TechRadar Verdict

The SumUp family of products and services continues to impress with its low cost and stress-free usability. If you’re looking for an in-house supplement to its mobile payment processing appeal then the SumUp POS system is a great choice.

Pros

- +

Simple to use

- +

Low fees

- +

Excellent app

- +

Good support

Cons

- -

Less visible presence in the US

Why you can trust TechRadar

SumUp POS is one of the quickest and easiest ways of boosting your business, with the added bonus of little in the way of hoops to jump through. The UK-based mobile point of sale (mPOS) concern is already popular with many businesses thanks to its other products and services, which include the Air Card Reader and the 3G Card Reader.

The former lets you use this natty bit of tech by mating it with your smartphone in order to accept mPOS payments, which is handy during the coronavirus crisis. The latter allows you to process payments on the go using mobile network connectivity. Another option however, is this, the SumUp point of sale hardware, which can be teamed up with the SumUp app to beef up the selling power of your business.

Other services worth looking at include Shopify, AirPOS, Lightspeed POS, EposNow and Square POS.

- Want to try SumUp POS? Check out the website here

SumUp POS: Pricing

SumUp POS has quite a lot of appeal as it doesn't carry a monthly cost. In the UK, where SumUp is headquartered, you get the easy option of one fee per transaction and with any type of card. Therefore, you get zero monthly costs and just a 1.69% transaction fee.

Adding further weight to the potential of SumApp is the app and POS hardware combination that gives you a physical device for processing payments, which currently costs £139 and includes a SumUp Stand, Air Card reader and charging station. Sold on its own, the SumUp Air Card reader, which allows you to take payments in tandem with your smartphone costs £59 and if you want that with the accompanying cradle then it’s £69.

The SumUp 3G card reader is currently £99 while the docking station, which lets you print receipts and keep your card reader charged is £169 (though currently £129 for a limited time offer). All prices exclude VAT.

In the US, there’s a counterpart, the SumUp Point of Sale, which says the company is powered by the SumUp app. Again, there are no monthly costs and a 2.65% charge per transaction.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

SumUp POS: Features

The SumUp POS terminal concept, and indeed the other products in the range, certainly makes a change from many of the other humdrum chunks of hardware out there. There’s a SumUp stand, which in effect is a sustainably sourced and neatly styled bit of kit to hold a tablet.

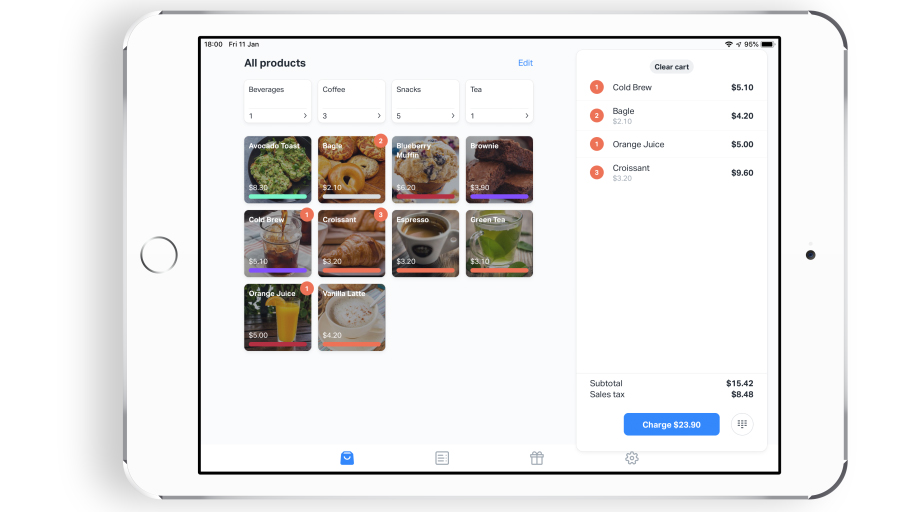

There’s also the Air Card Reader, which will let you accept major debit and credit cards, including contactless Chip & PIN, Apple Pay and Google Pay. You can also make use of the SumUp charging stating, which ensures your terminal is ready to go at any given time. In terms of functionality then the SumUp POS revolves around the supporting app, which if you activate the Product Catalogue allows you to utilize it as a point of sale solution.

The Product Catalogue lies at the heart of the SumUp POS system as it lets you create, manage and customize all of the products and categories in your business. The functionality therefore includes everything needed to itemize your stock, such as pictures, prices and descriptions.

SumUp POS: Performance

SumUp is all about speed and convenience, which is echoed by the super-speedy way you can sign up for an account and order your terminal within 5 minutes. In terms of payment processing then SumUp POS is able to handle Visa, V Pay, Mastercard, Maestro, American Express, Apple Pay, Google Pay, Diners Club, Discover and Union Pay.

All of these benefit from the SumUp policy of not having any fixed or recurring costs, so you just get charged a small fee per transaction. Performance on all fronts, no matter which route you take, appears to be pretty impressive.

SumUp POS: Ease of use

Like some of the best POS systems, SumUp POS have done a fantastic job of creating a range of easy-to-use hardware that makes getting to grips with the whole point of sale process a doddle.

Not only has the tech been designed and put together with ease of use at its core, the supporting app is also perfect for people who might not normally enjoy the task of processing payments.

SumUp POS: Support

Much like its hardware and app, the support from SumUp POS looks to be in very good shape too. The website, by way of an example, has an entire Help area that contains a mountain of great information in relation to every aspect of the customer experience.

There are invaluable guides on setting up the card reader and other POS tips and tricks. You also get valuable insights into security and account information. If you don't find what you’re looking for there then real-time help comes in the shape of phone support Monday to Friday from 8 to 7 and Saturday from 8 to 5. You can also chat with the team during the same hours, or email them with a query.

For the US, there’s live support via a toll-free number that covers weekdays from 9 to 7, along with an online support center and help email address.

Final verdict

The SumUp POS solution makes a great supplement to the other products and services in this impressive mPOS range. A lot of thought has clearly been put into the useability of the tech here, with little in the way of challenges facing anyone new to the word of POS kit.

The app is also especially impressive, while the other big bonus with SumUp is the smaller overheads that are involved. Indeed, if you’re a smaller business looking for a quick and easy payment processing solution then SumUp and the associated POS hardware makes a great way to turn your venture into a much more versatile operation. And, realistically, for very little in the way of outlay at that.

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.