TechRadar Verdict

Although the name of the product is a bit weird, IdentityProtect.com is a powerful identity theft protection app with some interesting features beyond the usual. While the cost is significantly more than other products, it has similar features to other competitors, such as the $1 million theft protection insurance on the Ultimate plan. The app doesn’t provide much detail about the theft protection offered, and doesn’t have the brand name recognition of competing apps, but it does provide an alternative at a price.

Pros

- +

Dark web protection

- +

$1 million theft protection insurance

- +

7-day trial for minimal cost

- +

Direct phone support

Cons

- -

No name recognition

- -

Short trial period and not free

- -

Expensive monthly cost

- -

Single tiered plan only

- -

Support falls short in hours and options

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

A stern-looking man stares down at you. His glasses are dangling in his hand, with a frown on his face, and his hand is planted firmly on his hip. His expression makes the clear statement, “Why have you not been using theft protection?” With this knowledge, your life is now in his hands, and your future will be dictated by him alone.

While sounding like a parental scolding, it’s actually a mascot of sorts for the credit identity provider, IdentityProtect.com. (The company refers to itself that way, instead of Identity Protect, in a persistent reminder that we’re discussing online identity theft here.) Right on the homepage, the stern-looking man greets you with the intention of making you want to register for an account, but just might make you snicker instead. It also doesn’t help that the IdentityProtect.com website relies too heavily on stock images - one guy is giving a thumbs-up holding a smartphone with a superimposed product logo. We also couldn't find any information on the number of subscribers, nor the number of credit breaches resolved, nor how many years this company has been in business.

Despite these shortcomings, the product itself is quite solid. It has some extra features that are not as common with other apps with a pricing model that is attractive for budget-minded consumers.

Plans and pricing

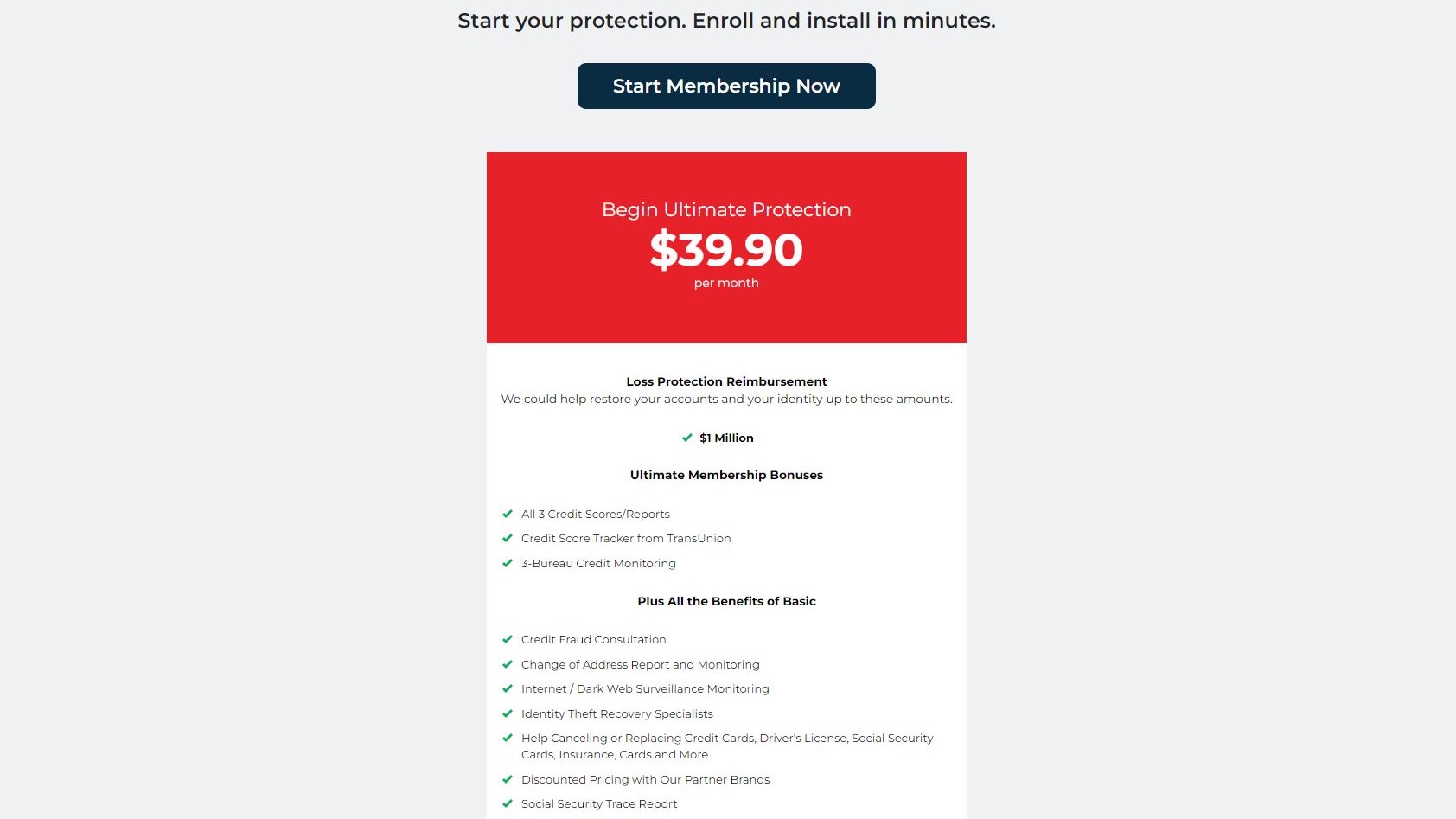

IdentityProtect.com simplifies the pricing plans to a single one, unlike Norton LifeLock and many other identity theft protection apps that have multiple tiers. Previously IdentityProtect.com offered two tiers of plans: a Basic plan for $12.95 per month which included one credit bureau and $100,000 of identity theft protection insurance, and the Ultimate plan at a cost of $19.95 per month which included $1 million in protection and alerts from three credit bureaus.

However IdentityProtect.com’s current plan has significantly increased in price. The single option has a monthly cost of $39.50 per month, without a discount offered for paying annually. We found a mention of a Basic Plan, but could not find any plan to actually purchase other than this Ultimate one.

Realize that much better known, Norton LifeLock’s top plan costs $23.99/month, over $15 lower for the Ultimate Plus plan, and also offers an annual discount. Also compare this with the cheapest identity theft product we’ve found, which is Complete ID through a Costco membership, but costs only $8.99 for Executive members (or $13.99 per month for Business members). So, however we price it, this makes IdentityProtect.com’s offering a rather poor value.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

IdentityProtect.com also previously offered business plans that ranged in price from $39 per month for 10 employees up to $149 per month for a company with 100 employees. It’s a bit odd, actually, to offer these plans because identity theft protection is a highly personal topic - akin to health insurance or a retirement plan. While it was a way for employers to offer the app as another benefit, it also seemed like a tacked-on payment option without any real benefits. Apparently there were not too many takers, as we could not currently find the business plan anywhere on the company’s website.

Interface

Identity theft protection apps commonly use a dashboard interface, with tabs at the top of the screen to navigate dealing with identity theft issues. IdentityProtect.com follows the same formula with a bit of a dull and boring interface devoid of any inspiration for creative thinking when it comes to resolving credit problems, or if you have a hacked bank account. We can concede that It’s clear, clean, and consistent, with a professional polish, but realize that it does not provide the wizards or dashboard interface of one of our top picks in identity theft protection, Norton LifeLock.

Features

With a quick glance, IdentityProtect.com superficially offers all the features you would expect. You can easily see alerts about your credit, bank account changes, and track your credit score. With the Ultimate Membership plan you have access to three credit agencies for scores and reports. Fairly standard stuff. A shortcoming is that the product website leaves out whether you can call in and resolve issues, other than that there are “Identity Theft Recovery Specialists,” but no indication how they get involved. There are also references to a Credit Fraud Consultation, a Social Security Trace Report, and discounted pricing with our partner brands, without any further details leaving this too amorphous in our opinion, especially at this higher price.

However, there are a few extras beyond what we’ve found with other apps. One falls under Internet / Dark Web Surveillance Monitoring, which we found in further detail that it means to “Patrol the internet to find unauthorized information about you.”

Support is also hardly a standout. It took us some clicks, but we did find a direct support number, and an email. It is open 7 days a week, but not 24 hours a day, and really only for 6 hours on Sunday. There is also no support portal, chat, and the FAQ is only three questions long.

The competition

There’s a sense that IdentityProtect.com is a somewhat middle-of-the-road product at best, with average features and expensive pricing. It's higher cost than some apps like Norton LifeLock and even more expensive when compared with Complete ID or IdentityForce. There is no longer a Basic plan for IdentityProtect.com which would make this more affordable. The app doesn’t mention a hotline to be called for resolving issues with your credit by talking to a licensed investigator, making this all fairly predictable.

Final verdict

That said, it’s the extra features such as Dark Web protection that might make IdentityProtect.com more appealing to somebody. For those that need to see alerts about a fraudulent checking account, or will benefit greatly from trimming down on their email or snail mail, maybe IdentityProtect.com is a perfect fit. Unfortunately it's an expensive product, but it does have many of the standard features most of us need, and the interface is decent but unremarkable. It falls short that the app should include more information about identity theft on its website to educate customers, both current and potential. The app should also make it more obvious if there is an investigator you can call for resolution of credit issues.

We've also highlighted the best identity theft protection

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.