TechRadar Verdict

Adyen POS is an all-in-one payment solution that offers standout features along with comprehensive support and security. Its complicated pricing model, however, is a huge drawback.

Pros

- +

No monthly fees

- +

Great customer support

- +

Simple interface

Cons

- -

Complicated pricing table

- -

Not suitable for low-volume merchants

Why you can trust TechRadar

If you’re looking for the best POS system for your business, you might have heard of Adyen POS, a Dutch company that provides payment processing services for companies like Microsoft, Uber, and Spotify.

In this Adyen POS review, you’ll find information about its pricing, features, interface, support, and security to help you decide if Adyen POS is the payment processing solution for your needs.

Adyen POS: Plans and pricing

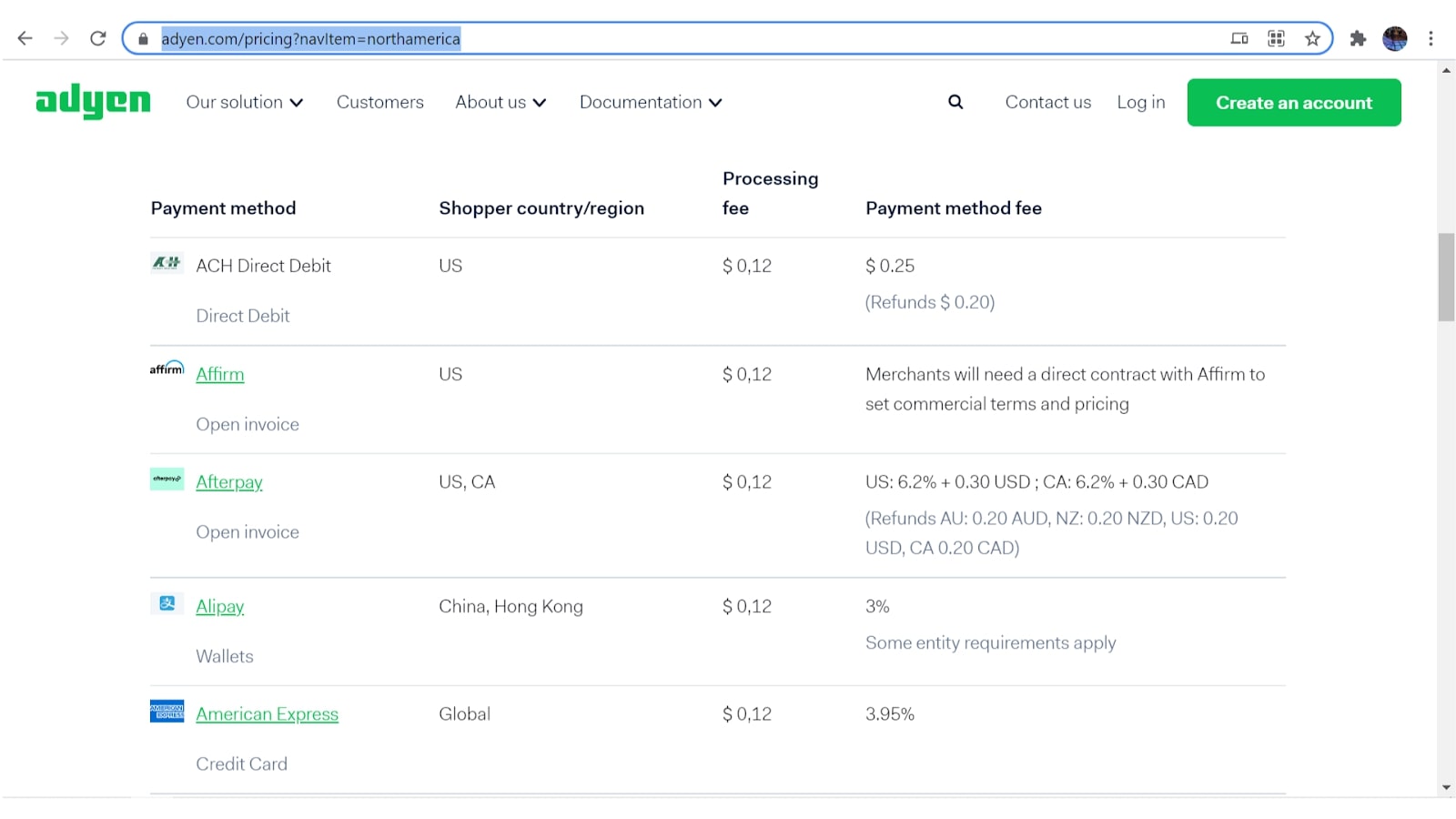

Adyen does not charge monthly, setup, integration, or closure fees. Instead, you’ll be charged a processing fee ($0.12) plus a payment method fee per transaction. Payment method fees vary.

For example, Adyen charges fees for Mastercard and Visa according to an Interchange ++ model: a combination of the interchange fee charged by the bank, the fee from the card network, and the applicable acquirer markup.

Other payment methods such as Alipay and ACH Direct Debit see a flat fee of 3% and $0.25 per transaction respectively.

You can find a full breakdown of Adyen’s pricing on its website. Do note that with Adyen, you’ll require a minimum invoice of $120 per month, depending on transaction volume and region.

Adyen POS: Features

Adyen offers a wide range of features that business owners will find useful. Like many POS providers, they integrate in-store, online, and app-based transactions in an all-encompassing system.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Merchants can process all kinds of payments in multiple ways without the hassle of dealing with different processors for a point of sale, payment gateway, or mobile payment.

Local & Global payments

Adyen are well known for their ability to deliver a localized version of global merchant processing. International merchants can accept payments and process them locally as well as globally.

With this flexibility, you can avoid several costs of operating an international business, such as cross-border card network and interchange fees and bank surcharges. Also, you don't need to juggle between multiple vendors for different global payment types.

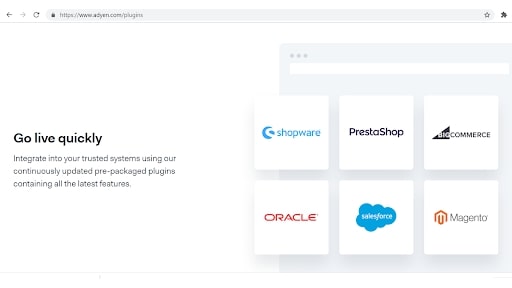

Plugins

Adyen offers a range of plugins for leading technology solutions to give your shoppers the best checkout experience. In addition to in-house plugins built and maintained by Adyen, you’ll find plugins like Shopify, WooCommerce, Spryker, and more that Adyen has created with its partners.

The plugins are easy to integrate and come with Adyen’s payment platform functionality delivered out of the box.

POS Reporting & Insights

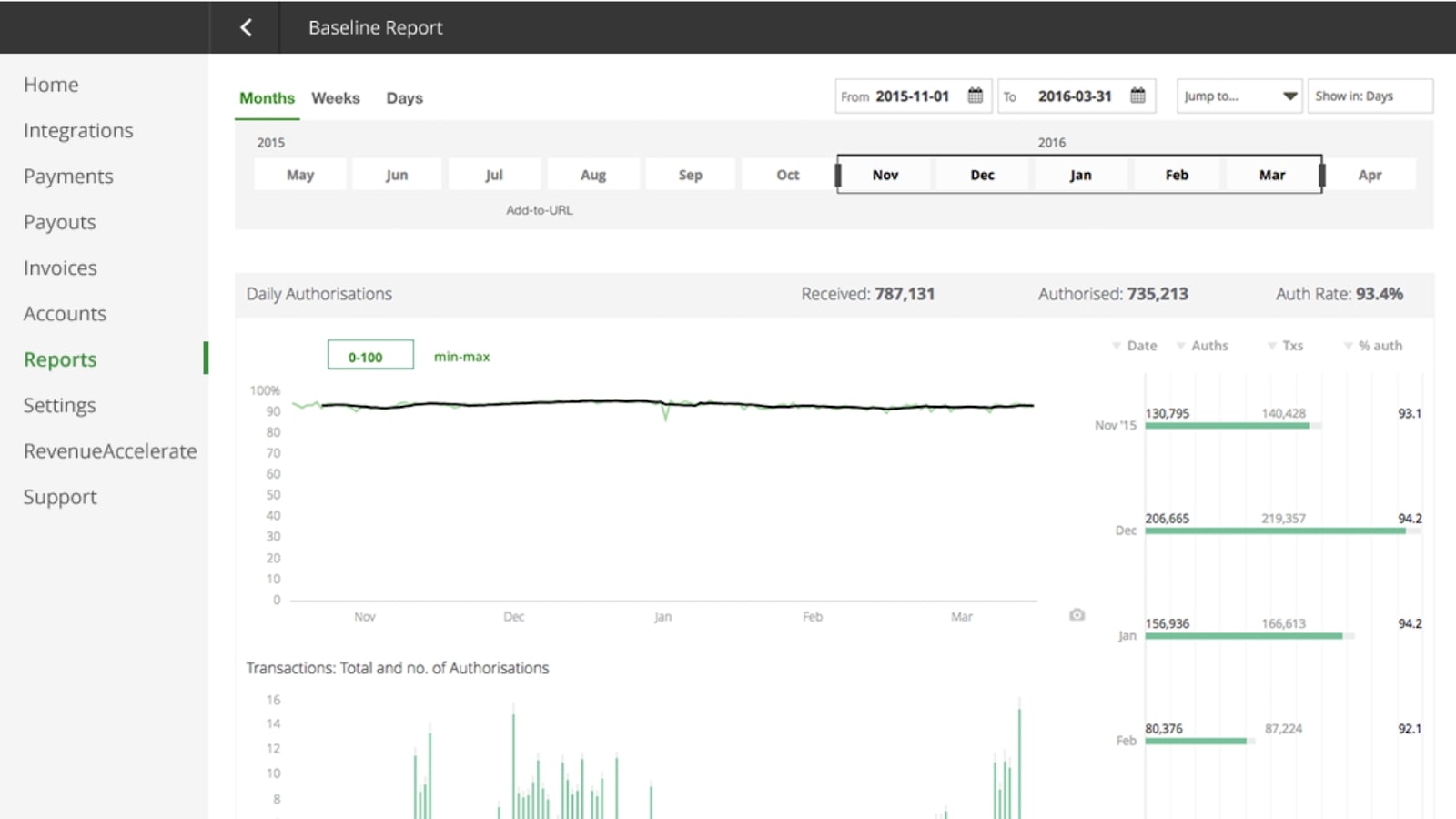

Adyen’s all-in-one payment solution stores your client’s information and complete transaction history within a single system to allow for a seamless customer experience. More than that, with a dedicated Customer Area, you’ll be able to unlock powerful shopper insights that will help grow your business.

Customer Area gives you a full view of a series of charts that document each step of the payment flow. At a glance, you’ll see how many payments come in, how many are authorized, and how many are finally settled. Business owners can identify potential areas for improvement and take action where necessary.

Adyen POS: Interface, set-up and in use

Getting started with Adyen is an easy but long process. You'll have to:

1. Create an account

2. Speak to Adyen's team for tailored advice and an assessment of your business

3. Request to start processing payments

...and only then can you sign a contract, before you can go live.

After you sign up, however, Adyen's ease of use shines. Its simple API allows you to initiate payments from web browsers, mobile devices, and POS systems.

On the backend, Adyen's helpful dashboard navigates to all the essentials that you'll need. You can view performance, terminal fleet management, and reporting in one clean and intuitive interface.

Adyen POS: Support

Adyen’s user support team is top-notch and contactable via email or phone. You can find a long list of worldwide offices and phone numbers on Adyen’s contact page, and all lines are available 24/7.

Alternatively, you can fill up a support ticket on the site and get a solution within eight hours. Adyen’s website also features multiple Adyen POS resources, links, and an FAQ section that are useful for troubleshooting.

Adyen is also known to be active on Twitter, LinkedIn, Facebook, and YouTube. You can comment on its posts to get instant replies and support.

Adyen POS: Security

Adyen is fully PCI DSS 3.2 compliant as a Level 1 Service Provider, which is the key security standard within the payments industry.

All users benefit from Adyen RevenueProtect, a risk management feature that protects your business against fraud.

It comes with a range of powerful built-in risk tools including 3D Secure authentication, real-time machine learning, specialized device finger-printing, and automated chargeback defence.

You’ll also be able to customize your risk settings by adding or creating risk rules and block lists.

The competition

Competition is stiff in the POS system market. For one, users who prioritize flexibility and customization will find Lightspeed POS’s bespoke solution attractive.

A basic plan ($69/month) comes with different features and options that can be added as needed.

Furthermore, Adyen’s complicated pricing model can make cost determination a challenging process. Users who prefer simpler pricing models often go for platforms such as Square POS ecommerce, where transactions come with a straightforward 2.6% + $0.10 fee.

Adyen POS: final verdict

With its simple interface, comprehensive support and security, and useful features, Adyen is easy to recommend. Some users, however, may find its pricing model complicated. Additionally, low-volume merchants may find it a challenge to hit the minimum monthly invoice of $120.

Beyond that, the all-in-one payment solution with global merchant processing is perfect for business owners who'd like to avoid a whole host of operating costs and the hassle of managing multiple processors.