TechRadar Verdict

Simplicity is the key to the appeal of GoCardless with great functionality and good value for money being the main plus points of this service.

Pros

- +

Simple but effective

- +

Great for recurring payments

- +

Easy to use

- +

Decent integration

Cons

- -

Mixed opinions on standards of support

Why you can trust TechRadar

GoCardless is a business that specializes in effectively processing invoices and direct debit payments for business customers. The GoCardless system operates on a global basis and it can handle high volumes of recurring billing scenarios, with a dashboard-driven design that allows business owners to manage their customers and ensure payments for goods and services are carried out seamlessly. According to GoCardless, 1 in 12 recurring payments fail, so a system that can help limit that scenario and ensure businesses receive the correct payment on time has made this software a hit with many companies.

- Want to try GoCardless? Check out the website here

With well over 55K businesses using the service GoCardless also lists many large high-profile companies amongst its client base. Not bad, seeing as it has only been around since 2011. Adding extra appeal is the way that GoCardless can be integrated with the likes of Salesforce Billing, Zuora, Recurly and many more.

Pricing

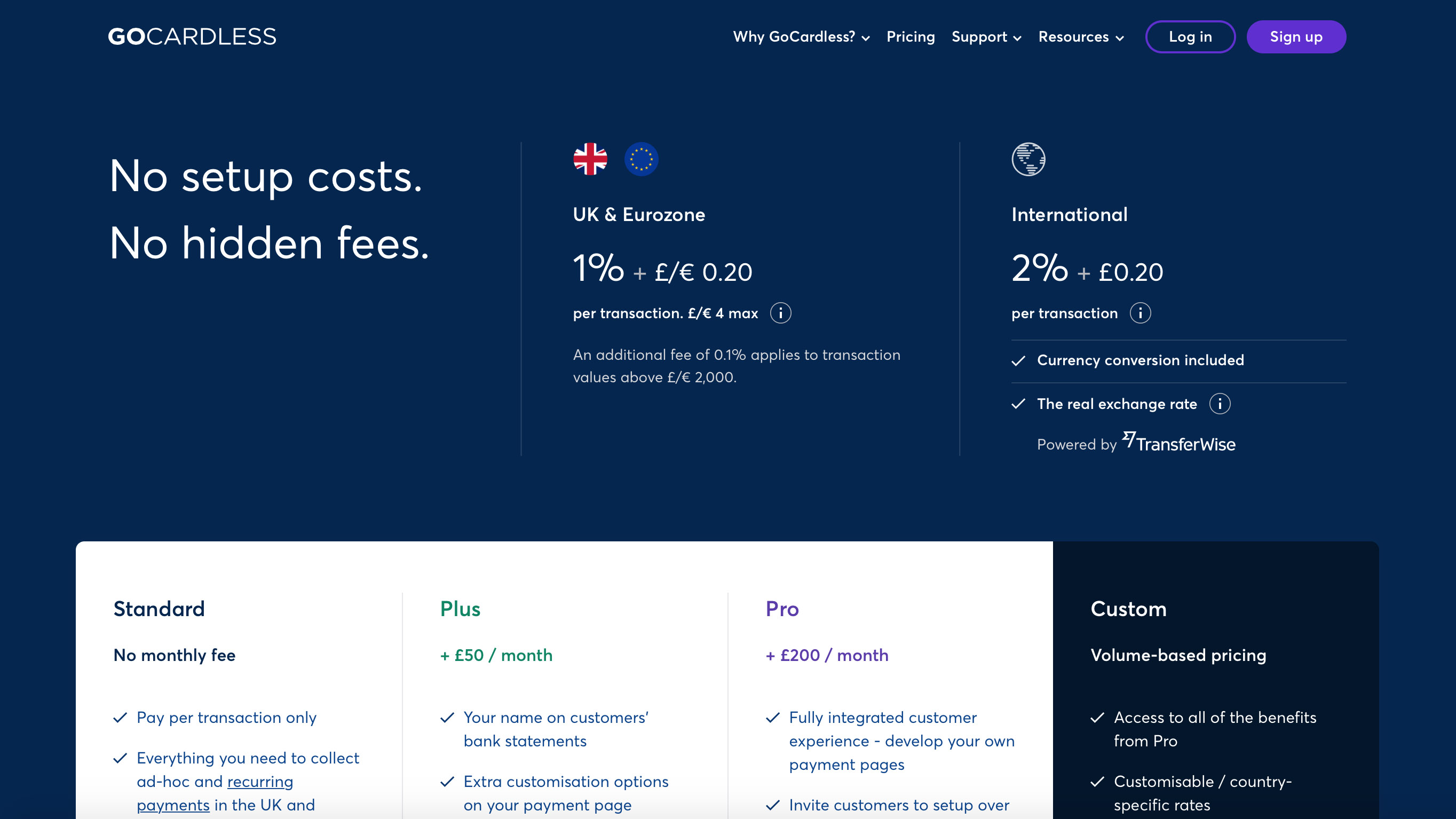

According to GoCardless there are no setup costs or hidden fees involved in the pricing structure it has, with three different packages currently being available. Standard comes with no monthly fee and works on a pay per transaction only basis.

Next, the Plus edition starts at £50 per month while a Pro option costs from £200 per month and is obviously aimed at the larger business. Per transaction fees for the UK and Eurozone are currently 1% plus £/€ 0.20 per transaction capped at £4. For transactions of £2,000 or more there’s an additional 0.1% fee on the portion of the transaction above the £2,000 threshold.

For international it costs 2% plus £0.20 per transaction, which is taken in your customers’ currency. So, by way of an example, in the US the cost is 2% plus $0.25, while Canada is 2% plus CAD 0.33 and Australia is 2% plus AUD 0.36.

Rounding out the package options is one other, the Custom edition, which GoCardless charges on a volume-based pricing arrangement.

Features

The Standard, Plus and Pro packages all share a common set of features, with the likes of access to international payments with monies collected in local currency and one-off or recurring payments being the central theme. GoCardless also lets your business collect fixed and variable payment amounts, as well as setting the date and frequency of transactions.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

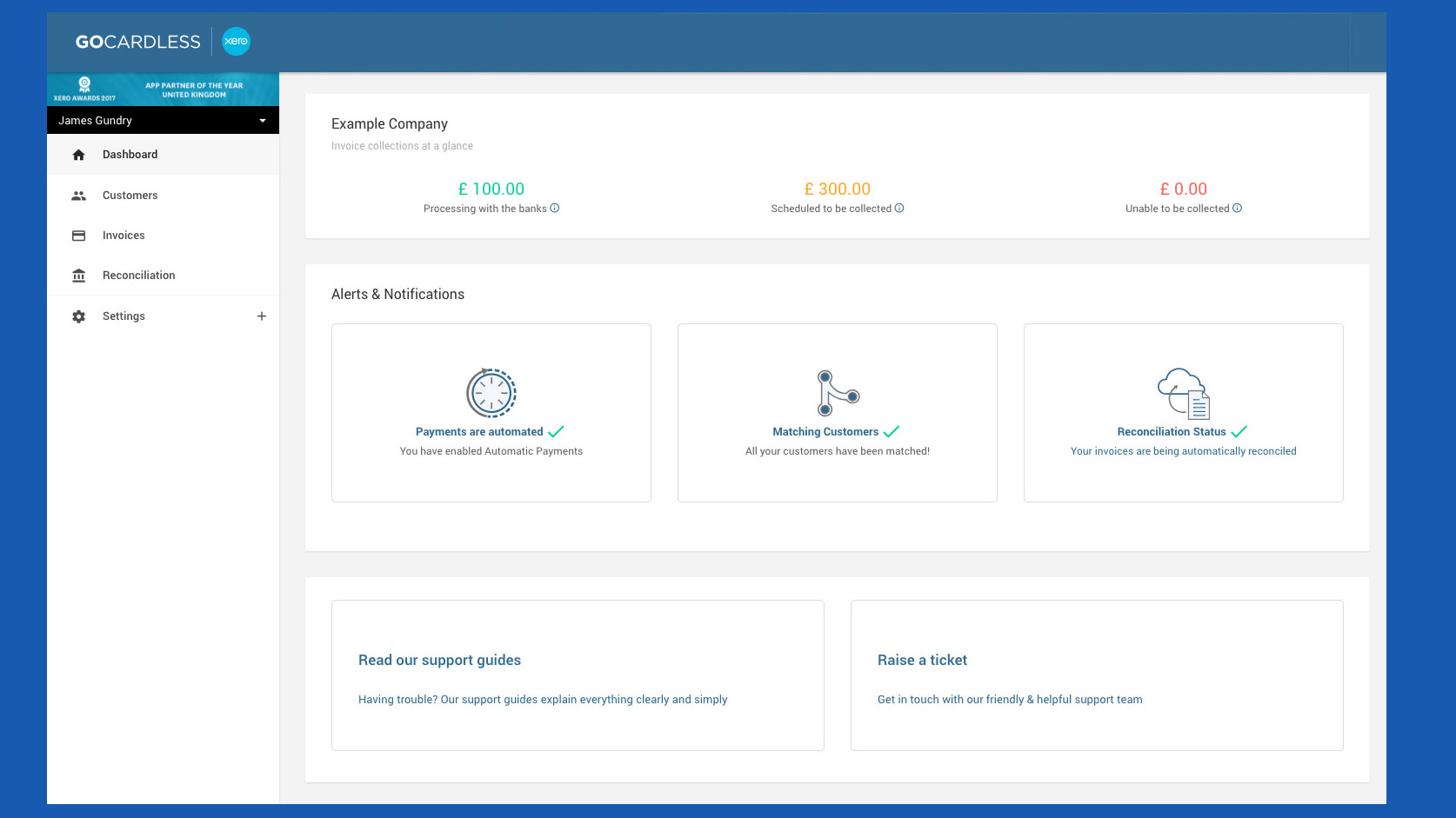

In addition, there’s the option to optimize your payment processing using the included Success+ feature. You’ll find GoCardless integrates nicely with partners too, including over 200 accounting and billing platforms such as Xero, Zuora, Recurly, QuickBooks and Sage. This allows you to collect direct debit payments alongside an existing setup. Alternatively, it's possible to just use GoCardless via the built-in dashboard.

Performance

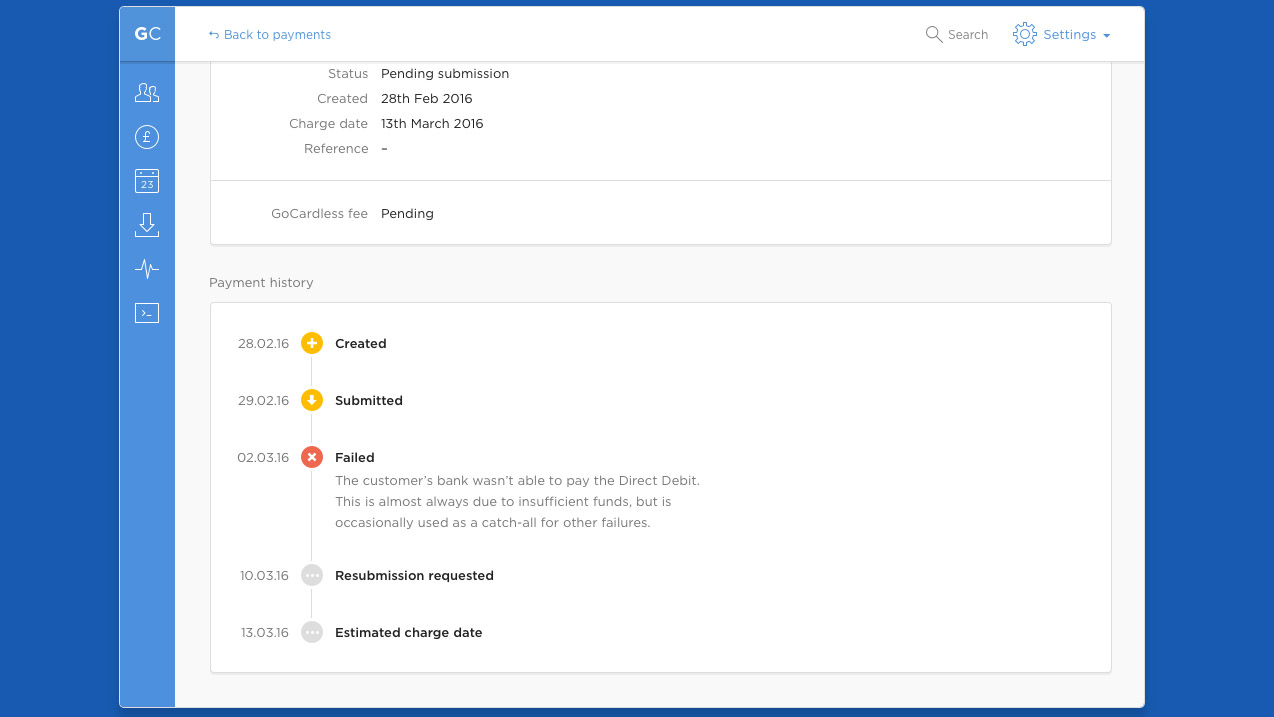

With its potent payment processing capabilities GoCardless needs to have the backup of being safe and secure. Therefore, the packages come with the benefit of being authorized by the Financial Conduct Authority. Meanwhile, payments are protected under the Direct Debit Guarantee and the service also carries ISO27001 information security management certification. A cloud-based delivery ensures that overall you should be able to enjoy a bump-free ride while you’re using the system.

Ease of use

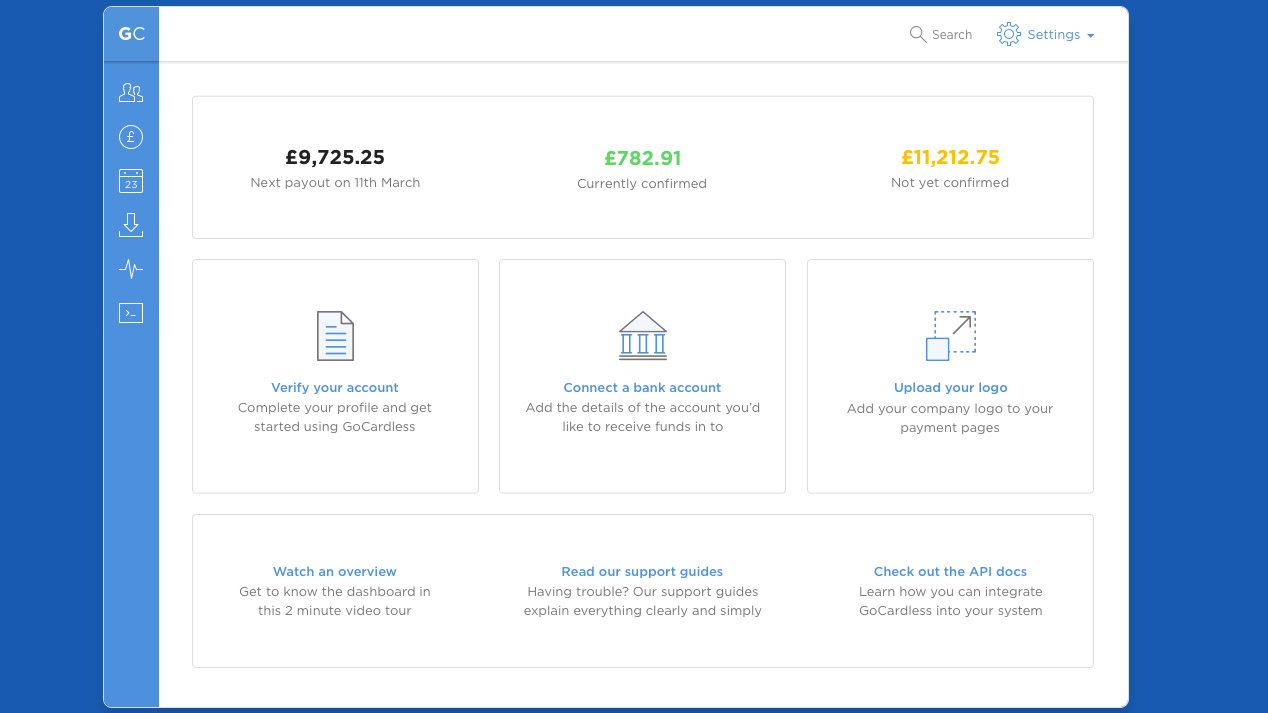

One of the highlights of GoCardless, alongside the payment processing aspect, is the straightforward way it allows you to customize and brand your content. It’s easy to produce a payment page with your logo on, and add your own colour scheme and branding touches to GoCardless payment pages and emails too.

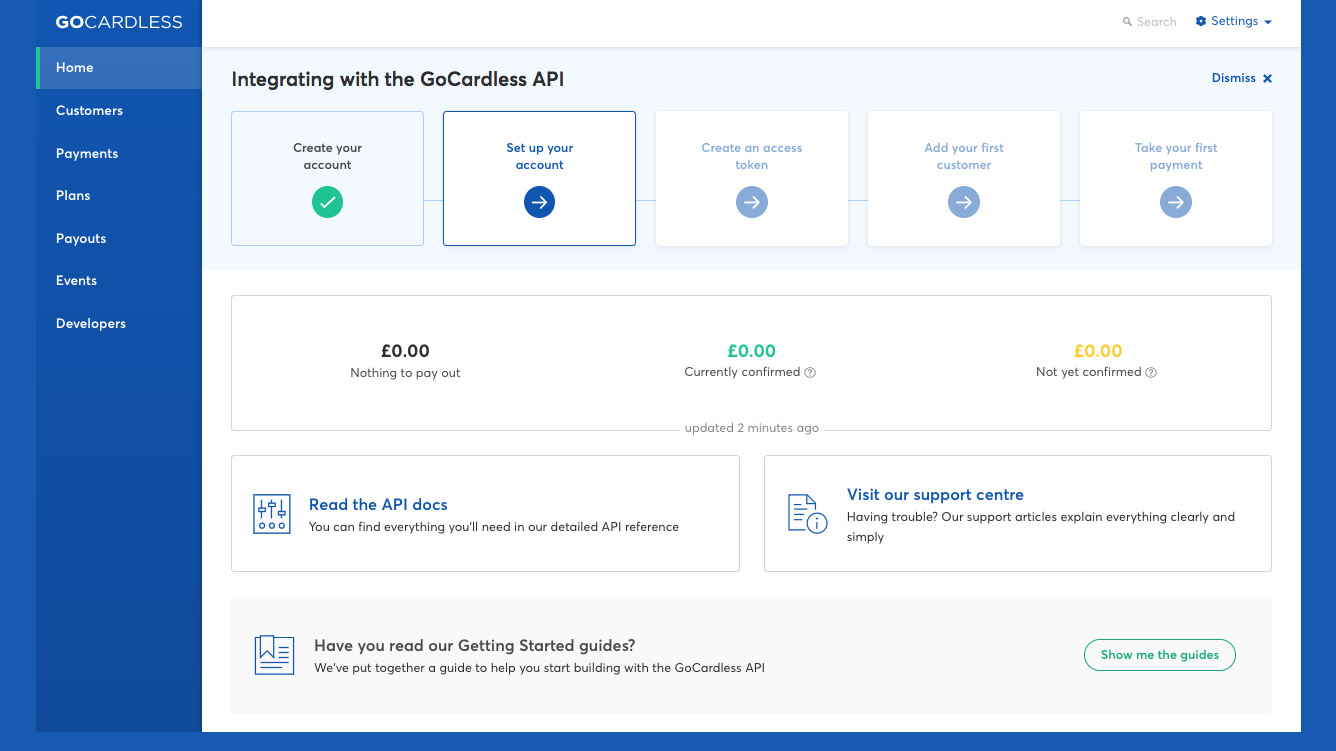

Meanwhile, the day-to-day management of features and functions is all pretty simple thanks to the central dashboard found within GoCardless, which manages to pack in all of the core menu options needed to keep business ticking over.

Support

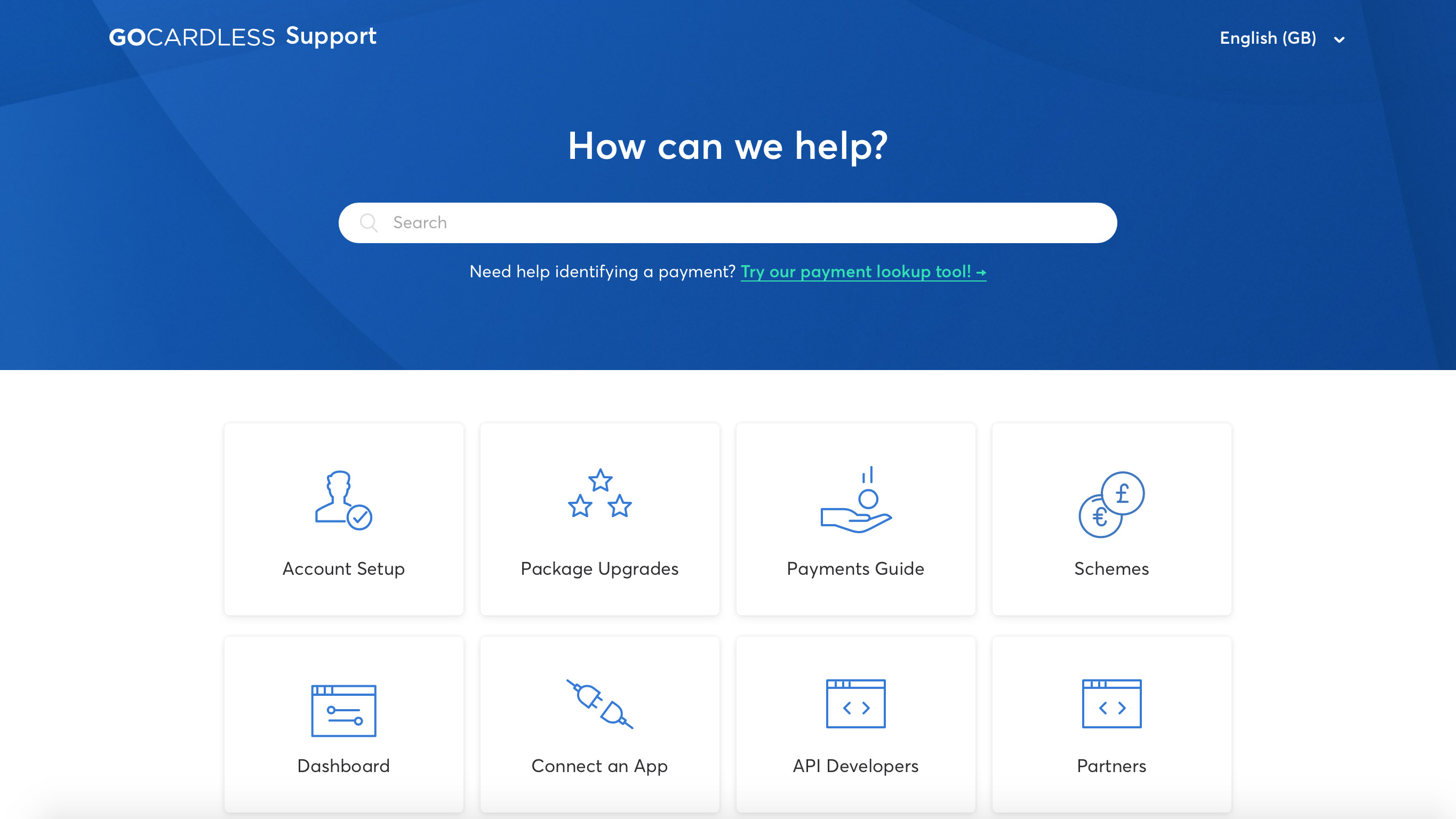

When it comes to support then GoCardless does a very good job of covering all bases. You can start off by heading to the support portal, which is the gateway to all sorts of help. For starters, there are online options, including guides for setting up your account, upgrading your package, figuring out how payments are made and insights into the central Dashboard.

You can also find out how to incorporate an app into your workflow and get useful help if you’re interested in the API side of things. GoCardless has a handy area for Merchant FAQs while you can also contact support directly for other queries.

This can be done via an online ticketing system, although the opening hours are listed as Monday to Friday 9am to 6pm PST, which is worth noting if you’re not located on the west coast or even in the US for that matter.

For localized support times simply change the site setting to your region, so you’ll get Monday to Friday 9am to 6pm UTC if you’re in London and so on.

Final verdict

GoCardless will prove to be an ideal solution for businesses that are looking to process payments on a recurring basis by using the convenience of direct debit. With its power packed performance characteristic GoCardless should help reduce payment failures while also automating many of the administrative tasks that can frequently make recurring payment processing tedious.

Usefully, once it’s been set up and is running GoCardless has the potential to reduce churn rates, and improve customer retention levels. There’s also an impressive list of other software options that GoCardless can be integrated with, meaning a simplified and hopefully more efficient workflow for business users. Add on attractive pricing and that global appeal and you’ve got a very impressive offering.

Additional business software options worth looking at include Sage Business Cloud Accounting, QuickBooks, Xero, FreshBooks, Freeagent, GoSimpleTax, TaxCalc, Nomisma, ABC Self-Assessment or Crunch.

- We've also highlighted the best accounting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.