help with calendar management, and make sure that all deadlines are met, to avoid any issues with late payments.

GoSimpleTax: Performance

GoSimpleTax is a powerful tool that integrates with third-party platforms, including SumUp, FreshBooks and Xero, plus it's a futureproof option for self-employed individuals who will soon be subject to MTD rules.

Users report seamless submission to HMRC and swift tax calculations, including real-time tax estimation that helps tax payers work out how much they might be liable to pay.

While it may not be suitable for enterprise-level tax operations, for typical individuals including sole traders, GoSimpleTax excels in terms of performance.

GoSimpleTax: Ease of Use

So far, so good for the interface, which appears to be intuitive and jargon-free, offering step-by-step guidance for taxpayers filling in their details who have little to no accounting background.

The mobile apps often receive praise for being user-friendly, and we found the app relatively simple to use. It changed in 2024 when GoSimpleTax paired up with small business digital current bank account come bookkeeping/accounting app Coconut, but despite a change in brand direction, the functionality remains the same.

Longer-term, slower interface changes and the somewhat confusing relationship between GoSimpleTax and Coconut removes some of that simplicity that other companies in this space can offer.

GoSimpleTax: Support

Support is available, with inquiries answered online promptly, often in an hour timeframe. However, there is no dedicated phone support.

Customers get access to expert support, with Residency subscribers also gaining access to specialist support on that topic too. There doesn't seem to be an extensive knowledge base, which means waiting for a reply to an email ticket could become frustrating.

GoSimpleTax: Final verdict

Realistically, nobody is ever going to say they enjoyed doing their taxes, but with GoSimpleTax we can certainly state that it is less of a burden - and this is about the best we can hope for.

Pluses include the SaaS approach, the modest cost, free trial, and receipt scanning functionality. However, you'll have to deal with a lack of paid plans, a dating interface and the company's confusing status and relationship with Coconut.

It also lacks broader accounting and invoicing capabilities, so you'll need to run separate bookkeeping software alongside GoSimpleTax if this is needed – and chances are, you might be able to find bookkeeping software with tax submission support built-in.

At the end of the day, for UK tax filers with a basic or intermediate return to tackle, and a desire to complete it using a choice of cross platform devices, means GoSimpleTax is a compelling solution.

- Also check out the best tax software

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.