TechRadar Verdict

Square POS is well-suited to meet the needs of small business owners and vendors on the go, but it’s not such a good fit for those organizations with larger volumes of transactions.

Pros

- +

Intuitive interface

- +

Quick setup and onboarding

- +

Mobile compatibility

Cons

- -

Limited customization

- -

High transaction fees

Why you can trust TechRadar

Square POS offers payment processing, inventory management, and sales tracking in one intuitive platform. With built-in analytics, customer loyalty tools, and online ordering integration, Square POS helps businesses streamline operations, improve sales, and enhance customer experiences.

Square POS, is a widely used point-of-sale (POS) system provider in the U.S. and beyond. Founded in 2009, it was one of the pioneers of ubiquitous POS systems that small businesses could easily set up. Before Square and its cohort, obtaining POS systems was a complex process many small businesses didn’t bother with.

Square simplified the process by creating a card reader that users could insert into their smartphone or tablet’s headphone jack. It helped usher in the market for portable, user-friendly POS systems with transparent fees. Since then, it has become a dominant force in the global POS market, serving over 4 million businesses.

We've listed the best POS systems for restaurants, small businesses, and retail. Not sure how to pick a POS yet? Read our How to choose the right POS system for your business guide, followed by 9 inspiring ideas on how to use POS system customer data.

I extensively tested Square’s point-of-sale solutions to provide an honest review. During the test, I focused on its features, pricing, user-friendliness, customer support, and other crucial factors. Read on to learn more about Square’s POS solutions and if they are ideal for your business.

- Want to try Square POS? Check out the website here

Square POS: Pricing

Square doesn’t charge a monthly fee or setup fee. Instead, it takes a cut of every transaction processed on its POS system. I consider this pricing model a good tradeoff for small businesses with limited funds for prior setup.

The transaction fees vary for different scenarios:

A customer taps, dips, or swipes their card on your card reader: 2.6% + 15¢ for each transaction.

A customer buys an item from your online store without swiping their card: 2.9% + 30¢ for each transaction.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

You manually input the customer’s card details or use previously saved details: 3.5% + 15¢ per transaction.

Square provides your first mobile card reader for free, but you must pay for any subsequent one. If you need another POS device except for the mobile card reader, you’ll have to pay for it.

The Square Reader for contactless and chip payments costs $59.

The Square Stand and Square Kiosk cost $149. Alternatively, you can pay $14 per month for 12 months.

The Square Terminal costs $299 or $27 per month over 12 months.

The Square Register costs $799 or $39 per month over 24 months.

Square’s processing fees are noticeably higher than those of many other POS systems I’ve tested. The tradeoff is that customers don’t incur significant overhead fees (setup and monthly fees). You can get a card reader for free, and Square doesn’t have a monthly minimum requirement like other POS systems.

Notably, Square offers custom pricing for businesses processing over $250,000 annually. If you fall under this category, you can contact the sales team and negotiate a more cost-effective deal.

Square POS: Setup

The straightforward setup process is one thing I appreciated when testing Square’s POS systems. You don’t have to jump through many hoops to sign up and begin receiving payments from customers.

The first step is creating a Square account, which you can do via the website or mobile app. During registration, you have to provide personal details, including your name, address, phone number, date of birth, and last four digits of your Social Security number (for U.S. residents). You also need to upload documents, including proof of address and government-issued identification.

After registration, you must provide banking details so Square can remit sales to your account. Verifying your bank account can take up to a week, after which Square will send a card reader.

As mentioned, Square provides your first mobile card reader for free. If you need a more advanced device, you can order it from the Square store and follow the setup manual.

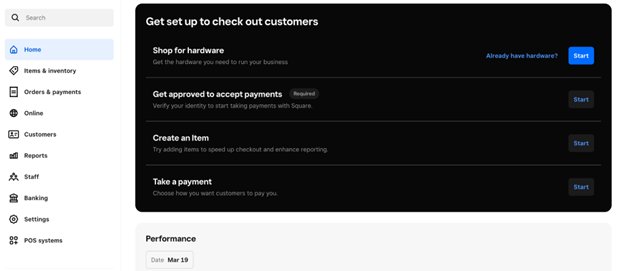

With your Square account and banking details verified, you can access your dashboard to configure payment options. Think of this dashboard as your business’s online headquarters. On it, you can add employees, locations, and items to your catalog.

To begin receiving payments, you need to download the Square Point of Sale app on an iOS or Android device. Sign into the app to see a list of all products: you can manage your previously added products or add new ones.

If a customer wants to pay for a product, they can swipe, dip, or tap their card on your Square device to do that. I liked that the POS device had on-screen tutorials to guide first-time users.

After reviewing many POS systems, I can proudly attest that Square is one of the easiest to set up. You can easily set it up yourself, unlike some POS systems that are so complicated that you’ll need an external consultant to handle the initial setup.

Square POS: Features

Square POS features

Square offers a comprehensive point-of-sale solution for businesses. I like that it’s a versatile tool that works for various types of businesses, from mom-and-pop shops to restaurants and retail stores.

The best hardware to choose depends on your business type. Square’s card reader works with a smartphone. You can plug it into your smartphone via a USB-C port or headphone jack. It’s suitable for mom-and-pop or pop-up stores needing quick payments.

However, a card reader won’t work for more advanced businesses like restaurants or convenience stores. Instead, you can choose the Square Stand or Kiosk, which works with an iPad. These devices let you store payment data and organize your catalog so customers can seamlessly place orders. I liked the minimalist, sleek look of these devices and the intuitive interface of Square’s software.

You can also choose Square Terminal or Register, the most advanced POS devices it offers. The Terminal is an all-in-one device that accepts card payments and prints receipts. Your customers can swipe or tap their cards to pay on this device, and you'll immediately print a receipt. I appreciated the Terminal’s sleek look, although I also grumbled about its bulkiness.

The Register is Square’s most advanced hardware both physically and digitally. It has two screens – one for the customer and one for you – and an interactive interface that makes selling enjoyable.

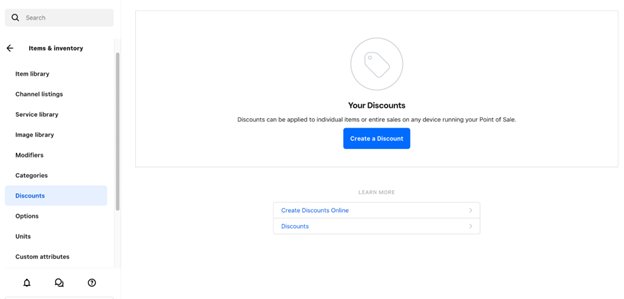

Square’s POS system revolves more around its software than its hardware. I appreciated its intuitive system for cataloging products, setting prices, logging orders, managing discounts, tracking receipts, and more.

With Square's POS app, you can easily create a product catalog with prices for each product and add-on. Once customers choose specific products, the prices are automatically calculated (including taxes and any applicable discounts), and they can pay seamlessly.

I liked that Square organizes all transaction data in one place. The app allows you to monitor all your sales and customer details, such as viewing each customer and the total amount of goods they've bought from you. With customer details easily retrievable, you can pinpoint specific profiles to run personalized campaigns for or offer discounts.

Another thing I appreciate about Square is its extensive reporting features. It gives an interactive overview of your complete sales history. For example, you can view charts comparing your sales from one year to another, a month to another, a day, or even hours. You can monitor all incoming and outgoing transactions to evaluate your growth prospects and bottom line. Everything is accessible from the Square Point of Sale iOS or Android app.

Many companies charge big bucks for software similar to Square’s, but not in this case. You can use it for free, and Square makes money from transaction fees.

However, I didn’t find Square’s POS system all rosy. For one, I think its processing fees are too high for larger businesses. Small businesses can tolerate a 2.6% to 3.5% fee per transaction, but this adds up significantly for larger businesses. Some POS systems offer much better deals for larger companies.

Another issue I observed is Square’s limited customization and scalability. Users are locked into its ready-made software and can’t tweak many configurations. Integrating Square with other business systems can also be challenging, although I think it’s improving on this end.

To summarize, Square is a good option for small businesses. However, large companies should consider other POS systems with lower transaction fees and extensive customizability.

Square POS: The competition

Square has many competitors offering robust POS systems. I’ve tested endless POS systems and consider Stripe Terminal to be the most fitting competitor. Stripe offers portable card readers and all-in-one devices similar to Square’s. There are no setup or monthly fees, but transaction fees are similarly high.

However, Stripe outshines Square in customization and scalability. It is much easier to configure than Square, and it offers wider integration options. Stripe is a good choice for small but fast-growing businesses.

Square POS: Final verdict

Square is an ideal POS solution for small businesses. It provides the hardware and software needed to accept payments seamlessly. The setup is noticeably simple, and the interface is easy to understand.

Square POS has some drawbacks, such as its relatively high transaction fees and limited customization. These drawbacks mainly affect large businesses, for which Square isn’t suitable.

Stefan has always been a lover of tech. He graduated with an MSc in geological engineering but soon discovered he had a knack for writing instead. So he decided to combine his newfound and life-long passions to become a technology writer. As a freelance content writer, Stefan can break down complex technological topics, making them easily digestible for the lay audience.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.