TechRadar Verdict

Commission free trading app for novices. Comes with its own limitations

Pros

- +

No minimum deposit

- +

No inactivity, account or withdrawal fees

- +

Free stocks and ETFs trading for basic orders

Cons

- -

Buying overseas shares incurs 0.45% fee

- -

Cannot trade directly in mutual funds, bonds, options, or cryptocurrencies

Why you can trust TechRadar

Ed: Since this review of Freetrade has been published, a number of changes have been made to the service.

- Free instant execution for trades during market opening hours (not execution at 3pm each day)

- Over 1500 stocks, ETFs, investment trusts to trade

- Under "sound regulation" it's worth flagging that we are (and have been for some time) a member of the FSCS scheme that protects customer deposits up to £85,000.

Founded back in 2016, Freetrade is one of the popular UK based fintech startups. This fintech startup offers commission-free stock trading and is regulated by the United Kingdom's Financial Conduct Authority (FCA). It is considered as one of the safest platforms for trading.

Freetrade provides commission-free trading for over 600 stocks and ETFs. The free option is conditional and is available till the time you’re OK for your trades to be executed by the end of the day.

Even though Freetrade is a young brand, it is increasingly getting popular among traders. As such, you could call Freetrade a direct competitor to Robinhood.

The Freetrade app, as well as the website, is colorfully designed keeping in mind the target users - young millennial.

What does Freetrade offer?

Freetrade is ideal for UK based traders and is a mobile-based tradings service. It has apps for both the platform Android and iOS which are designed to be fast, responsive and intuitive. As mentioned earlier it has over 600 assets available for trade.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

The Freetrade app allows you to trade in popular stocks and ETFs from UK and US exchanges. However, it does not let you invest directly in mutual funds, bonds, options, or cryptocurrencies, other than ETF funds.

Cryptocurrencies especially are very popular among the young users, the target user base of Freetrade, so not being able to invest in these assets may put off some users. However, you can always request for your favorite assets to be added to the platform.

Opening an account

Setting up a Freetrade account is super straight forward. Once the app is installed, it asks you for standard identification for anti-laundering such as:

- Name

- Address

- National Insurance Number

- Proof of identity

- Proof of your address which can be your driving license or Passport

Accounts

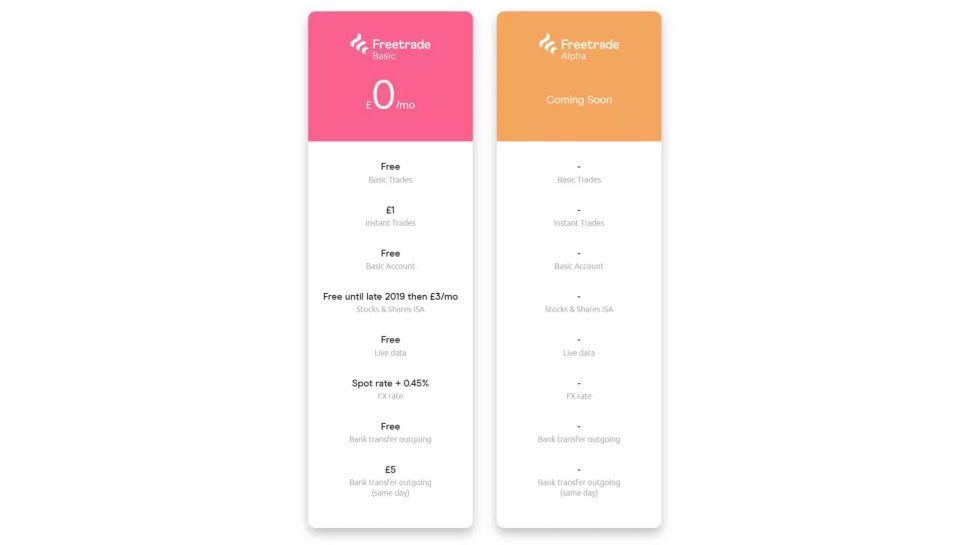

Freetrade offers an account with zero subscription fees and offers commission-free trades of stocks and ETFs.

Once the account is up, it needs to be funded. Freetrade accepts most modern payment option which includes back transfer, Google Pay and Apple pay. The funds may reflect into your account within a few minutes, however, in the worst-case scenario, it may take a few hours too.

Freetrade runs a referral scheme as well. After the first purchase, traders can refer their friends. Once these friends have signed up using the referral link and have made their first purchase, you are entitled to get a free share of up to £200. These Free shares are credited on Wednesdays.

Regular withdrawals on Freetrade are free as well, however, same-day withdrawal may be chargeable at £5 each. It also charges a 0.45% FX fee for buying shares in other countries.

Features

Freetrade offers a number of features:

No minimum deposit requirement: Even if you have £1 in your account, you can invest it right away Freetrade doesn’t have a minimum amount transaction

Fractional share trading: You can purchase fractional shares of US and UK stocks along with ETFs using Freetrade. This option allows you to purchase a share partially, which is otherwise very costly.

Zero commission trade with stocks and ETFs: You do not need to pay any commission to transact using Freetrade.

Sound regulation: Freetrade is a member of the London Stock Exchange (LSE) and is regulated by one of the top regulatory authorities, the FCA in the UK. This also means there's no dealing with third-party brokers for LSE listed stocks that would otherwise add fees to such a service.

Support

Customer support is available via chat in the app but is not available 24/7. There is no email support or a helpline number in case you want to speak live to someone.

Final verdict

While Freetrade does not have a lot of assets to trade on as compared to a full-service platform, it is still very popular among users. Millennial-friendly policies like mobile-only strategy, no minimum deposit, and commission-free service are its highlights.

Advanced traders may still not be attracted towards the service because of the lack of some important assets. Its services are mostly limited to the London Stock Exchange.

- We've featured the best forex trading apps.

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.