Whodunnit: SK Hynix rejected $374 million advanced payment from Nvidia rival to ringfence HBM stock — and instead, Samsung competitor signed $749 billion dollar deal with Nvidia

Both SK Hynix and Samsung are ramping up HBM production to meet demand

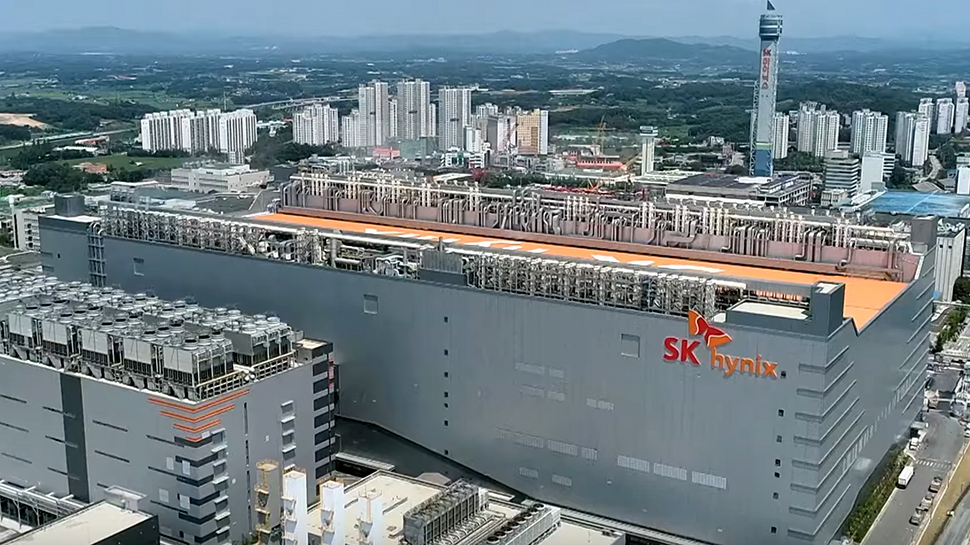

SK Hynix, the world’s second-largest memory maker (behind fellow South Korean chip giant Samsung), recently turned down a 500 billion won ($374 million) advance payment from an unnamed AI accelerator company to secure a dedicated high-bandwidth memory (HBM) production line.

Instead, according to The Korea Economic Daily, SK Hynix has committed to supplying over 1 trillion won ($749 billion) worth of HBM products to Nvidia, the leader in AI chip development.

HBM, a critical component in AI accelerators and high-performance computing, has become a hot commodity as demand for AI chips continues to surge. Nvidia’s AI chips, which are crucial in data centers and AI applications, heavily rely on HBM, making memory suppliers like SK Hynix key players in the supply chain.

AI and data center growth

Samsung and SK Hynix, the two largest DRAM producers globally, are both expanding their HBM production capabilities. Samsung is currently building a new production line for DRAM and HBM at its Pyeongtaek facility, which will supply AI accelerator chips for companies like AMD. Meanwhile, SK Hynix recently teamed up with TSMC to advance HBM development.

SK Hynix's decision to reject the offer from Nvidia's competitor underscores its strong commitment to Nvidia, which continues to dominate the AI chip market. The global DRAM market, which includes HBM, is expected to double to $175 billion this year, driven largely by the growth of AI and data center technologies.

Both Samsung and SK Hynix are set to benefit from this boom, with increasing investments in DRAM production. Samsung’s capital expenditure for DRAM is expected to rise by 9.2 percent in 2024, reaching $9.5 billion, while SK Hynix is tripling its DRAM spending to $7.1 billion this year.

As AI continues to grow, memory chipmakers like SK Hynix and Samsung are ramping up HBM production to meet the increasing demand from tech giants like Nvidia. HBM prices, currently five to six times higher than standard DRAM products, are expected to further boost profitability for both companies as they continue to benefit from the skyrocketing AI market.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

More from TechRadar Pro

Wayne Williams is a freelancer writing news for TechRadar Pro. He has been writing about computers, technology, and the web for 30 years. In that time he wrote for most of the UK’s PC magazines, and launched, edited and published a number of them too.