TechRadar Verdict

A good platform to start saving money, but not for investing a large sum of money

Pros

- +

Easy to use App

- +

Save along with regular spend

- +

Easy to set up and invest

- +

Novice friendly

Cons

- -

Only for the UK

- -

Expensive

Why you can trust TechRadar

Moneybox is a new trading app aimed at helping young investors to build an investment portfolio by rounding up everyday purchases. The app invests the change left after the last card transaction and puts that spare change in saving or an investment product of your choice.

The company was founded in July 2015 by entrepreneurs Charlie Mortimer and Ben Stanway. In Aug 2016, a year later, the app was announced which is currently one of the fastest-growing apps in its category in the UK.

The USP of this application is that it allows you to invest in big companies like Amazon, Netflix, Apple, Nintendo, Unilever and Disney even when you have a meagre £1 to invest.

What does Moneybox offer?

Moneybox's concept is simple, and offers the app as like a virtual savings jar. The pennies saved can then be used to fund investments that people might not ordinarily feel that they can save for. It's especially aimed at people who feel they can save small amounts that could build up over time.

The app automates the whole process of investment and when you spend the next time, it will round up to the nearest pound and invest the amount which would otherwise be left as a change.

For example, if you purchase groceries worth £6.50 using your debit or credit card, total spend would be rounded off to £7 by the Moneybox app. The round-up function shows £7 on your statement while keeping aside 50p for investment.

Call it a “digital piggybank” where you can put in spare change after every shopping, the only difference here is that the change will earn you returns too.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

The amount may look petty to start off, but if the company feel that if a user follows the process every day for the entire year, it is possible to save a significant sum.

Savings plan

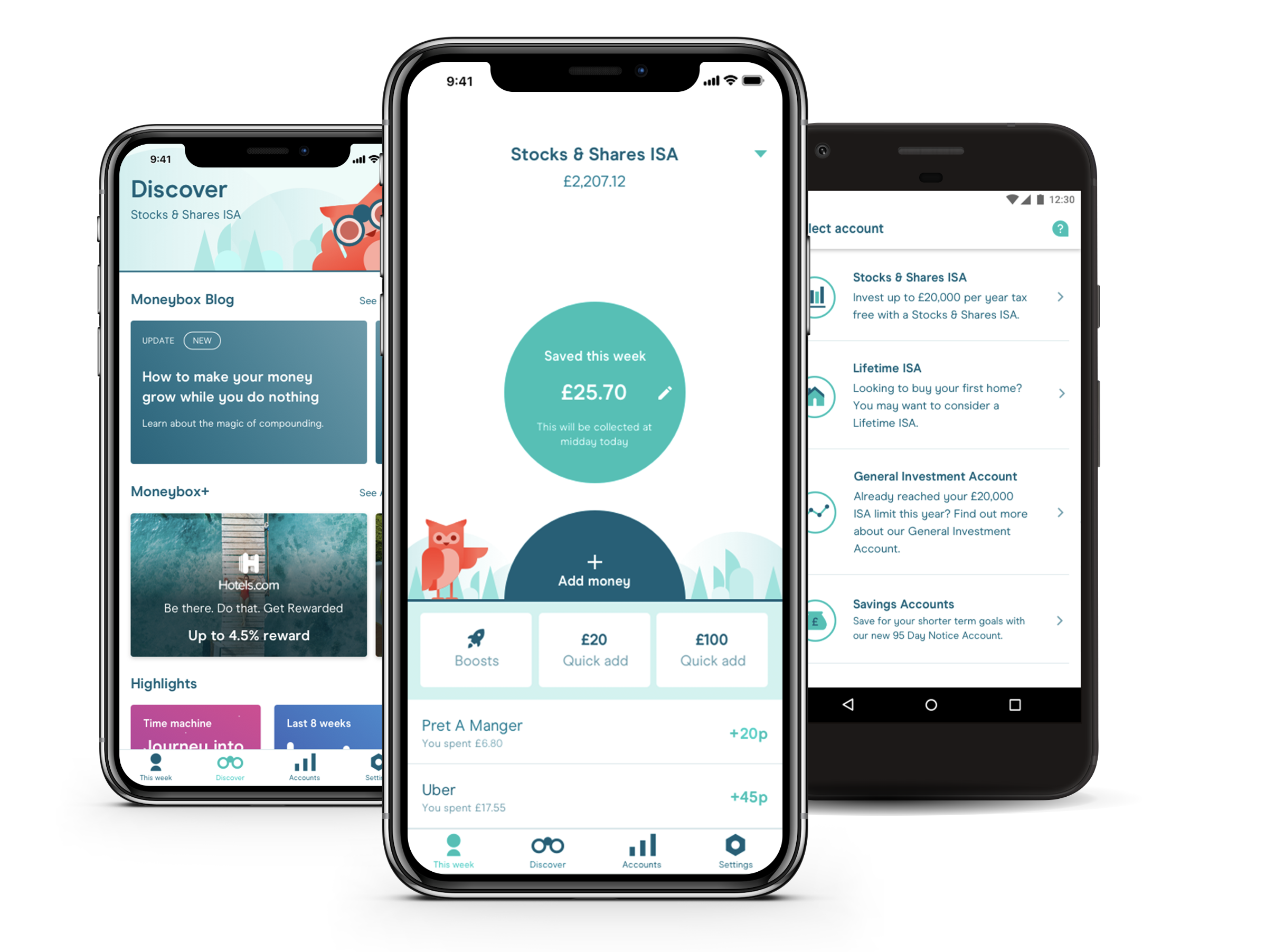

The app gives you an option to round-off your purchases automatically every 48 hours or manually add one-shot payments every week or month. The option to choose between the automatic or manual round-up options can be found in the account section in the app.

Once these round-ups reach your preset weekly goal of savings, it would automatically be debited out of your account to be invested in your preferred investment account.

Some people may argue that petty saving on each transaction or making a one-shot deposit every week is fairly similar. However, it is about building a habit to save regularly, and if the amount lying in the account gets spent during the course of the week, then you’re left with no funds to invest.

Multiple accounts

Moneybox offers multiple accounts to choose from:

General Investment Account (GIA): This is a regular investment account which returns taxable yields. Stocks and shares ISA. An investment of up to £20,000 a year will not attract taxes.

Stocks and shares ISA: Allows you to invest up to £4,000 a year tax-free and also offers a 25% contribution from the government to buy your first home or as a retirement benefit

Junior stocks and shares ISA: Perfectly suitable for kids. This offers tax-free earning but with the funds are locked till the time they turn 18

Self Invested Personal Pension: Moneybox allows you to open and save for a SIPP as well.

These accounts are available to UK tax residents who are at least 18 year old. Users are required to provide their national insurance number to open the Stocks and Shares ISA. For the GIA account, this is not a mandatory requirement.

Mobile app

Since Moneybox is a mobile-only platform, the first step to open an account with Moneybox is to download the app on your smartphone from the relevant app store. You can also get the link messaged to your phone directly from the website.

During the signup process, you need to decide how the account will be funded. The application has three options: roundups, weekly deposits, or one-off deposits. In case you choose the round-ups function, you need to provide your financial details like online banking, credit or debit card details.

Setting up the account is easy and once it’s done you can check the status of your weekly target on the home page of the app.

It offers email or chat support seven days a week 9-5:30pm.

Charges and fees

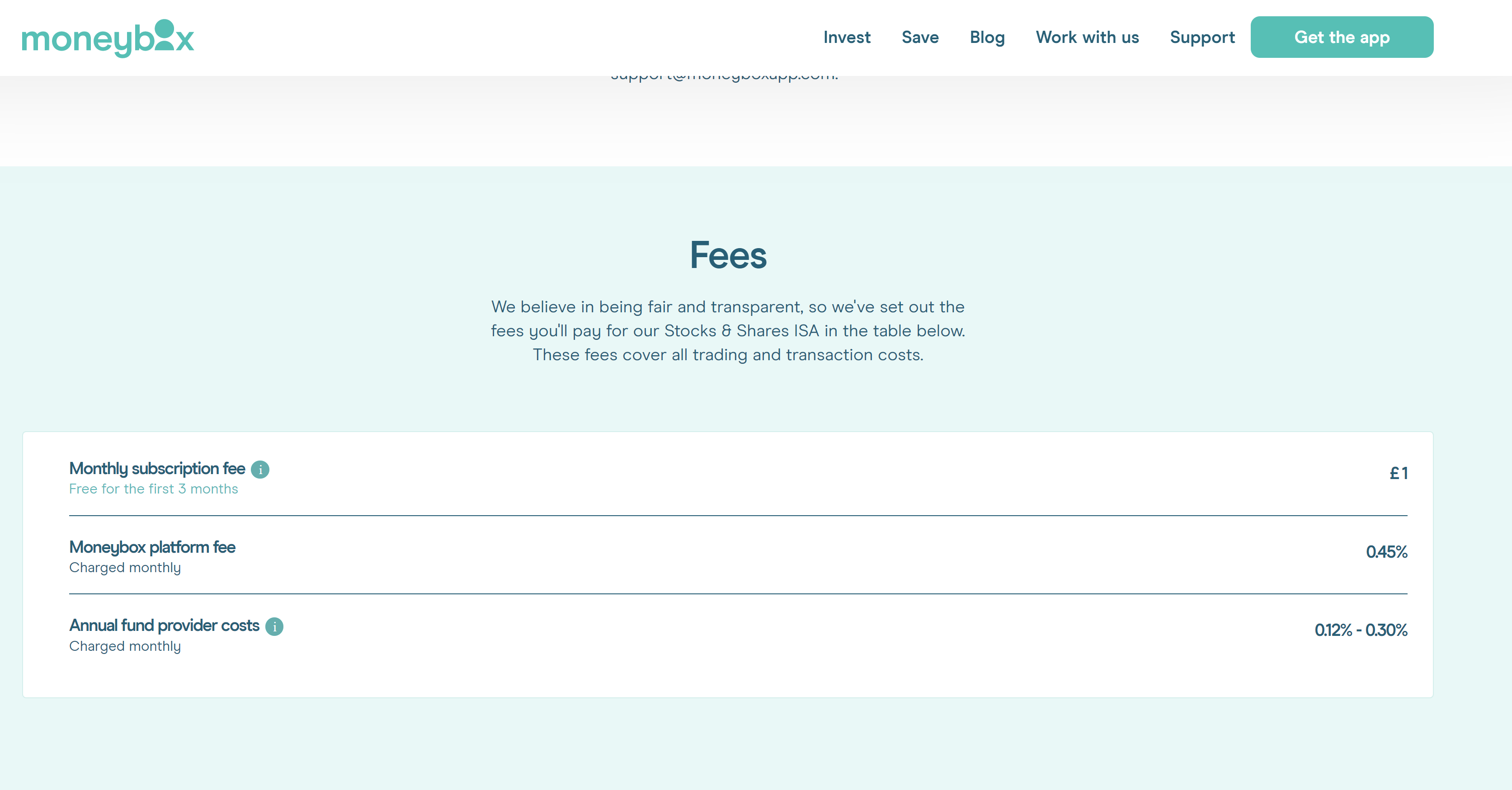

Moneybox charges in three different ways:

- Monthly Fee: The fee of £1 per month covers all transactions and investment costs. It is collected by selling down your largest holding at the each end month automatically.

- Platform fee: Moneybox charges you 0.45% of your investments per year. This can be deducted out of your account every month at the same rate.

- Fund providers charge: This ranges between 0.12% to 0.30% per year

Final verdict

Moneybox is the easiest way to start saving and investing. Used over time it could help you build up a fairly decent portfolio. While the ISA accounts are well suited for this purpose, Moneybox itself may not be the best solution for much bigger portfolios.

Though the app inculcates the habit of saving money it becomes an expensive choice as the fees may eat into your returns.

In case you want to invest a bigger sum of money, there are other platforms which charge you lower fees and may offer higher returns as well. However, if you're struggling to save anything at all then this could be a very handy app indeed.

- We've also featured the best budgeting software.

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.