Finance Digital Transformation – why businesses should go through it

The invoice process is one of the quickest, safest processes to choose for Digital Transformation.

Invu CTO Stuart Evans explains why accounting departments in UK businesses should go through the journey of Digital Transformation. Using real-life data from an Invu implementation Stuart provides a benchmark against which businesses can measure their own performance.

At eWorld 2017, which is well attended by procurement and supply professionals from businesses across the UK, industry experts discussed the latest technology and innovations that can make a real difference to the way a business performs from an operational perspective.

- We've also highlighted the best accounting software

- Here's our list of the best tax software around

A key theme was that UK businesses are continually assessing how they can remain competitive, and that 2017 should be the year that business look to improve the competitiveness of the finance department. Through Digital Transformation, a finance department can significantly reduce the amount of time spent performing manual processes. Businesses that embrace Digital Transformation can streamline invoice and purchase order processing, and underpin their daily functions with hard data to identify where further time savings to the business can be made.

The main driver for businesses to put themselves through what can sometimes be a painful process of Digital Transformation is increased control and efficiency, because after all time is money. Both time and control are very important for the invoice and purchase process and by removing excess effort in routine transactions, this allows more time for finance departments to employ critical thinking over exceptions and financial data – making business decisions based on strategic insight.

A new driver for Invoice automation in the UK is a ‘duty to report’ introduced in the Small Business, Enterprise and Employment Act of 2015. This has imposed a duty on large businesses to report on their payment practices, to deter them from withholding payments to smaller suppliers and therefore disrupting the overall UK economy. These requirements mean that large businesses needed to provide a six-monthly report on how quickly invoices are turned around from receipt to payment. This shift means that finance departments no longer only need to report on the financial amounts of invoices, but on each individual invoice and how quickly it was turned around to payment. Invoice automation not only improves the metrics, but also provides the data for the reporting in a click.

Trust the technology

Financial controllers place a lot of trust in the tangible elements of their job function. They trust the rubber stamp of invoice approval or the spreadsheet into which they manually input the data – and the complex formula that is perfectly understandable to them, but clear as mud to anyone outside the finance department. Going digital and moving towards automation means that trust needs to be placed in machines. This can sometimes be difficult for businesses at first as it requires change management and relinquishing control over traditional manual processes.

Real life benchmarks

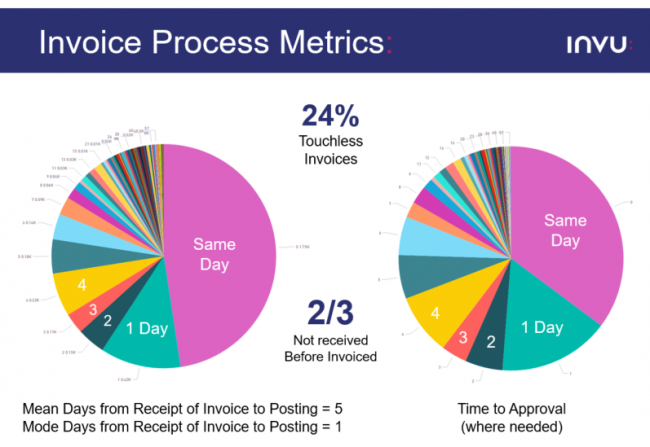

By leveraging post implementation analytics from Invu projects, we are able to provide real life benchmarks that arm finance executives with purchase processing benchmarks derived from real life data.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Adactus Housing is a good example of the benefits of invoice processing automation and purchase order processing. A housing association based in the North West of England, Adactus manages around 13,000 properties and has 350 employees. With a turnover of £55 million, it processes more than 30,000 invoices per year. Previously it had no central purchase order system and just used paper-based departmental spreadsheets – the system was entirely manual and there was no way of tracking payments. It needed purchase order controls because, auditors demand transparent processes from housing associations who must be able to demonstrate they are spending their allocated budgets responsibly.

Invu recommended that Adactus Housing captured their invoices electronically using ABBYY FlexiCapture and then traffic those invoices through the Invu document management and workflow system in order to get the invoices authorised in an auditable fashion. Invu works with ABBYY because its OCR engine guarantees data quality and it offers effective and simple customisation.

Now Adactus’ control over the invoice process is fundamentally better. At any one time it can see a global snapshot of its financial liabilities – it has a clear picture of what it has to pay and more importantly when those payments need to be made. It now just takes a few clicks to process a batch of as many as 50 invoices.

The ‘invoice to pay’ process has speed up markedly. From receiving an invoice to posting, Adactus has a mean average of five working days for the process to be completed. This is skewed significantly by some invoices being held up by up to 50 days from the point of arrival. Touchless invoices that are processed automatically without any human input matching them to purchase orders or raising payment, using data capture, automation and leveraging the technology, account for just under a quarter of the invoices Adactus receives (24%). The rest come in via email or on paper and need to be scanned in and captured. At one time as many as 60% of invoices, required significant human checking before they could be paid. As part of the Digital Transformation, the invoicing process was simplified as far as possible to increase the number of invoices that could be processed automatically.

If we consider the mode value of ‘days to posting’ data we can see the most likely case is now just one day end to end, from receipt to posting. As a result, operating costs in the invoice processing part of the business have reduced significantly.

Conclusions and learnings

As part of Digital Transformation, accounting departments have the opportunity to simplify their invoice/purchase order approval process and it is vital they do so on day one, to avoid uncertainty and doubt when using a new system. When the rubber stamp, staples and boxes are gone, the staff need to adapt to a new way of working – and that change needs to be made safely if it is to succeed. Once the new process is established, simpler, cleaner authorisation models are far easier to measure and manage.

The added visibility and audit trail of the processes provided by using technology is where the real benefit is seen. At all times in the approval process of invoices or purchase orders, each step is tracked and monitored and it is clear to the accounting department where any bottlenecks may occur.

If your accounting department is not already using an invoice processing or purchase order processing solution then the time for change is now. The invoice process is one of the quickest, safest processes to choose for Digital Transformation, and it offers a compelling return on investment.

Stuart Evans, Chief Technology Officer at Invu

- Speed up your business' digital transformation efforts with our top picks for the best accounting software

Since joining Invu as chief technical officer in 2007, Stuart has overseen the development of Invu Document Management. Prior to Invu, Stuart was a lead architect for Sage, overseeing products for the accountancy marketplace. He has a great team spirit.