5 mistakes everybody makes when it comes to sole trader accounting software – and here's how to avoid them

These are some of the most common mistakes to make when choosing and using sole trader accounting software, and how to avoid them.

One of the most daunting tasks a sole trader could have to do is accounting – bookkeeping is not for the faint-hearted, because easily made mistakes could end up costing you hefty fines from HMRC.

As a sole trader, you'll really benefit from accounting software that's designed specifically for you and your business, so make sure you're getting the right tools depending on your earnings and whether you're VAT-registered.

Where sole-trader accounting software stands out over old-school spreadsheets is ease of use – with the right tools, you'll be able to see your data in a more glanceable format, input transactions far more easily, and stay compliant with HMRC's Making Tax Digital (MTD) rules.

In this guide, we'll look at some of the most common mistakes sole traders make when choosing accounting software and how resolving those mistakes could prove highly beneficial to you.

Save time and unlock growth with integrated business tools and AI automation all in one place. See our plans and pricing here. No commitment, cancel anytime and free human product support.

1. Picking software designed for limited businesses

As a sole trader, you might be somewhere between side hustler and small business owner, which means your earnings could be far higher than the average personal salary. This can easily give you a false sense that you need advanced tools like corporation tax tools and complex reporting, but these are generally unnecessary and can add to your software bill.

Also, remember that corporation tax and income tax are different – as a sole trader, you won't be paying corporation tax and drawing a salary or dividends, so the amount of money you owe the Government will differ. Make sure your software caters to your own earning style.

Fix this by focusing on the size of your business and what your responsibilities are to HMRC – look for simple profit tracking tools and support with your self-assessment. Sole trader-specific plans are designed specifically for you, so don't be tricked into paying for advanced and complex suites.

2. Overpaying for multi-user features

Another mistake sole traders can make is overpaying for software that gives them access for multiple users, implying they're part of a team with dedicated finance workers and accountants. Extra logins, known as seats, tend to cost more, so the monthly costs can stack up.

Even if you need to work with a third-party accountant, don't be fooled into paying for a bigger package than what you need. Some accountants have their own access to popular software, while most software tools will let you export your data via CSV files.

If you know you'll be working with an accountant, it's worth asking them which software they recommend or finding out whether the software you prefer lets accountants log in to view figures on your behalf.

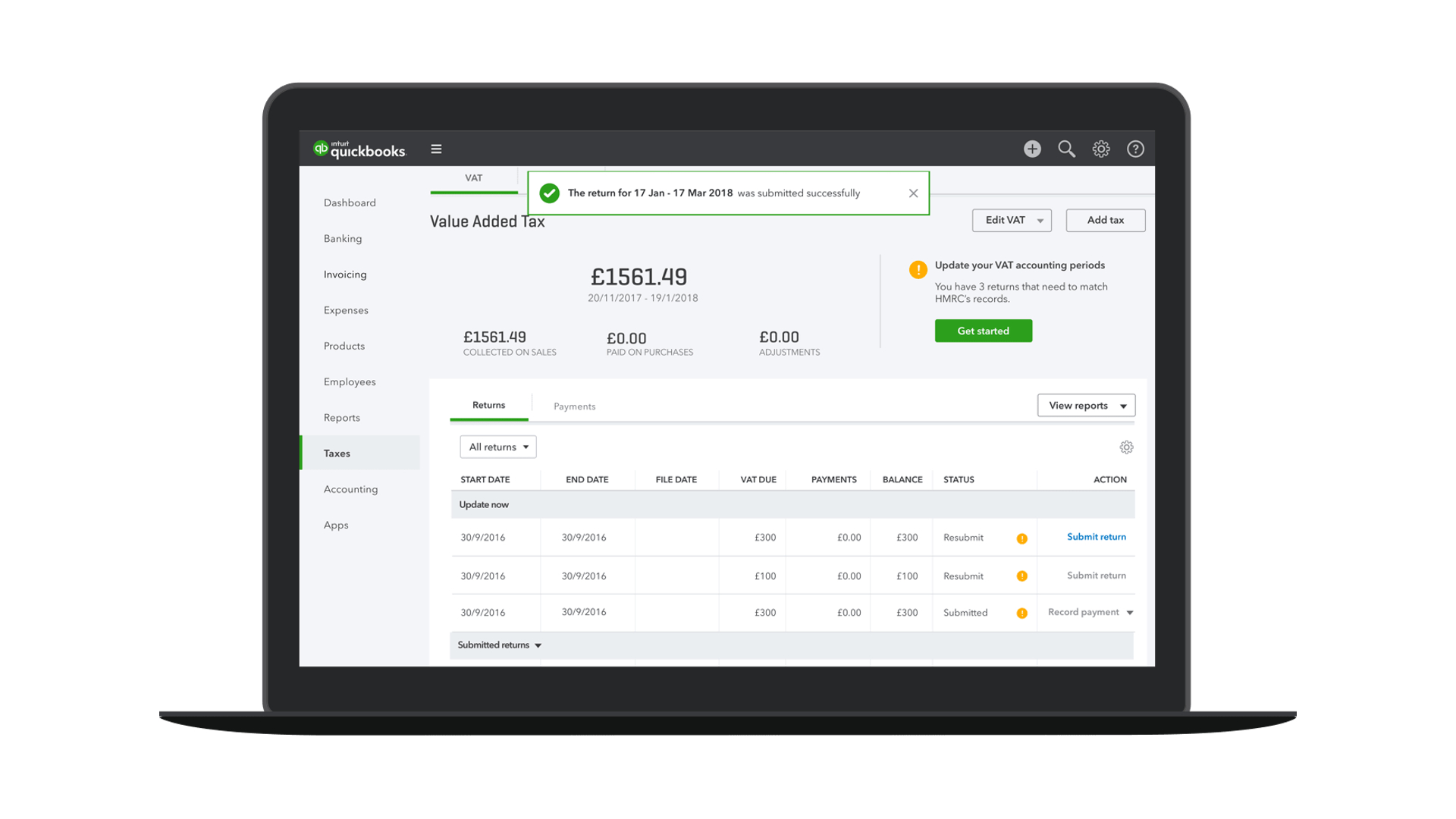

3. Not checking MTD compatibility

HMRC's Making Tax Digital rules are evolving, and different sole traders are being affected at different stages depending on how much they earn, but don't think that because you're unaffected now, you won't be later. Thresholds are lowering, and your income could soon take you into MTD territory.

The first band of people, earning over £50,000, will need to take up MTD software from April 2026. One year later, this expands to those earning over £30,000, and the Government is even looking at reducing this further to £20,000.

On the flip side, don't assume that all sole trader accounting software is MTD-compliant. Some vendors target lower earners who don't need this just yet, and others are slow to react or don't update their software.

Avoid this mistake by looking for platforms that explicitly state they're recognised by HMRC and that they do direct submissions for you.

4. Forgetting about ease of use

Because accounting isn't the most glamorous task for many sole traders, it's easy to forget about its usability and treat it as a boring administrative task, but this only adds to your feeling of wanting to put it off until later.

Your software choice should be easy to navigate wherever you choose to access it. Often, this includes comprehensive dashboards and extra features on the desktop, so make sure you're familiar with how they work.

Mobile access is also a crucial part of sole trading – on-the-go access ensures you can make small updates from anywhere, such as logging quick transactions before you forget.

The hard thing about this is that you might not know what's good until you've tried it. So before you commit to any particular vendor by inputting or migrating all your data, try out a few different options to see which you find the easiest – this will vary depending on your skill level and experience with finances and taxes.

Thankfully, most accounting software companies offer free trials or heavy discounts during your first few weeks or months.

5. Ignoring important integrations

Many sole traders still manually enter transactions and handle raw data, which leaves them open to mistakes at various parts of the process.

This might mean they miss expenses or type in the wrong figure, which can cause nightmares later on down the line when trying to balance the books or sorting out an over/underpayment on a tax bill.

One of the most important integrations any sole trader accounting software can include is real-time bank feeds. This essentially means your software and bank will talk to one another, automatically updating transactions on your books for up-to-date information.

It's still a good idea to double-check what's been pulled across to make sure no personal transactions are included and that any automatic categorisation has been done correctly.

Summary

Being a sole trader can be a challenge at the best of times, juggling multiple business operations that aren't necessarily part of the reason you got into business in the first place.

An array of accounting software tools on the market only complicate things further, enticing you with more tools than you actually need.

Sole trader accounting software should be easy to use and compliant with HMRC rules around tax and MTD – look closely at anything more than that to avoid being overcharged for tools that are designed more for businesses with multiple employees.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

With several years’ experience freelancing in tech and automotive circles, Craig’s specific interests lie in technology that is designed to better our lives, including AI and ML, productivity aids, and smart fitness. He is also passionate about cars and the decarbonisation of personal transportation. As an avid bargain-hunter, you can be sure that any deal Craig finds is top value!