News

Explore News

-

Audio News

-

Computing News

-

Earbuds and Airpods News

-

Health & Fitness News

-

News about Cameras

-

News about Fitness Trackers

-

News about Headphones

-

News about Laptops

-

News about Phones

-

News about Small Appliances

-

News about Smartwatches

-

News about Tablets

-

News about The Home

-

News about iPads

-

Smart Home News

-

Television News

Latest about News

NYT Wordle today — answer and my hints for game #1673, Saturday, January 17

By Marc McLaren last updated

Looking for Wordle hints? I can help. Plus get the answers to Wordle today and yesterday.

‘People love the unexpected’ — Disney on the Lego Star Wars Smart Play launch

By Jacob Krol published

TechRadar caught up with Divya Dalal, VP of Global Hardlines at Disney Consumer Products, to discuss 25 years of Lego Star Wars and the launch of Smart Play.

'ReRAM is the replacement for (NAND) flash': $170 billion US tech company backs tiny startup in race to find the holy Grail of universal memory

By Efosa Udinmwen published

Weebit’s ReRAM shows higher speed, density, and reliability than flash memory, gaining backing from TI and industry-wide attention.

ChatGPT ads are coming — OpenAI confirms and explains how they'll work

By Lance Ulanoff published

After countless rumors, OpenAI has confirmed that ads are coming to ChatGPT and they'll be a part of conversations. Here's how they will work and how you can opt out.

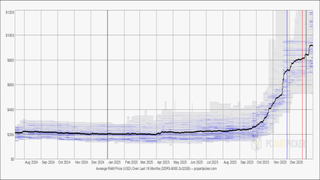

Good news! RAM prices seem to have finally stabilized - bad news, it's probably because memory prices are so high, that it's forcing most of us to give up buying anything

By Efosa Udinmwen published

CES 2026 DDR5 prices surged dramatically in late 2025, then stabilized at extreme levels as buyers resisted further increases in high-capacity kits.

Microsoft, Meta, and Amazon are paying up for ‘enterprise’ access to Wikipedia

By Craig Hale published

Wikipedia reminds us how important it is for AI training, which is why many tech firms pay for enterprise subscriptions.

Some top-end SSDs are now literally worth more than their weight in gold

By Darren Allan published

Is a high-end SSD worth more than its weight in gold? Yes, in some cases, as storage prices follow in the footsteps of RAM.

The era of AI hype is over - firms now want to see real returns

By Craig Hale published

Many businesses have already operationalized generative AI, and are looking at the future of agentic AI within their workflows.

Sign up for breaking news, reviews, opinion, top tech deals, and more.