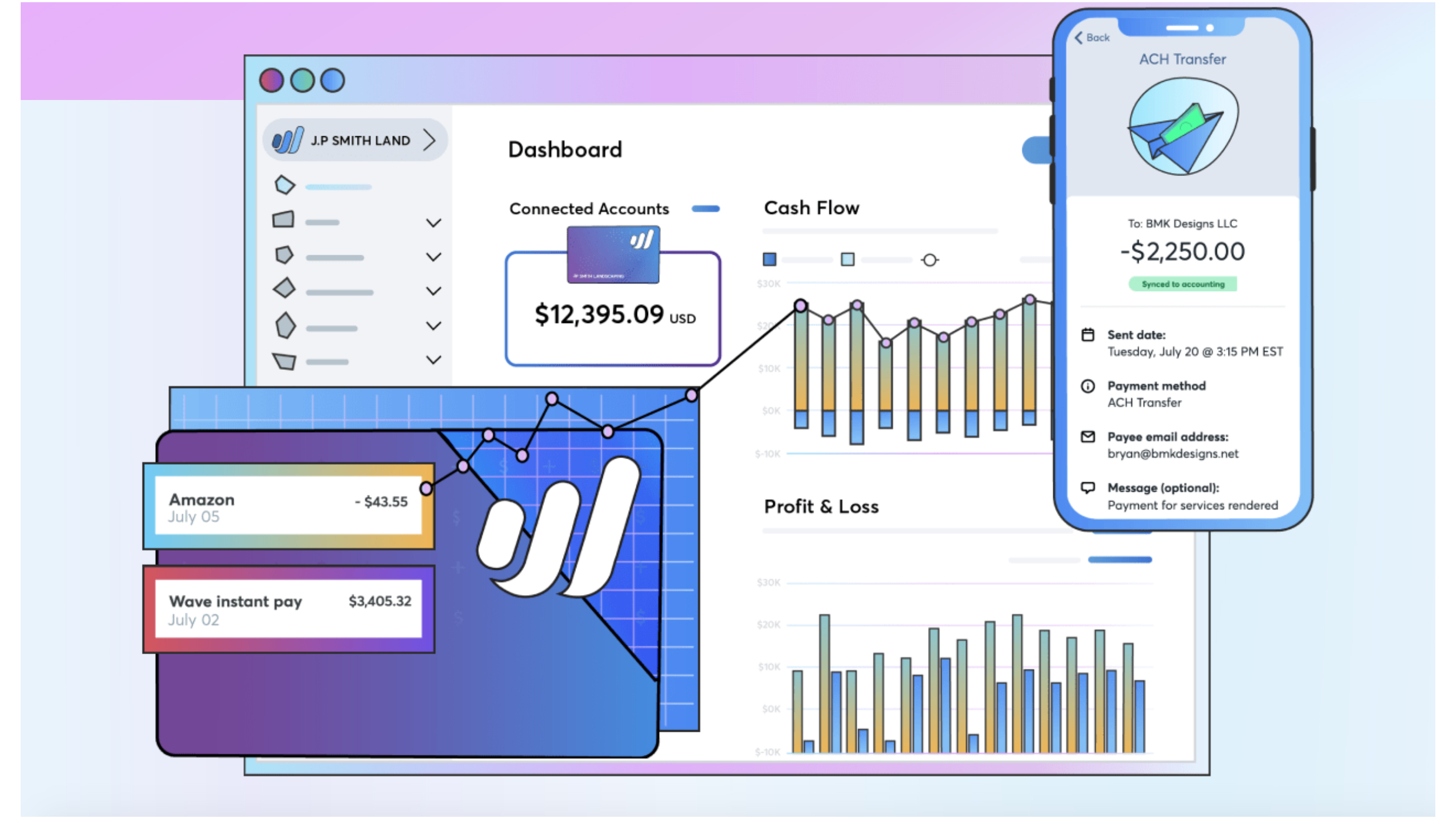

Wave Financial has launched Wave Money, a new fee-free bookkeeping product aimed at small business owners who want to handle accounting, invoicing and payments in one place.

Wave Money is comprised of a business bank account, a debit card and the mobile app itself. Business owners can therefore deposit funds, spend with the Wave debit card, and manage everything from within the Wave Money software.

Currently on limited release to single owner businesses in the US, the Wave Money app is only available for iOS devices at present.

- The best tax software

- Have a look at the best accounting software

- These are the best expense tracker apps around today

Efficient finances

Described as a first-of-its-kind small business banking and bookkeeping solution, Wave Money comes with no banking fees, carries a built-in bookkeeping feature and allows users instant access to their money.

According to figures based on 2019 Wave US and Canada customer data, the average Wave business pays more than $425 in annual bank fees. The fee-free Wave Money app also features no account minimums and allows small business owners to use a bank account that manages their bookkeeping automatically.

Other features within the Wave Money app include automatic expense categorization, which makes it easier to track business expenses with little prior knowledge or experience. Wave says that the feature has been designed to make small business users be better prepared for tax time.

Small business owners can also manage their business income and outgoings in one place with real-time bookkeeping, allowing SMEs to stay on top of their accounts on-the-go and resulting in tax-ready records at the end of the year.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

“Most entrepreneurs start a business to do what they love, not because they want to spend time on finances. Few first-time entrepreneurs have accounting expertise. Yet, establishing good financial management and bookkeeping practices are essential,” said Kirk Simpson, co-founder and CEO of Wave.

“Wave Money is made specifically for the entrepreneur who loves their work, not bookkeeping. It’s free and makes managing small business finances easy, even for those with little finance and accounting knowledge.”

Small business owners will also have access to mobile check depositing, plus access to the largest free ATM network in the US. Business owners can also pay vendors and contractors via email, send and receive ACH transfers, and deposits up to $250,000 are insured by the FDIC.

“Wave was created to empower business owners and shake up the banking industry. Wave Money is another key step in that process,” said Simpson. “Now more than ever, small businesses need all the help they can get.

Many small business banks have fees, complicated record keeping, and can take days to give business owners access to their money. When the stakes are higher than ever, this is not acceptable. It’s time the small business community has a free banking and bookkeeping solution that empowers them to do what they do best – run their business.”

Toronto-based Wave Financial was acquired by Kansas City tax titan H&R Block a year ago, which itself has a strong foothold in the small business accountancy marketplace.

- We've also highlighted the best personal finance software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.