New technology challenges for control rooms

Developing markets are growing fast

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

The global emergency response market is made up of a huge variety of call-taking models and emergency response procedures. IHS has tracked the critical communications market for over 16 years and has examined some of the emerging trends worldwide to see what is driving change based on newly published command and control room research.

EMEA

In EMEA, there is a mixture of trends. Western Europe has a mature installed base of public safety control rooms, so its market is more service-orientated, with service revenues approximately the same as those on hardware.

However, with the current state of the economies of the region, public funding is being cut aggressively in many countries, which is having its effect on the control room market and driving consolidation of some of the smaller control rooms.

In Eastern Europe and the Middle East, IHS has observed the installed bases as growing, as new control room infrastructure is being deployed. Notably, the control rooms that are deployed in these regions tend to be larger and regionalised. IHS is predicting a significant change in the size of control room systems over the next five years, as shown in Figure A.

IHS expects consulting, as part of the service market, to grow considerably over the next five to ten years. During the research for this project, IHS noted there was increasing demand for consulting services both as part of the control room design and upgrade process and in new deployments.

These consulting services typically included design of the system, the procurement process and project management – highlighting how the increasing complexity of some emergency response systems is driving growth in the service market.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Asia

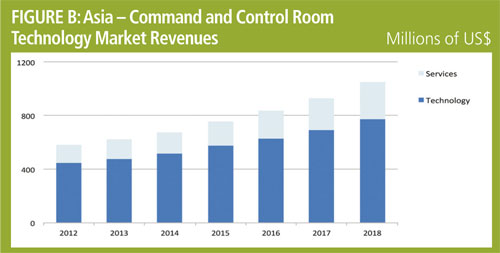

Asia is the fastest growing control room market for public safety, with its total market forecast to increase from $620m in 2013 to over $1bn by 2018, as shown in Figure B. IHS forecasts that by 2018, India and China public safety control rooms spending alone will top $500m combined, highlighting the huge growth in these countries.

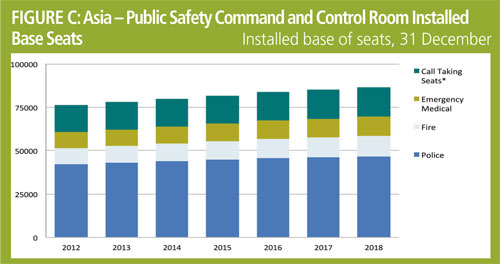

One of the largest factors has been the evolving expectations of citizens to emergency response; they are now demanding that emergency service provision be improved. IHS anticipates this will drive a huge opportunity for control room suppliers looking to enter new markets. Changes are likely to be slow, so IHS expects growth in both the installed base and revenues for the next 10 to 20 years; Figure C shows the changing installed base.

Within Asia, one of the other factors affecting control rooms was the high number of nuisance calls to some of the emergency control rooms. In India and Indonesia for example, IHS noted the tendency for nuisance calls reaching 90% of those to emergency control rooms.

This situation was highlighted in control rooms with little capacity, and only a few phone lines for genuine emergencies. It is likely that this will be addressed, with both education and legislation essential for changing understanding of the use of emergency numbers, so civilians use them only when an emergency response is required.

Latin America

The Latin American market is a fascinating example of the evolving emergency response market, with huge investment in countries such as Brazil and Mexico. Across the region, there is a mixture of call-taking models in operation, with some of the more developed countries deploying larger capacity urban control centres with advanced technologies.

High crime rates are a problem in some regions, so there is focus on deploying CCTV, as this has been shown to reduce crime rates.

As a result, there is an increasing trend for converged capability control rooms — where both emergency response and CCTV feeds are handled at the same location.

Although currently there is little integration between the two, IHS expects to observe increasing integration of CCTV and the emergency response process.

In countries with little emergency infrastructure, law enforcement may be the only public safety agency that is available with some capability of emergency response.

In some parts of Latin America (and in some other regions such as Asia), the installed base of control room seats for law enforcement agencies is much higher than for emergency medical response and fire services, as seen in Figure D.

In Latin America in particular, improving law enforcement has been one of the key trends dominating the market — with increasing attention on understanding control room operations and optimising processes.

There is a focus on better evidence management and records management, and recording software are forecast to grow quickly over the next five to ten years.

North America

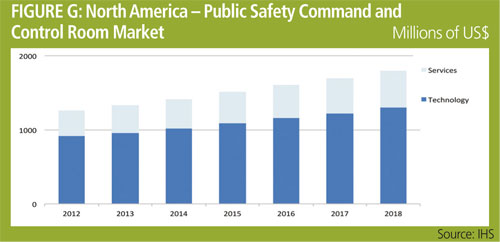

The North American command and control market is one of the largest worldwide, thanks to the hugely fragmented installed base in the US, with over 6,000 PSAPs (public safety answering points). Across regions there are different approaches to emergency management, with varying levels of integration between agencies.

In the US there is a mixture of multi-agency and single agency deployments. Figure E shows the forecast change in the installed base over the next five years. The major trend in the US is consolidation, where smaller control rooms are being combined to form larger control centres, often covering several municipalities or regions.

There is a long-term cost advantage to this, as well as the improvement operationally, with more regions being better able to work together should the need arise. IHS observes both single agency consolidation and multiagency, where several different agencies can be collocated in the same centre.

As part of the IHS research into the command and control room industry, an in-depth user survey is conducted, particularly focusing on the North American public safety control room market. The public safety market is currently being driven by a number of factors.

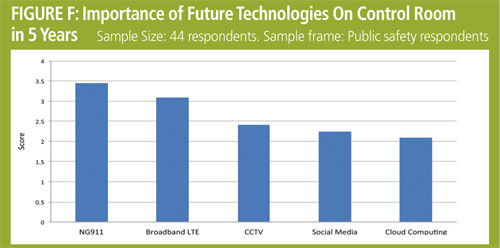

IHS asked respondents from the North American market about the impact of future technologies on public safety control rooms. From the results (figure F), it can be seen that NG911 is most likely to affect control rooms within five years, closely followed by broadband LTE. CCTV technology also scored highly, and IHS forecasts that increasingly, CCTV technology will be taken up over the next 10 to 20 years, particularly in the larger urban control rooms. This further links in to the idea of ‘Real Time Intelligence Centres’ where it is likely that analytical technology will be used increasingly, with the idea of more dynamic resourcing based on predictive policing.

Despite some of the funding issues, particularly in the US market, IHS expects steady growth over the next few years, as investment is made not only in rolling out new technologies (such as broadband and NG911) but also in consolidating control rooms. Figure G shows the IHS forecast for control room technology and service spending in the North American market.

Broadband technology

One of the largest challenges for control rooms is the use of broadband technologies in critical communications; private LTE networks for public safety pose a real challenge for control rooms to adapt to the changing critical communications market.

The US has led the way in the field of private LTE for public safety, with both spectrum and $7bn of federal funding allocated to a nationwide broadband network. This network aims to facilitate a huge range of data capabilities for public safety users, including access to video streaming, maps and photos.

However, while this will impact communications from a first responder perspective, it falls to vendors to provide solutions for control rooms that will facilitate data exchange between the caller to the first responder, while being able to absorb the information relevant for the dispatcher.

Social media

One of the key future challenges is how to effectively integrate and use information from social media in the emergency response.

First, there is a challenge in developing intelligence and analytics solutions to process information and trends occurring on social media perhaps to analyse events, anticipate incidents or to capture real time information on ongoing emergencies.

Longer term, another stream that social media could take is as a reporting mechanism to the emergency services, very similar to the 911/999/112 emergency calling functionality; here civilians would be able to report incidents over social media rather than dialling the traditional emergency numbers.

Some prototype solutions are already being developed for this market. However, it remains to be seen whether this is something that will be realistically implemented globally. That said, it is inevitable that public safety agencies will have to respond in some way to the growing expectations and use of social media by ordinary citizens.

To summarise: the command and control industry for public safety is a diverse and evolving market with huge potential for suppliers. Depending on the region, different trends are driving change, with shifting expectations of citizens now a key factor driving investment in some emerging economies.

Similarly, the service aspect of developing markets continues to grow, whilst making up a major portion of the more developed emergency response infrastructures.

Longer term, developing products that are future ready, forming strategic partnerships with other suppliers and responding effectively to the changing dynamics of this market are the fundamental ways for companies to succeed in this sector.

Jennifer Shortland produces reports on the global command and control room industry for public safety, transportation and utilities. jennifer.shortland@ihs.com

Image Credit: NakoPhotography / Shutterstock

Désiré has been musing and writing about technology during a career spanning four decades. He dabbled in website builders and web hosting when DHTML and frames were in vogue and started narrating about the impact of technology on society just before the start of the Y2K hysteria at the turn of the last millennium.