TechRadar Verdict

M1 Finance is one of the best options to invest in individual shares and EFTs.

Pros

- +

No Broker fees or commissions

- +

No minimum Initial deposit

- +

Automated portfolio management

- +

Fractional shares

Cons

- -

No Tax-Loss harvesting

- -

Only ETFs and stocks

- -

No mutual funds

Why you can trust TechRadar

M1 Finance is a Chicago based online financial services company. It is also known as Robo-advisor. It is registered with the Securities and Exchange Commission as a broker-dealer and is also a member of the Securities Investor Protection Corporation (SIPC) and the Financial Industry Regulatory Authority (FINRA).

Founded in 2015, it offered services like Investing, Asset Management, Lending, and other financial services. In 2016, they introduced the ability to automate monthly deposits and maintain a preset portfolio allocation to make the funds withdrawal with ease.

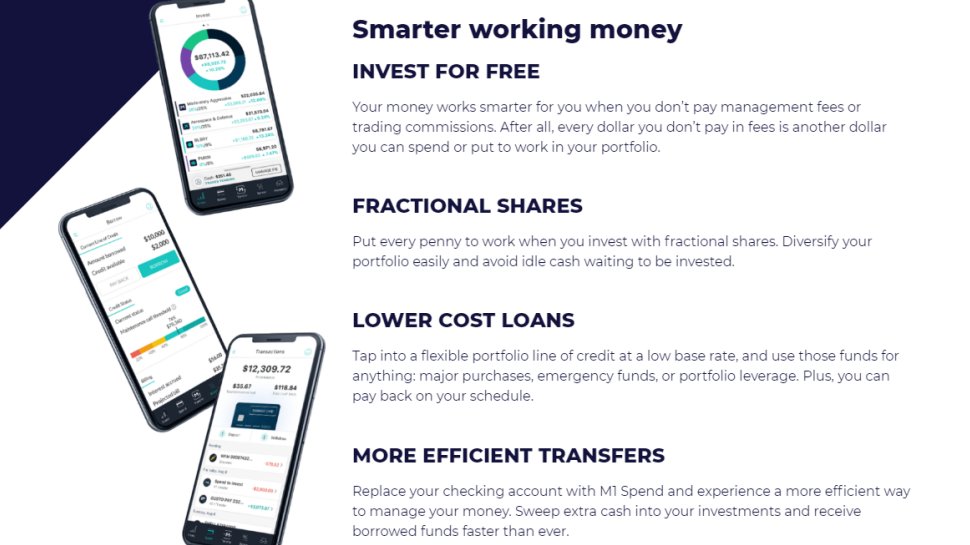

Also, the good thing about M1 Finance is they are available on all modern platforms. M1 Finance has a web-based trading dashboard along with both iOS and Android applications available for a quick download.

What to expect

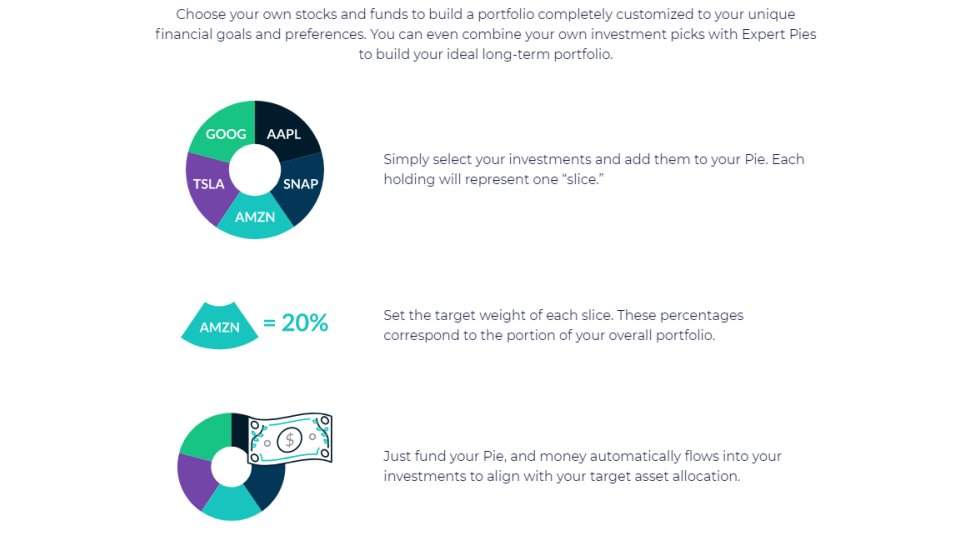

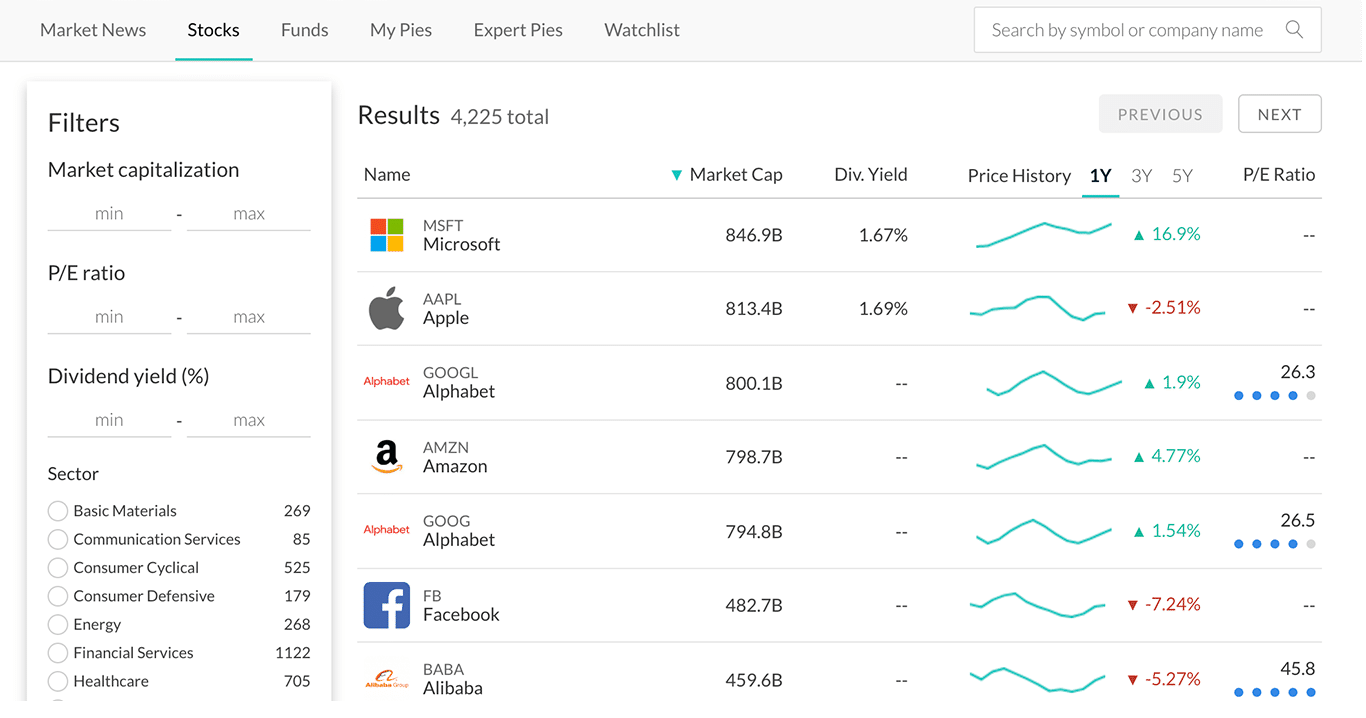

M1 Finance offers automated investing with a high level of customization and a unique combination of automated investing allowing customers to create a portfolio as per their specifications. A user can create portfolios containing low-cost ETFs or use individual stocks or both in the same. M1 Finance offers low-cost alternatives that allow fractional share transactions and control over these portfolio contents.

For the new users, it is quite easy and straightforward to sign up for the M1 Finance account. All the user needs to do is to enter the email address and choose the password, just after this the user will get a pie-building feature where the user can build the pie or choose the made up of ETFs or individual stocks. For help, there are tutorials on the site alongside to guide how the site works.

M1 Finance is also expanding to offer a digital bank along with its investment service. They are also looking forward to launching a service that will sweep your excess cash into a paying 1.5% per year, it includes a debit card that earns 1% cashback on different purchases. The service will be named as M1 Spend.

The M1 Standard limited for the long term users. If the user is looking forward to investing in long term usage then the user will get decent cashback. That’s one of the reasons to go with M1 finance. There are better-paying places to park your funds, also there is a no-fee savings account or a user investment portfolio.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Few of the expert pies available for the user are:

- General investing: The user can set this one up to reflect your risk tolerance and create a diversified portfolio to protect yourself

- Plan for retirement: This pie is just for the target retirement date

- Responsible investing: If you are a responsible investor then only you need this pie

- Income earnings: This pie only works for dividends and income returns

- Hedge fund followers: This one follows the strategies of reputable and acclaimed investors

- Industries and sectors: This option lets you invest in certain industries that interest only the user

There is a no-risk assessment questionnaire that helps you answer the understand the process better. The offers you Individual, joint accounts, ITAs and trust accounts.

A user can also set up automatic deposits in part of the initial account setup which you can edit whenever you please. Margin loans are allowed and M1 Borrow service lets you borrow up to 35% of the account value at a 4.00% interest for non-investing purposes.

Fees and charges

M1 Finance does not charge for trading fees. Well, that’s a piece of great news for the user that they don’t need to pay for the custom pies. There is something they charge for, that’s the termination fees.

Also, there are two versions of spend that you can choose, the free one is M1 Standard and M1 Plus which comes with an annual fee of $100 fee for the first year and $125 per year thereafter. There is also an inactivity fee if the user stays offline for more than 180 days, the platform penalizes a user with $20 for the same.

Support

Customer support is one of the important features on any trading platform. Here you can sort yourself from the issues that you may face during trading. From their Support Center you can go through manage account, transfers, invest, spend and borrow specific queries. Users from across the globe can sign up for trading on M1 Finance.

Solo Investors get the benefits from both of the worlds. The user can customize the portfolio and invest in any stocks and ETFs s/he wishes. M1 Finance will manage the same for the user. For the medium experienced investors, the company does not provide any advice or recommendations. This service is recommended for experienced users. For the long-term investors, M1 Finance allows trading only once a day.

Final Verdict

This tool is best fit for the starters. If you want to start the active investment portfolios then this may be the best space to start with. M1 finance does automatic maintenance of proportional investment allocation. It offers more control over the investments and provides a fine balance between automation and manual control on the investment, depending on each user.

- Best forex trading platforms: trade and invest on your Android or iPhone

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.