Samsung

Latest about Samsung

6 design-focused wireless speakers from CES 2026 I can't wait to hear

By Carrie Marshall published

My favorite speakers from CES 2026 that look good as they sound (hopefully)

Samsung Galaxy S26 leak shows no sign of the Pro or Edge models

By David Nield published

It looks as though Samsung is going to stick with its traditional approach when it comes to its 2026 flagship phones.

Goodbye cheap OLED TVs — RGB mini-LED and wallpaper OLEDs will be your doom

By Al Griffin published

At CES 2026, it was clear that OLED TV makers are shifting focus to higher-end, design-forward models. Meanwhile, RGB mini-LED is coming to smaller screen sizes to challenge OLED's dominance

iPhone 7, Galaxy S7 Edge, and the very first Google Pixel — these are the phones we were using in 2016

By Jamie Richards last updated

The web is alive with the sound of 2016 nostalgia – let’s take a look back at the best phones of our favorite era.

Samsung built a stunning micro-LED TV where the bezel is also a screen

By Matt Bolton published

Samsung's 140-inch next-gen TV shows how micro-LED can create very cool new design opportunities

OLED-beating NanoLED TVs could come in 2029, says a big company in the game

By Carrie Marshall published

QD-EL works like OLED, but could be brighter and more efficient – and it may not be a pip-dream any more

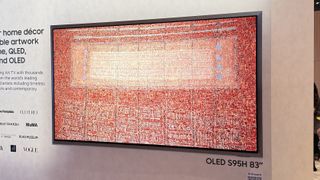

Samsung S95H - here's everything we know about the 2026 flagship OLED

By James Davidson published

Everything we know about the Samsung S95H, the 2026 flagship OLED TV that Samsung revealed at CES.

The best 4K Blu-ray players: Ultra HD marvels chosen by our experts

By James Davidson last updated

Streaming services are popular, but there's no better way to watch movies than with the best 4K Blu-ray players.

Sign up for breaking news, reviews, opinion, top tech deals, and more.