TechRadar Verdict

The original Classic incarnation of Money Dashboard has been distilled into a more simplistic though feature heavy app that shows plenty of early promise.

Pros

- +

Free to use

- +

Chunky new features

- +

Good level of support

Cons

- -

Some users reporting bugs with Neon

Why you can trust TechRadar

Money Dashboard Neon is a newly released successor to the original Money Dashboard Classic, which was in itself a pretty big hit with folks who needed to keep tabs on their cash. Indeed, along with a complete spread of features and functions, Money Dashboard Neon adds in really useful bonus features, especially in the way that you can now move money between accounts. Especially useful during coronavirus.

Aside from that, the application lets you connect all of your bank accounts and credit cards in order to get a much more detailed overview of your finances. If you're looking to manage and save money then Money Dashboard Neon might be the software to help you get things off on the right footing.

However, the new app does seem to be garnering criticism for its overtly simplistic approach compared to the original, so read on to see if the successful formula has been compromised. Other similar personal finance packages include Mint, You Need a Budget (YNAB), AceMoneyLite, Money Dashboard or Moneydance if you want to check those out too.

- Want to try Money Dashboard Neon? Check out the website here

Pricing

You can get Money Dashboard Neon as a web app or for any mobile device by downloading it from the App Store or Google Play. While you can use the app for free it is worth noting that the service does obviously need to make money, so it’s a market research tool for the creators that in many ways seems to use you as the guinea pig.

Money Dashboard also says that it may make suggestions for products and services such as credit cards, home loans and insurance. As a result, it may receive a fee from the product provider. If you have no problem with that then you’ll find that Money Dashboard Neon boasts quite a lot of usefulness in return.

Features

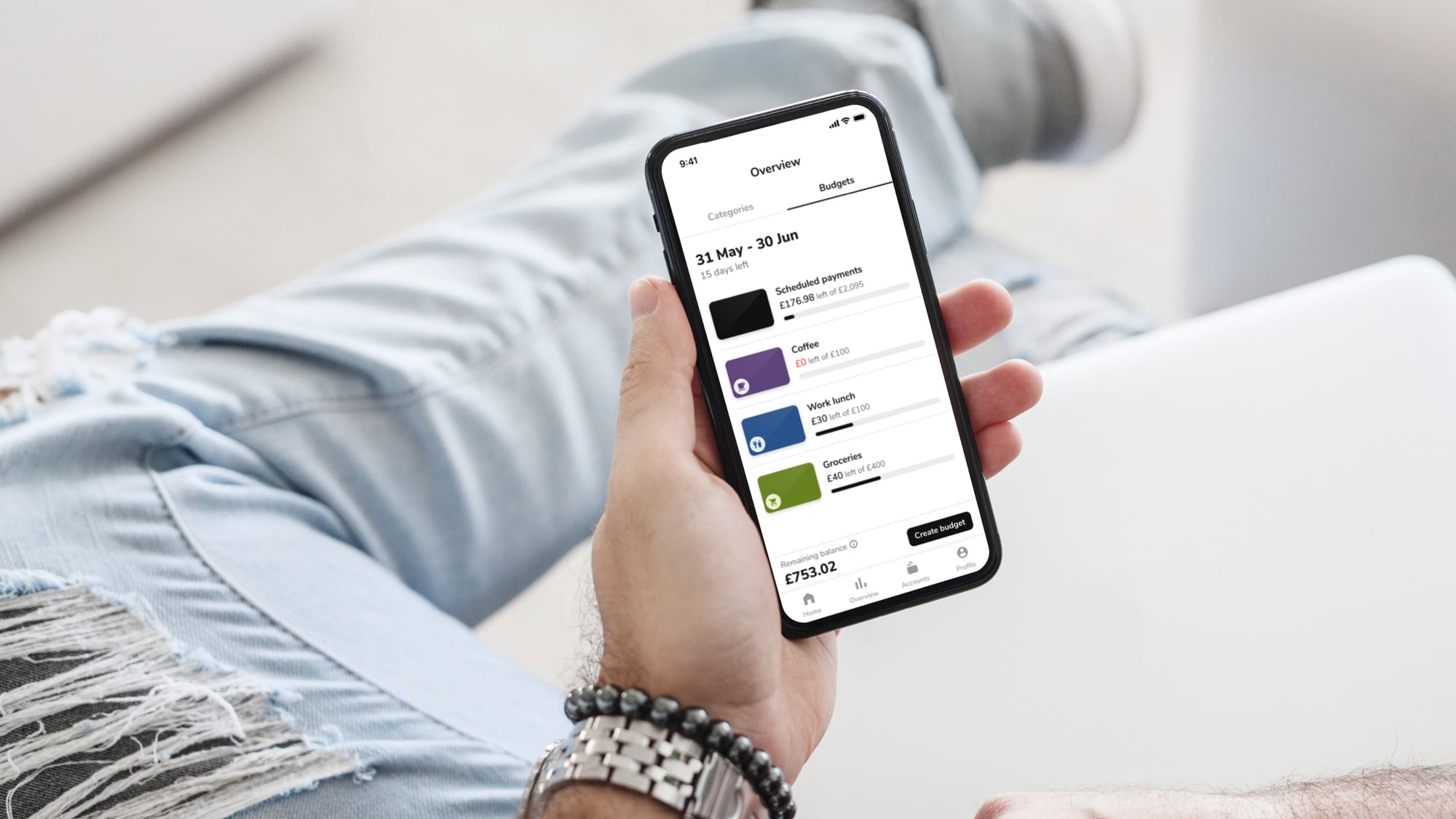

The original Money Dashboard app had a nice line in features for managing your money and budgeting for the future. Now Neon takes things a step further, with a more advanced feature set, plus more power tools that ultimately mean you can tweak your finances with even more precision.

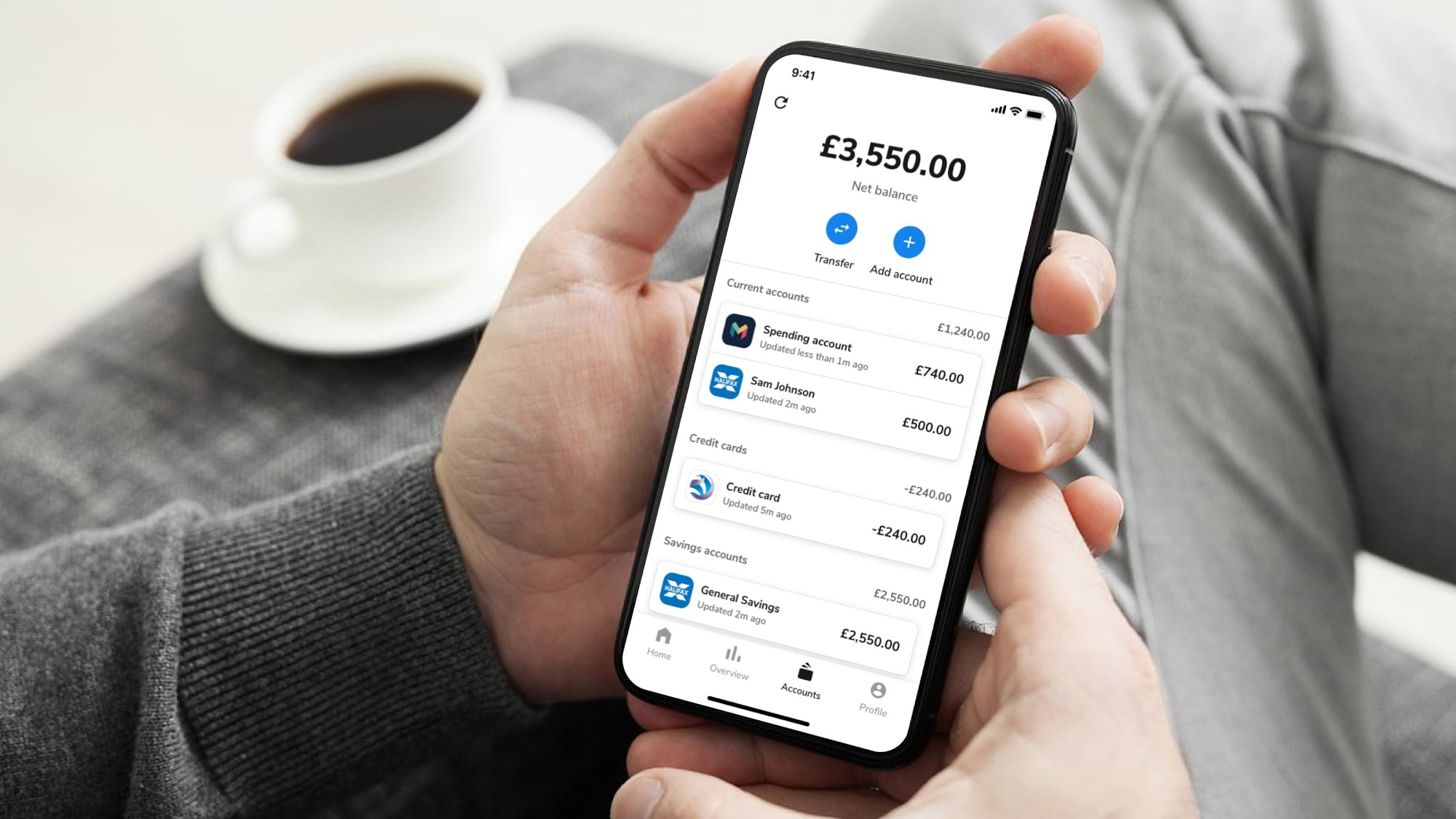

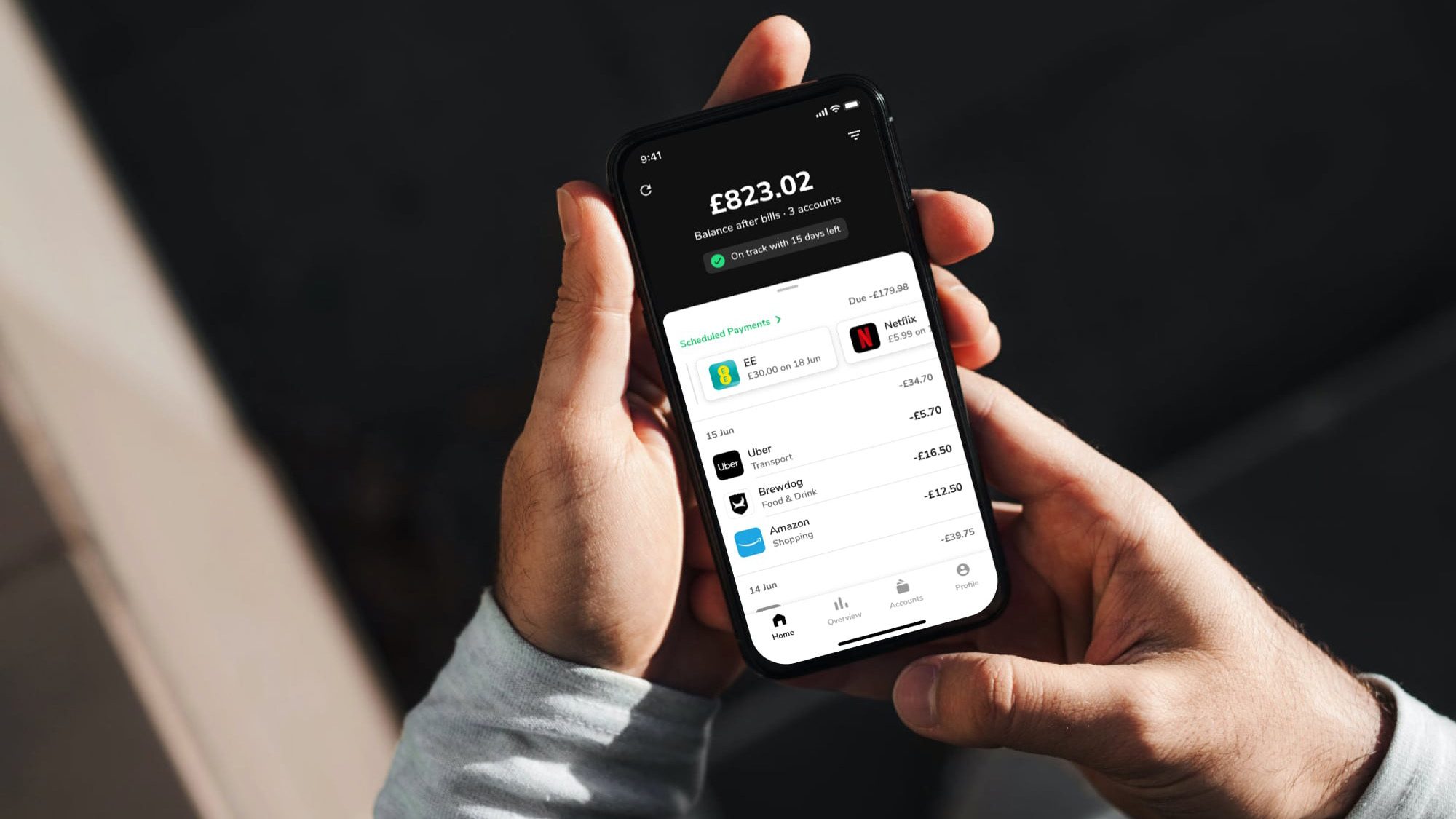

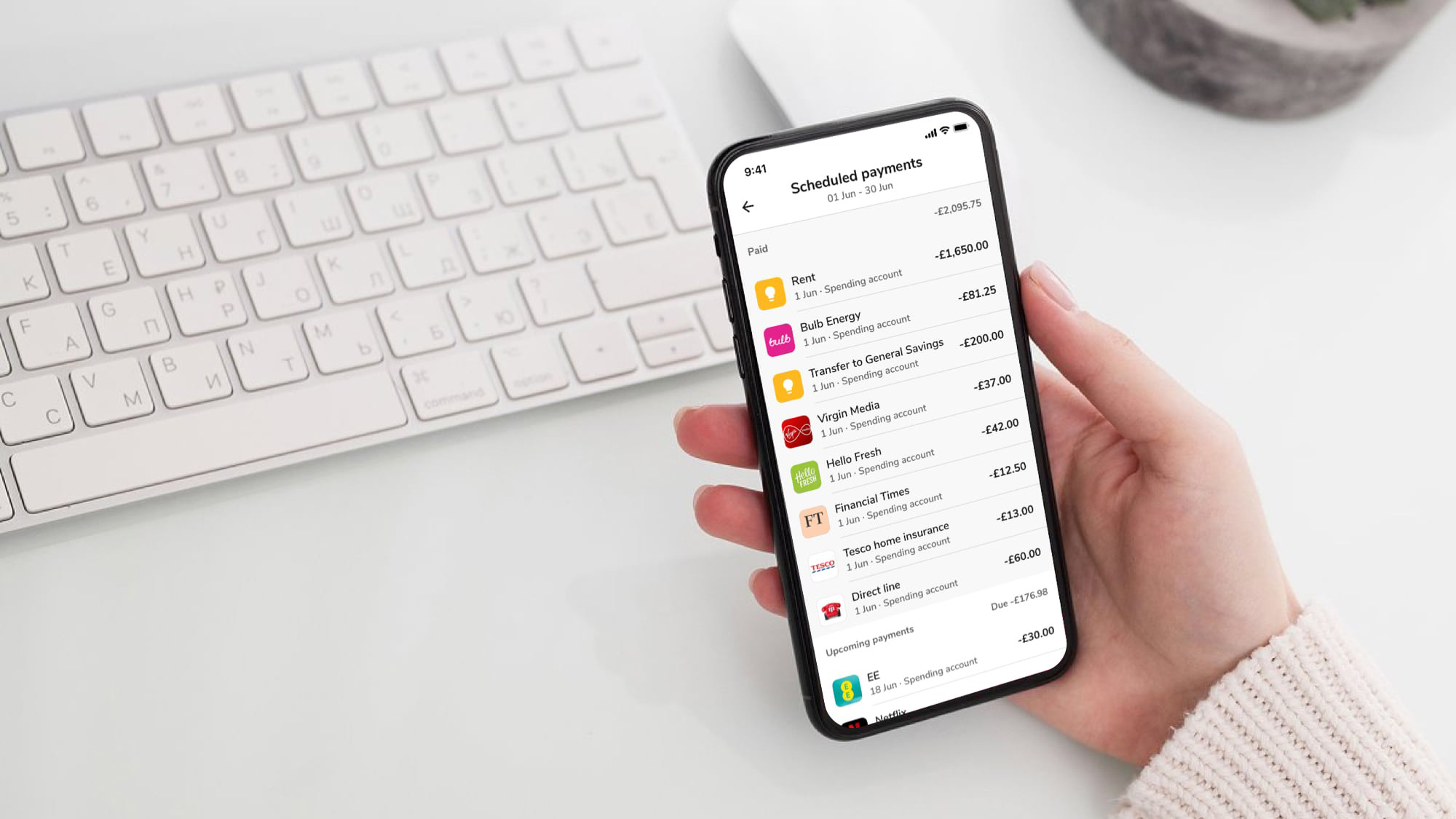

Managing all of your bank accounts and credit cards in one central location is perhaps the main appeal of Neon, with the option for connecting to all of your accounts too. The Balance After Bills is neat feature that shows how much you’ve got left until payday after calculating all of your other outgoings.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Fine-tuning of things like savings management, thanks to the ability to move money between accounts, can quickly help you to adjust your cash management so you’re getting the best deal on any savings. Money Dashboard Neon is also set to let you open new savings accounts and also secure loans, directly from within the app itself.

Performance

The new edition of Money Dashboard now boasts even better performance than before, especially when it comes to connecting to a wide variety of banks. Bank of Scotland, Barclays, Clydesdale, First Direct, Halifax, HSBC, Lloyds, Monzo, Nationwide, Natwest, RBS, Revolut, Sainsbury’s, Santander, Tesco and TSB are just some of the options on offer.

In fact, it's possible to connect to over 40 different financial institutions, which makes the convenience factor better than ever. Money Dashboard Neon is available for all mobile devices too, so it’ll work happily whatever gadget you might be using.

Ease of use

You’ll find that Money Dashboard Neon continues the theme that was used so well for the app interface in the original software. We love the quick and easy way you can pick your way around the features, dipping in to more detail as and when it’s needed. The app is certainly no slouch when it comes to performing well, but it's also easy to use.

The way Money Dashboard Neon lets you manage every facet of your money while you're on the go is a real bonus. Where once you'd probably prefer to wait until you get home and do it all from your laptop the interface is now so clean and easy to get around that pretty much any financial chore can be tackled, even if you’re out and about.

Support

As was the case with the original edition of Money Dashboard, the Neon version comes with the same solid support options. There’s a whole chunk of the Money Dashboard website that's been tailored to helping anyone who needs assistance. There are basic FAQs, a community area, a dedicated Help Center along with options for contacting support directly too. All in all, Money Dashboard Neon seems to be every bit as customer-focused as the previous edition was.

Final verdict

Money Dashboard Classic was a fine personal finance app that was aimed primarily at users in the UK. It has gone on to help over 600,000 consumers, while the new and improved Neon edition looks to take those numbers up still further. With a noticeably advanced array of features the software is now more adaptable than ever.

The designers have done another great job with the interface, there’s the ability to connect to a huge selection of financial institutions through open banking while it’s safety and security features look to have been fine-tuned. Indeed, Money Dashboard Neon is FCA authorized and regulated, is supported by ISO 27001 certified services and boasts 256-bit encryption. Biometric security features as extra appeal.

Put it all together and this edition of Money Dashboard dazzles, despite some users sounding rather less enamoured by its overhauled charms.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.