TechRadar Verdict

Identity Guard offers a comprehensive suite of identity protection features that set it apart from competitors like Norton LifeLock. Beyond standard credit monitoring and alerts, Identity Guard provides monthly credit reports, phishing scam blocking, and tax refund alerts. While its website could benefit from more detailed explanations, its unique features make it a strong choice for those seeking robust identity security.

Pros

- +

Family plans cover an unlimited number of children

- +

Extra alerts are helpful

- +

Transparent pricing

- +

US based customer support

Cons

- -

Slim website details

- -

Lacks a VPN

- -

Limited hours of support

- -

Slow email support response times

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

Maintaining a strong understanding of your online identity is crucial. This knowledge empowers you to effectively monitor your credit, review bank accounts, and stay vigilant against potential threats. Equipped with accurate information, you can proactively respond to and potentially prevent identity theft. The absence of such information can leave you feeling vulnerable and powerless against hidden adversaries who may impersonate you and commit crimes without your awareness. The field of identity theft protection relies heavily on the information at your disposal and the subsequent steps taken to address any issues that arise.

Identity Guard, an identity theft protection app, offers a plethora of robust features, including expert consultations for identity recovery. However, it falls short in providing detailed information about its functionality and benefits. The website, resembling an online brochure, lacks comprehensiveness. In comparison, Norton LifeLock excels in presenting clear and detailed information about how its tools protect, assist, and resolve identity theft issues. Identity Guard could greatly enhance user understanding and satisfaction by improving the website's content and incorporating more detailed explanations within the app.

Identity Guard, established in 1996, stands as a venerable entity in the identity protection sector. Its longevity in the industry speaks volumes about its commitment to safeguarding individuals' sensitive information. With over two decades of dedicated service, Identity Guard has significantly impacted protecting over 47 million identities. This remarkable achievement showcases the company's proficiency in recognizing and mitigating identity fraud risks.

Identity Guard, renowned for its commitment to safeguarding individuals' identities, has achieved remarkable success in resolving identity fraud cases. Surpassing the milestone of 140,000 resolved cases, Identity Guard's expertise and dedication have empowered countless individuals to reclaim control of their compromised identities. This outstanding track record is a testament to the organization's unwavering commitment to protecting its clients from the devastating consequences of identity theft.

Through the years, Identity Guard has honed its capabilities, developing a comprehensive suite of identity protection solutions tailored to meet the unique needs of individuals and families. Its team of highly skilled professionals, armed with cutting-edge technology and extensive knowledge, works tirelessly to detect and resolve identity fraud attempts promptly and effectively. Identity Guard's proactive approach includes continuous monitoring of credit reports, social media activity, and dark web surveillance, ensuring that potential threats are identified and addressed in a timely manner.

Moreover, Identity Guard's commitment to excellence extends beyond resolving identity fraud cases. The organization is dedicated to providing unparalleled customer support, offering personalized assistance and guidance to individuals throughout the recovery process. Its team of knowledgeable and compassionate professionals works closely with clients, providing emotional support and practical advice to help them navigate the complexities of identity theft and restore their peace of mind.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

As a result of its exceptional service and proven results, Identity Guard has earned the trust and confidence of individuals seeking comprehensive identity protection solutions. Recognized as a leader in the industry, Identity Guard continues to raise the bar for identity protection services, empowering individuals to take control of their identities and protect themselves from the ever-evolving threat of identity fraud.

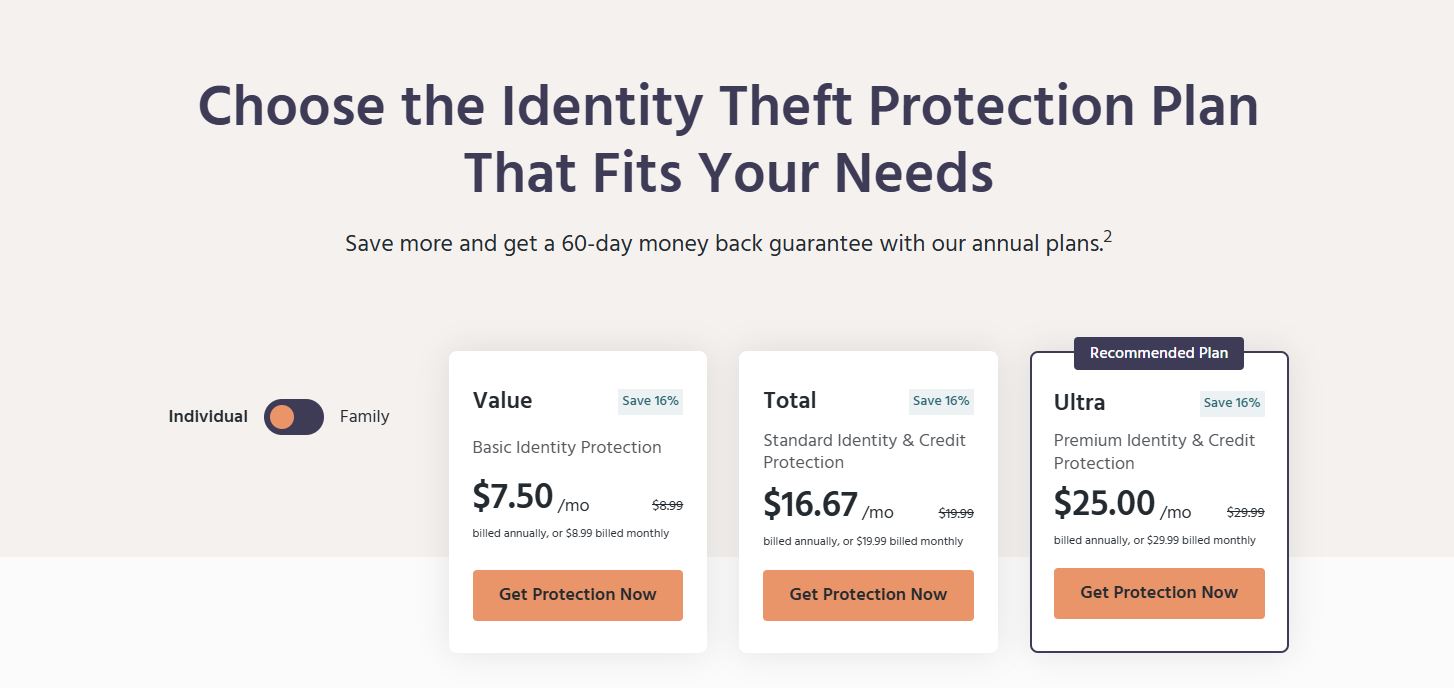

Plans and pricing

Regarding pricing, Identity Guard is transparent, unlike Norton LifeLock, which has confusing plans and tiers. Identity Guard categorizes its plans into two main groups: individual and family, with the latter being more expensive. Within each group, there are three tiers: Value, Total, and Ultra. Unfortunately, the lowest tier, the Value plan, lacks credit monitoring and an actual credit score, two essential features offered by Identity Guard. Some identity theft protection apps provide credit monitoring but don't include the full credit score. To access the credit score, users must upgrade to the Total or Ultra plan.

Value offers a budget-friendly identity protection plan at $8.99/month (or $7.50/month when paid annually). While it provides essential features like high-risk transaction alerts, a risk management score, and $1 million in identity theft insurance, it lacks more advanced options like a VPN or a comprehensive credit score. Its safe browsing extension and password manager are useful additions, but may be too similar in comparison to free browser extensions. Given its omission of a credit score, the password manager might seem somewhat superfluous to some users.

By upgrading to the Total plan, which costs $19.99 per month or $16.67 per month with an annual subscription for the individual plan, you'll gain access to a credit lock, financial transaction monitoring, and 3-bureau credit bureau monitoring, along with a monthly credit score. Furthermore, Identity Guard provides bank account monitoring as an added layer of protection.

For $29.99 per month or $25 per month on an annual subscription for the individual plan, the Ultra tier provides advanced monitoring services. These include credit and debit card monitoring, 401k and investment account monitoring, and criminal and sex offense monitoring. Additionally, premium features such as home title monitoring, USPS address change monitoring, and an Experian credit lock are included with this subscription.

In contrast to some competitors' family plans, which limit the number of children covered, the Family Plans offer the advantage of covering up to two adults and an unlimited number of children. The Value tier of the Family Plan starts at $14.99 per month, with annual discounts available.

All plans include customer support through phone or email with a dedicated case manager based in the United States. The support service is available six days a week: Monday through Friday from 8 AM to 11 PM, and Saturday from 9 AM to 6 PM They are not available on Sundays. For email inquiries, the target response time is 24 to 48 hours.

Although there isn't a free trial, the annual plans come with a 60-day money-back guarantee.

Interface

If you seek detailed explanations of every feature and a user-friendly dashboard that guides you through each step, Identity Guard may not be the ideal choice for you. The marketing department's involvement appears to have overshadowed the app's functionality. Website notifications about IBM Watson and a prominent logo on the dashboard serve as reminders of its presence, although paying customers may not fully grasp the role of this super-intelligent mainframe in protecting their identity. While IBM Watson likely correlates identity tracking information and alerts users to potential issues, the customer's primary concern should be the effectiveness of the app, not the underlying mechanisms behind its operation.

While the app highlights the fundamentals of credit scores and monitoring, offering valuable insights for identity protection, it lacks comprehensive information in other crucial areas. Notably, there's limited coverage of criminal activity, fraud, banking issues, credit card problems, and identity theft beyond credit agency reports. Furthermore, the interface falls short in providing sufficient tips and instructional resources to assist users in navigating the process and comprehending potential risks.

Features

Identity Guard offers tiered identity theft protection services, including a standard suite of monitoring and tracking tools designed for individuals concerned about their credit. The higher tiers provide additional features like a credit score check, making it easier to identify and address potential suspicious activity.

The standard entry tier of Identity Guard includes the following features:

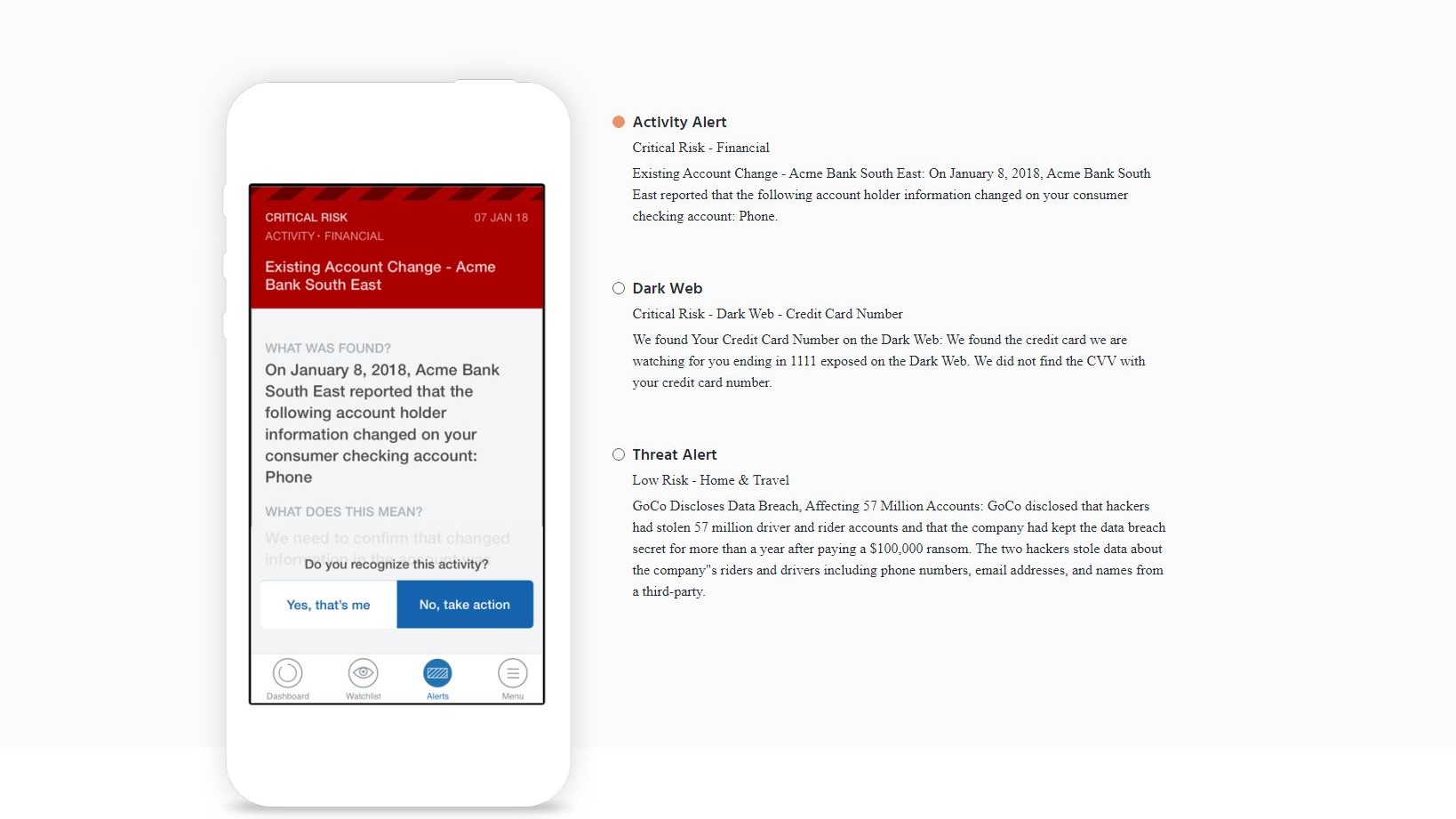

- Credit Monitoring: It continuously monitors all three major credit bureaus (Experian, Equifax, and TransUnion) for unauthorized changes or inquiries. If any suspicious activity is detected, you will be notified immediately.

- Fraud Alerts: Identity Guard places fraud alerts on your credit file, making it more difficult for fraudsters to open new accounts in your name.

- Identity Theft Insurance: This coverage reimburses you for expenses incurred due to identity theft, such as legal fees, lost wages, and child care expenses.

The two higher tiers of Identity Guard (Total and Ultra) include all the features of the standard tier, plus the following:

- Credit Score Check: With this tool, you can regularly check your credit score and track your credit history. This information can be helpful for identifying any potential problems that could affect your creditworthiness.

- Dark Web Monitoring: Identity Guard scans the dark web for your personal information, such as your Social Security number, credit card numbers, and passwords. If your information is found, you will be notified immediately so you can take steps to protect yourself.

- Identity Restoration Services: If you become a victim of identity theft, Identity Guard's team of experts will work with you to restore your identity and minimize the damage caused by the fraud.

In terms of the more basic features, the app does alert you about activity related to your bank account and other personal info, such as if there was suspicious activity over the phone where someone tried to use your bank account. The app provides consultations with experts who can guide you through any recovery or fraud remediation steps. Identity Guard doesn’t note whether these are licensed private investigators (which is the staple feature of some competitors, such as IdentityForce).

Identity Guard lacks a virtual private network (VPN) component, which is a notable limitation.

The competition

Identity Guard offers a limited user experience compared to Norton LifeLock. While Norton LifeLock provides comprehensive background material and a user-friendly dashboard to track progress in protecting online identities, Identity Guard lacks these features.

Other apps like IdentityForce excel in explaining their features but have their own drawbacks, such as hard-to-find explanations. Identity Guard's standout feature is the inclusion of an actual credit score, which can be beneficial for individuals focused on credit checks, such as those applying for a home or car purchase.

However, Identity Guard lacks monitoring for criminal activity conducted in the user's name, such as sex offenders impersonating individuals to secure loans. This limitation could compromise the overall effectiveness of Identity Guard's identity protection services.

Ultimately, users seeking a more comprehensive identity protection solution with background material, progress tracking, and robust monitoring capabilities may find Identity Guard lacking compared to other options in the market.

Final verdict

The Identity Guard website, which acts as the entry point for the app, gives the impression of haste and lack of polish. Upon arriving at the landing page, users are greeted with a minimalist design that lacks essential navigation options or information about the app's features and benefits. This omission is particularly confusing, as users may struggle to understand the purpose and functionality of the app without proper guidance. To access the homepage, users must manually delete the landing page URL, which adds an unnecessary step to the user experience. These issues collectively make it challenging for potential users to evaluate and learn about the app, potentially limiting their understanding of its capabilities and deterring them from exploring it further.

While the app does include valuable features such as credit score monitoring, there is a concerning lack of transparency regarding its identity protection capabilities. This lack of clarity leaves customers in the dark about the specific measures the app takes to safeguard their personal information and protect them from identity theft. Without detailed and accessible information about these critical aspects, users may be hesitant to trust the app with their sensitive data, undermining their confidence in the app's ability to effectively protect their identity. This deficiency in transparency not only erodes customer trust but also makes it challenging for users to make informed decisions about using the app.

We've also highlighted the best identity theft protection

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.