Best personal finance software of 2025

Improve your savings and reduce your debts

We list the best personal finance software, to make it simple and easy to manage your finances to improve your savings and reduce your debts.

Personal finance software allows you to record your spending and saving, and taxes, all in one place. This allows you to get a better overall picture of your income and costs.

However, the best finance software deliver a range of extra features, too, such as help with debt management, balancing budgets, or even provide financial advice as an additional service.

This guide looks at the best personal finance software out there and takes you through the standout features of each one, so that you can get a better idea of which package will be best suited to your needs.

If you're looking to manage your business affairs and bookkeeping with a bit more detail and need additional information, check out our guides to the best accounting software for small business and best tax software.

Below we list what we think are the best personal finance software platforms currently available and, underneath those, the best free personal finance software.

We've also featured the best budgeting software.

The best personal finance software is Quicken

Get 10% off the normal price for Quicken, the best personal finance software when it comes to keeping your money in order. Manage budgeting, bills, and investments from a single desktop or mobile app.

Preferred partner (What does this mean?)

The best personal finance software of 2025 in full:

Why you can trust TechRadar

Best personal finance software overall

Specifications

Reasons to buy

Reasons to avoid

Quicken is a long-established tool for managing personal accounts. While its reputation was built on a desktop version, the software is now available to run as an app on your mobile devices.

Quicken offers a good range of financial reporting tools. These are set around a few different areas, namely budgeting, bills, accounts, and even investments. For budgeting, it offers you a chance to input your purchases and income so you can compare them both together to get a better idea of how much you are spending compared to how much you are earning.

In terms of bills, you can also see which utilities and similar you are constantly paying out to, and see both the amounts to be paid and how much money you have left over. For accounting purposes Quicken can be used to bring your banking and credit card bills together in one place so that you have a very clear idea indeed of how much you're paying out. This is especially handy as people frequently underestimate how much regular small purchases can add to costs.

Adding value is the way Quicken offers the ability to track investments, whether as part of your savings, investment portfolio, or 401k pension plan. This means you have a clear idea of how much your savings and investments are worth, though it's fair to say you shouldn't panic about short-term fluctuations in the stock market.

Altogether, Quicken brings together your budgeting, banking, and investment reporting into a single dashboard, which you can view from your desktop or even via your cell phone by using the mobile app.

Read our full Quicken review.

Quicken - Try it for 30 days risk-free!

Start taking control of your money with the Classic Premier package at $35.99/yr, manage your money and save with the Classic Deluxe option at $46.79/yr down from $51.99/yr, maximize your investments with Premier for $70.19/yr, down from $77.99/yr or manage personal and business finances all in one place with Business & Personal at $93.59/yr, reduced from $103.99/yr.

Best personal finance software for spending

Specifications

Reasons to buy

Reasons to avoid

Just in case you need to be told explicitly what to do, along comes YNAB - short for You Need A Budget. Because, hey, if you don't want to spend every single penny you have and more, you absolutely do need one. And perhaps you have more money than you thought?

YNAB's primary mission, as you might expect, is to help you curb overspending and avoid living from paycheck to paycheck. Stick to the program, temper your spending appropriately, and eventually YNAB will see you spending last month's money rather than that which you've just earned.

The software is quick and easy to use plus it supports the majority of transaction information downloadable from banks. Better still, YNAB can be configured for personal or small business use by changing its monetary categories depending on your needs.

If you get off track, YNAB – which is reasonably forgiving and understanding for a software package – will tell you what you need to do to get back to where you need to be. You'll have to make sacrifices, but if it's guidance you need, this sets itself apart from the likes of Quicken.

Read our full YNAB review.

YNAB - Get a free 34-day trial

If you're keen to get a better grip on your finances then YNAB makes an ideal option to consider. There's a free 34-day trial available currently, which will let you explore all of the features and functions, without any cash outlay.

Best personal finance software for investors

Specifications

Reasons to buy

Reasons to avoid

Made primarily for Mac users (but also out on Windows and Linux), Moneydance is a desktop money management package with a very neat single-window interface. Load it up and you'll get an instant view of your finances, upcoming bills, recent expenses and more. Click an item in the left hand sidebar and the main content changes to reflect it.

Its reporting features are quite strong if not spectacular to look at, and one of Moneydance's most useful sections is its account register. If you're old-school and once managed a cheque book, this operates on a very similar principle. There's also an iOS app for logging transactions on the go, which later syncs with the software on your desktop.

Unfortunately for UK users, Moneydance doesn't support the connection protocols used by UK banks, so you'll need to download your transaction history manually to keep on top of it and revert to your bank's own app to move money around. US users, however, are well covered.

The plan offered applies per household rather than per computer, which means that you are licensed to run it on multiple desktops at home. While no free trial is advertised, a 90-day money-back guarantee is.

Read our full Moneydance review.

Moneydance - Buy now for just £44.41

For personal use, people who use Moneydance should buy one license per household, no matter how many computers you install it on, operating systems you use, people who use Moneydance, or data files you create. For business use, please buy one license per computer Moneydance is installed on, or per data file (on a shared network), whichever is smaller.

Best personal finance software for affordability

Specifications

Reasons to buy

Reasons to avoid

If you’ve ever experienced the original incarnation of Quicken you’ll know that it comes packed with features. Quicken Simplifi takes the usability feel of its bigger brother and presents a wealth of features in a much more mobile-friendly environment, which makes it ideal if you like to organise personal finances on the move. There is a desktop edition but Quicken Simplifi works really well when you’re dipping into those features and functions on your phone.

Although there are fewer power tools than the standard issue Quicken, this is a great app especially for anyone with more of a casual interest in staying financially organised. Getting your money into an organized state is central, but there’s also the option to get alerts, create reports and plan for the future too using Spending Watchlists. The great thing about all this is the way that the graphic-drive interface presents the figures.

Quicken Simplifi also boasts tools for projected cash flows and investments. There’s a credit score tracker and detailed reporting whenever it’s needed. Better still, the management of all this data can be done very easily, with all manner of options for sorting and organising accounts, payees, bills and transactions. Again, the impressive graphics help drive the experience and make it much less stressful than some more sober personal finance packages.

Read our full Quicken Simplifi review.

Get 50 percent off Quicken Simplifi

Quicken is often available by way of an offer and currently the same applies to Quicken Simplifi thanks to a 50 percent off deal, which takes the monthly cost from $5.99 down to a hugely affordable $2.99 a month, billed annually. There’s a 30-day money-back guarantee too, which is handy if you’re not sure quite how well Quicken Simplifi will suit your needs.

Best personal finance software for tracking

Specifications

Reasons to buy

Reasons to avoid

When it comes to budgeting apps and personal finance software, lots of folks are drawn towards free or low-budget options. However, sometimes it’s worth spending more in order to enjoy a rather more premium experience. If you care about your finances, or they can be complicated and perhaps problematical too, Monarch could be an alternative.

This software, which is supported by excellent apps for both iOS and Android, has been evolving over the last few years and is now one of the most potent power tools you can own. While it packs many of those handy everyday features and functions that other budgeting and personal finance tools offer, Monarch also boasts options that can help make life easier when it comes to more complex money matters.

However, there is indeed a cost for these extra power tools and Monarch is not the cheapest option out there in the financial software marketplace. It is possible to pay an annual fee, rather than going down the route of monthly payments, which makes the product slightly cheaper. Monarch, though, is essentially going to appeal to people who are very serious about getting their finances in order.

Read our full Monarch review.

Monarch - Personal Finance

Monarch is currently available for $14.99 per month, or there’s an annual payment option for $99.99. This equates to $8.33 per month over the course of a year, which shaves a little off the overall outlay.

Best personal finance software for budget tracking

Specifications

Reasons to buy

Reasons to avoid

BankTree is more than happy to support worldwide currencies, and in fact does a solid job if you're working simultaneously with more than one. Usefully, it offers balances in multiple currencies, rather than rounding them off into a single total. BankTree is also good for keeping track of everything, allowing you to scan receipts with its mobile app and import them later on.

Admittedly, BankTree is not the prettiest software package, and it's slightly more awkward to use than many of its more refined cousins. However, BankTree does produce very neat reports, which you can break down by time, or by payee. It may be worth experimenting with the free trial before you choose to invest in this one.

On a practical note, the desktop software comes with one year of updates and support, although you are restricted to using it on one PC. Running it on additional computers incurs an additional cost. There's also a browser-based version available.

Whichever version you opt for, there's a 30 day free trial available, so you can try before you buy to get a better idea if BankTree will work for you.

Read our full BankTree review.

BankTree - Personal Finance

BankTree Desktop Personal Finance software is available now for just £35.00. We will provide you with free email support, and free updates, and bug fixes to the current version of BankTree Desktop Personal Finance version 3.0. You can install the software on one computer. Any additional installations are charged at just £5.00 per computer.

Best personal finance software for complex finances

Specifications

Reasons to buy

Reasons to avoid

Pocketsmith comes fully featured, with a host of tools that not only help track expenses but let users keep tabs on their overall spending, plan for the future and also get on top of any outstanding debts. When it comes to monitoring accounts and related transactions there are a wealth of tools at your disposal. Pocketsmith makes it easy to connect to live bank feeds and this extends to in excess of 12,000 financial institutions around the globe.

This is enhanced by the fact that Pocketsmith can handle multiple currencies and can update its data dynamically based on the daily rates of any selected accounts. Even if this is complicated by multiple accounts and currencies, Pocketsmith allows users to categorise, label and annotate any spend, so that it’s easy to keep track on what’s going on with your personal finances.

Pocketsmith also has a powerful array of budget and planning tools. There’s the capacity for producing cash projections with a very generous limit of up to 60 years in the future on the top tier package. Similarly, the flexible way Pocketsmith lets users schedule upcoming bills and budgets makes light work of staying organised. The app rounds things out nicely with a decent set of reporting tools, which offers up cashflow statements and gives an insight on net worth.

Read our full Pocketsmith review.

Pocketsmith - for advanced money management

Things kick off with the Foundation package, which costs $119.95 a year or $14.95 a month. This is followed by Flourish, which is $199.95 annually or $24.95 per month. Top of the pile is the Fortune package, which costs a sizable $319.95 a year or, alternatively, $39.95 per month.

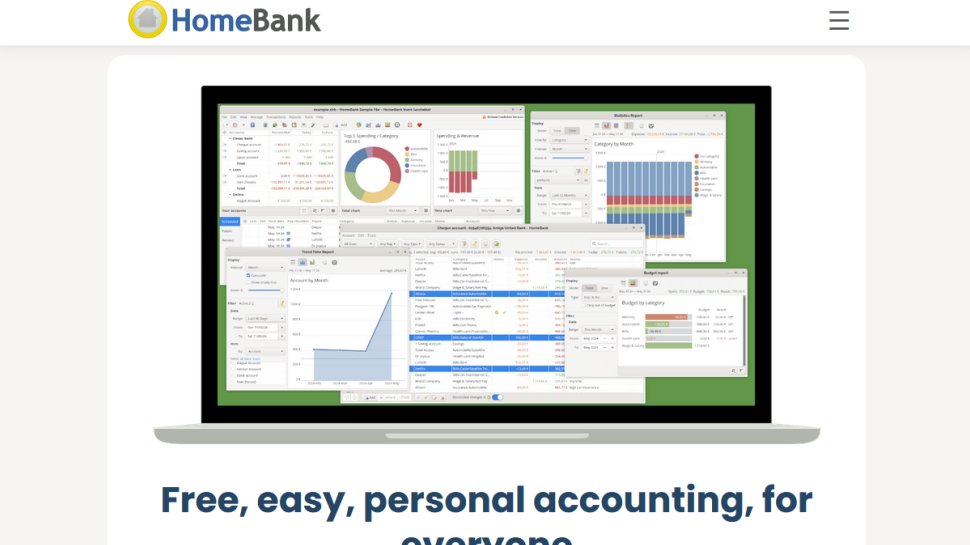

Best free personal finance software

Best free personal finance software overall

Reasons to buy

Reasons to avoid

One of the most appealing features of NerdWallet is its capacity for giving you access to your credit score. This can be incredibly useful for checking its current status, but also for learning about how to improve it and, also, for spotting anything that might not be right. Nestling within NerdWallet are nudges towards financial products, but that’s still worth living with for the valuable insight the software gives about your financial wellbeing.

The credit score information is dynamic too, so is useful for getting an up-to-date overview of your current financial situation as well as piecing together a more historical picture. There’s also a neat credit simulator that can help give users an idea of what would happen if a new credit card is applied for and so on. This all works nicely alongside allowing users to keep a close eye on incomings and outgoings from their bank accounts and other financial interests.

NerdWallet rounds out the appeal with a comprehensive helping of advice shop features, which can help shine the light on any aspects of personal finance that you’re not really sure about. Used regularly, the package really can help with becoming more knowledgeable about money matters.

Read our full NerdWallet review.

Best free personal finance software for on-the-go work

2. Buxfer

Our expert review:

Reasons to buy

Reasons to avoid

An online service that's not slathered in effects and colours, Buxfer does a good job of presenting your finances in a clean, professional manner. It cutely brags about the fact that it's currently helping its users manage over four trillion dollars in funds, so it's got a solid user base behind it.

You don't have to give Buxfer your exact banking details if you're uncomfortable doing so. Instead, you can opt for offline manual syncing with your bank account. However, if you do trust it, there's a layer of high-level encryption to protect your data and the company is regularly audited.

We like its budgeting tools best of all and the visual reporting is very strong. Better still is the fact that it doesn't force you into predefined categories and instead allows you to tag expenditures however you see fit. That means Buxfer should fit nicely into most people's banking lives.

The free version offers users five budgets, accounts and bill reminders. The Pilot version adds on automatic tagging and bank syncing, while the Plus version gives you unlimited budgets. Meanwhile, the Pro version includes online payments, advanced forecasts and more besides. Get it all though with a Prime version.

Read our full Buxfer review.

Best free personal finance software for basic reporting

3. HomeBank

Our expert review:

Reasons to buy

Reasons to avoid

HomeBank will appeal if you work on multiple platforms, or don't use Windows by default. Available for Windows, macOS and Linux (there's also an Android app in development) HomeBank can be installed normally or as a portable app, and it makes the topic of personal finance easily accessible. If you've been using another program – such as Quicken or Microsoft Money to manage your finances, you can import data to save having to start from scratch.

You can add an unlimited number of accounts to the program, and they can be linked to each other to allow for easy money transfers. It is all entirely dependent on manual editing, though. With enough data entered, it's possible to generate all manner of reports, including helpful predictive reports for car ownership and the like. Very much designed with the average person in mind, this is a personal finance app for people who hate personal finance apps.

Read our full HomeBank review.

Best free personal finance software for basic needs

4. AceMoney Lite

Our expert review:

Reasons to buy

Reasons to avoid

Billing itself as an alternative to Quicken sets a high bar for AceMoney Lite, but it's a target it manages to reach, even in its free, cut-down iteration. There's only support for two accounts in AceMoney Lite, but this should be enough for many people. You can even use the program to keep track of your PayPal account, which adds some degree of convenience.

Managing accounts in different currencies is no problem, but you'll have to enter data into this free personal finance software, rather than having your transactions pulled in from your bank account. That said, if you download statements from your online bank account, these can then be imported to save time with manual entry. AceMoney Lite also makes it easy to track your spending and investments, making it a reasonable financial tool for anyone looking to take control of their finances.

Read our full AceMoney Lite review.

Best free personal finance software for novice users

5. Buddi

Our expert review:

Reasons to buy

Reasons to avoid

Proving that free personal finance software doesn’t have to be complicated, Buddi keeps things about as simple as they can be. In a matter of minutes, it's possible to set up all of the accounts you need and start keeping track of your incomings and outgoings.

Money can be easily pulled from and moved between different accounts, and Buddi can generate all sort of reports about your spending and earnings broken down in a variety of ways. If you're looking to save money, the program can help you to stick to a budget and for anyone who is completely new to the concept of accounting, the Buddi website has a number of helpful guides to help get you started.

On the downside, Buddi requires you to have Java installed, which is not going to be to everyone's liking, and the software itself has not been updated for a little while. Neither of these two factors are enough to stop us from recommending that you take a look at the program – it could well be just what you've been looking for.

Read our full Buddi review.

Best simple free personal finance software

6. GnuCash

Our expert review:

Reasons to buy

Reasons to avoid

GnuCash is simple enough to be used for home finances, but flexible enough to be put to use by small businesses as well. While the software is easy to use, the fact that it's suitable for small business accounting is thanks to the inclusion of a number of extra features that you would not necessarily expect to find. We like the support for payroll management and double-entry accounting, for example.

Although relatively easy to use, this free personal finance software does really require some familiarity with accounting software, and it's simple to migrate from another program because you can import data in QIF and dOFX formats. Support for expense tracking makes this ideal software for preparing for tax season, and there are a huge number of reporting options to help you to make sense of your cashflow.

The software is available for macOS, Windows and Linux, as well as Android, and it's highly recommended that you try out this great tool before you consider any of the paid-for alternatives.

Read our full GnuCash review.

We've also featured the best stock trading platforms.

Best personal finance software FAQs

How to choose the best personal finance software

Picking which personal finance software package to use is pretty straightforward. The main thing is to consider what you'll need it for, and how much you'll be using it. After all, there's little point in purchasing a premium personal finance package if it boasts lots of features that you'll never use.

If you have reasonably basic budgeting needs to cater for, such as managing personal finances along with tracking your spending, then keep it simple. The great thing with many packages is that they can be configured to work as much or as little as you need them to.

For example, you may be a little disorganised when it comes to budgeting, so having software that can help with setting goals can be really useful. Setting up your personal finance package to assist with reaching these goals, and ensuring it lets you know if you're slipping behind schedule, can be invaluable.

If you're fairly good with your money and feel confident about how you manage cash then it may be that you'll want a more sophisticated personal finance package. Some of the more advanced options allow you to take on investments, offering a sophisticated range of tools for making your money work more efficiently.

Everyone has different needs when it comes to managing personal finances. That means the range and choice of best personal finance software packages is expansive, which is great for us, the consumers.

The best starting point if you're on the lookout for the best personal finance software package is, therefore, to decide just how complicated you think your money matters are. If you run a tight ship and are quite good with your finances, then a basic package will more than suffice.

Consider factors including how much you spend eating out each month and what sort of credit card terms you're working too such as managing monthly payments. You might want to factor in how much you need to save towards a pension. The best personal finance software can help with these matters, and more.

However, if you're not organised, you'll want to look at more complex personal finance packages that can do a lot more of the money management legwork. More sophisticated packages can help you become better at budgeting, keep track of incomings and outgoings and build up an archive of your financial affairs.

This can also be beneficial come tax filing time too, with many personal finance software packages integrating with some of the best tax software on the market.

What to consider with the best personal finance software

If you're in need of some organisational clout, especially if you're running a small business, picking a personal finance software package can help a great deal. Depending on your needs you'll find that the best personal finance packages allow you to keep on top of things like receipt logging and managing expenses, all from within one program.

The other bonus is that most of the personal finance software packages allow you to share your data with your preferred tax and accounting software. That means you'll be much better placed when it comes to tax filing time. There are personal finance packages tailored to both online and offline needs, with many having apps that let you track spending day-to-day. Cloud-based personal finance packages let you keep all of your data in a safe place too, so all bases are covered.

Personal finance features to look for

Desktop or mobile?

Have a think about where and how you'll use your personal finance package. Most of us tend to spend money on the go, so having a software package that allows you to log and track outgoings means a mobile and app-based solution makes a lot of sense. Most packages offer both desktop and mobile solutions, however.

Reporting capability

While personal finance packages are great at helping you manage money and track spending, they're also vital for producing reports. This data can subsequently be used for tasks, such as filing your taxes or for sharing with an accounts person who does the job for you.

Easy integration

You'll want to check that any personal finance software you're considering will, ideally, work in tandem with other packages. This is crucial when it comes to logging items like expenses. Check your package can be used to move figures from one place to another for much more efficient tax filing purposes.

Help and support

As is the case with any software package, it's always good to check there will be help at hand should you need it. Some personal finance packages come with free support, while others have it as part of a paid-for plan. How much help you will need depends on your confidence with the software.

How we tested the best free personal finance software

Remember, it's still possible to use a spreadsheet program like Microsoft Excel if you prefer. However, the great thing about personal finance software is it has been created specifically for money management needs.

What we look for in the best personal finance software packages is primarily the ease of use factor, combined with the range of features and functions. We also test how well the software runs, particularly in the app or mobile environment. Lots of us are time poor and being able to manage finances on the go is a popular option.

Naturally, we're also looking for just how well the software can handle tasks, especially for folks who have more complex personal finance affairs. Keeping your data safe and secure is a given too, especially if it's a package that can integrate with the best accounting software or tax filing packages.

Read more on how we test, rate, and review products on TechRadar.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

- Sofia Elizabella Wyciślik-WilsonFreelance writer

- Rob Clymo

- Brian Turner