TechRadar Verdict

Although MyFico is a costly product, it provides several useful features for credit reporting and an excellent user experience, from a reputable company as well. A FICO score is the industry standard, and MyFico has a polished look that makes the extra cost worthwhile, particularly if you're defending your identity against fraud.

Pros

- +

Brilliant interface

- +

Excellent simulator

- +

Powerful features

Cons

- -

Expensive

- -

No free trial

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

There is finally an identity theft prevention program that is worth your time and money among the multitude of options available. This is particularly noteworthy since MyFico is the consumer arm of the company that created the FICO credit score, which has been an industry standard for more than 25 years.

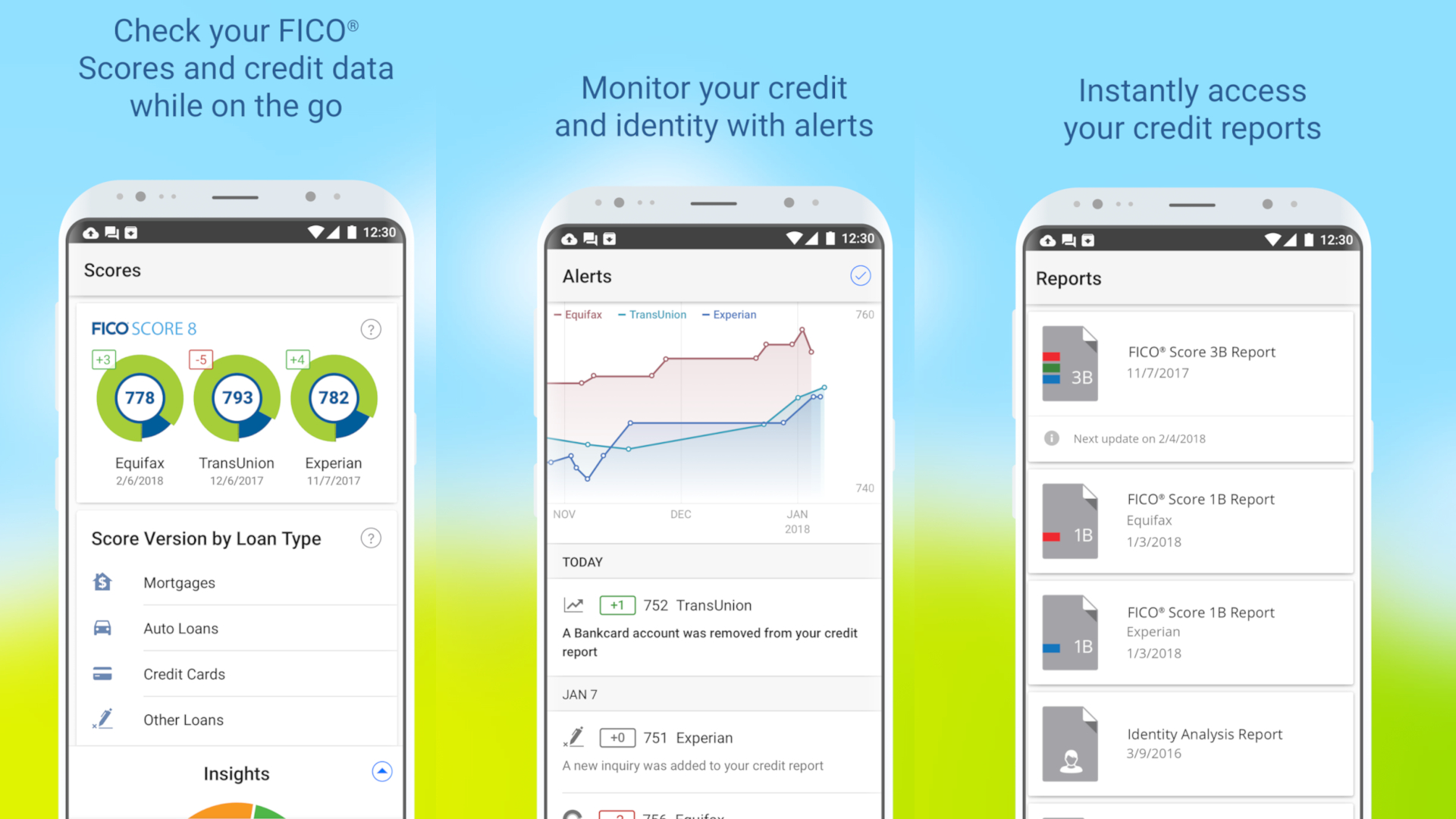

MyFico places a strong emphasis on your credit score and credit reporting, offering a wide range of educational content as well as detailed information about your credit situation. The mobile app presents this information in a vibrant and easy-to-understand manner, boasting a more polished appearance than most of the applications we've tried. Although this product is typically priced higher than others, it meets all the criteria for a high-quality offering.

First and foremost, the user interface (UI) is simple and easy to navigate. This is crucial because a clumsy and unappealing UI can make any program difficult to use. Quickly finding the features you need can help you protect yourself against criminals or hackers attempting to steal your personally identifiable information, which makes identity theft protection essential. MyFico's colorful display of credit scores includes pop-up alerts that notify you of potential risks.

Like many other products, the app offers $1 million in identity theft protection, although some of the more basic competitors provide similar coverage. Additionally, a credit score simulator is available, allowing you to see how various actions, such as taking out a new auto loan, may affect your credit score. The organization behind MyFico is well-known and reputable. Overall, this is an effective and intelligent product for monitoring your online presence.

MyFico: Plans and pricing

MyFICO offers a range of plans to help consumers monitor their credit and identity, with pricing structured across different tiers. The Free Plan provides basic coverage, including a FICO Score 8 based on Equifax data, monthly Equifax credit reports, and 24/7 credit monitoring.

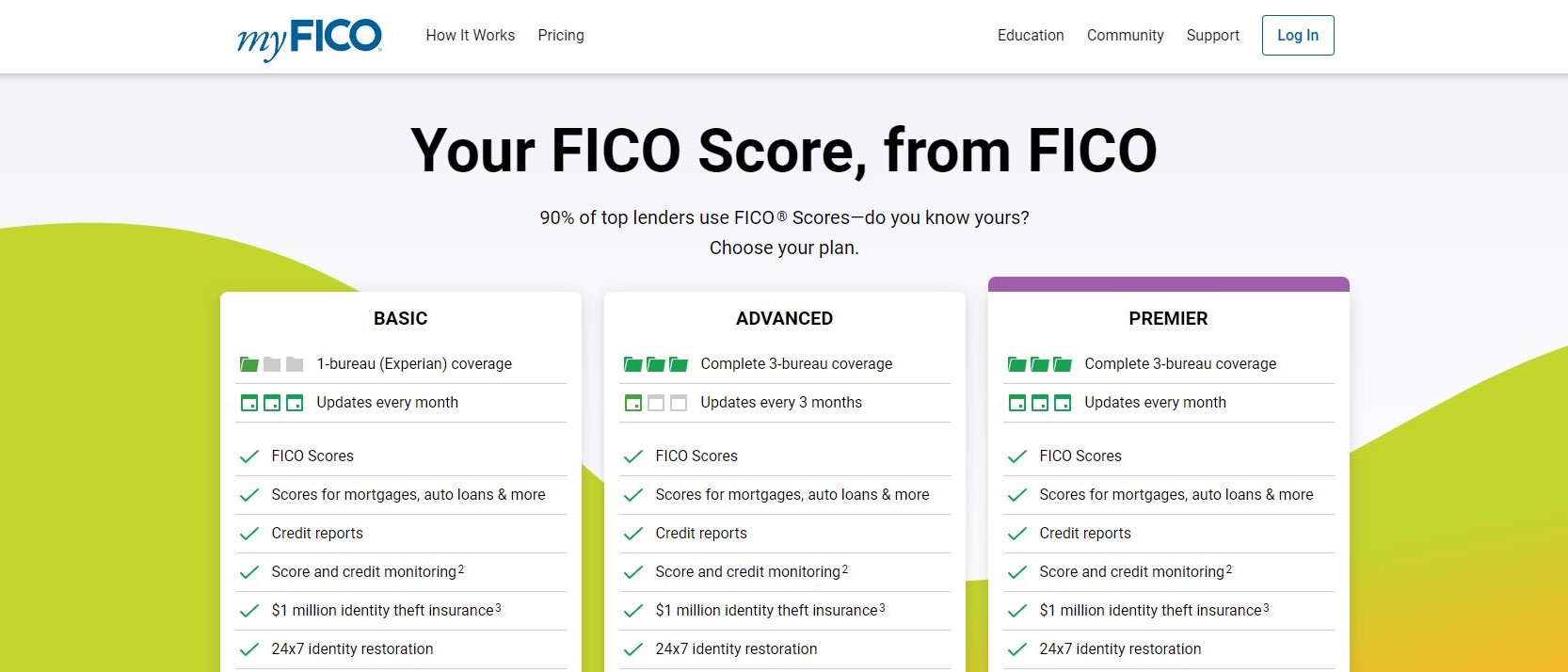

For more comprehensive coverage, MyFICO has three paid subscription tiers that automatically renew each month:

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Advanced Plan: Priced at $29.95 per month, this plan offers three-bureau coverage (Experian, TransUnion, and Equifax) with credit reports and FICO Score updates every three months. It includes comprehensive credit monitoring, FICO Score monitoring with alerts, and identity monitoring. Additionally, it provides $1 million in identity theft insurance and 24/7 identity restoration. Features like the FICO Score Simulator and "How Lenders View You" analysis are also included.

Premier Plan: This top-tier plan costs $39.95 per month and offers the most frequent updates, providing three-bureau credit reports and FICO Scores (including versions for mortgages, auto loans, and credit cards) on a monthly basis. Similar to the Advanced Plan, it includes proactive credit report monitoring and alerts, identity monitoring, up to $1 million in identity theft insurance, and 24/7 identity restoration. All paid plans feature FICO Score 8 and may include additional versions of the FICO Score.

Please keep in mind that all subscriptions automatically renew and are non-refundable

MyFico: Interface

MyFico truly stands out in the realm of identity theft prevention software, especially when compared to many other programs that often resemble outdated tax software from a decade ago. One of its most notable features is its vibrant, user-friendly credit score indicator, combined with a sleek, modern design that makes the mobile app particularly appealing to users.

The app boasts an intuitive layout, allowing users to easily navigate and access key features. Checking your credit score is a swift and straightforward process, while delving into potential credit issues or assessing identity theft notifications is just as seamless. This accessibility is vital in a landscape where timely intervention can make a significant difference.

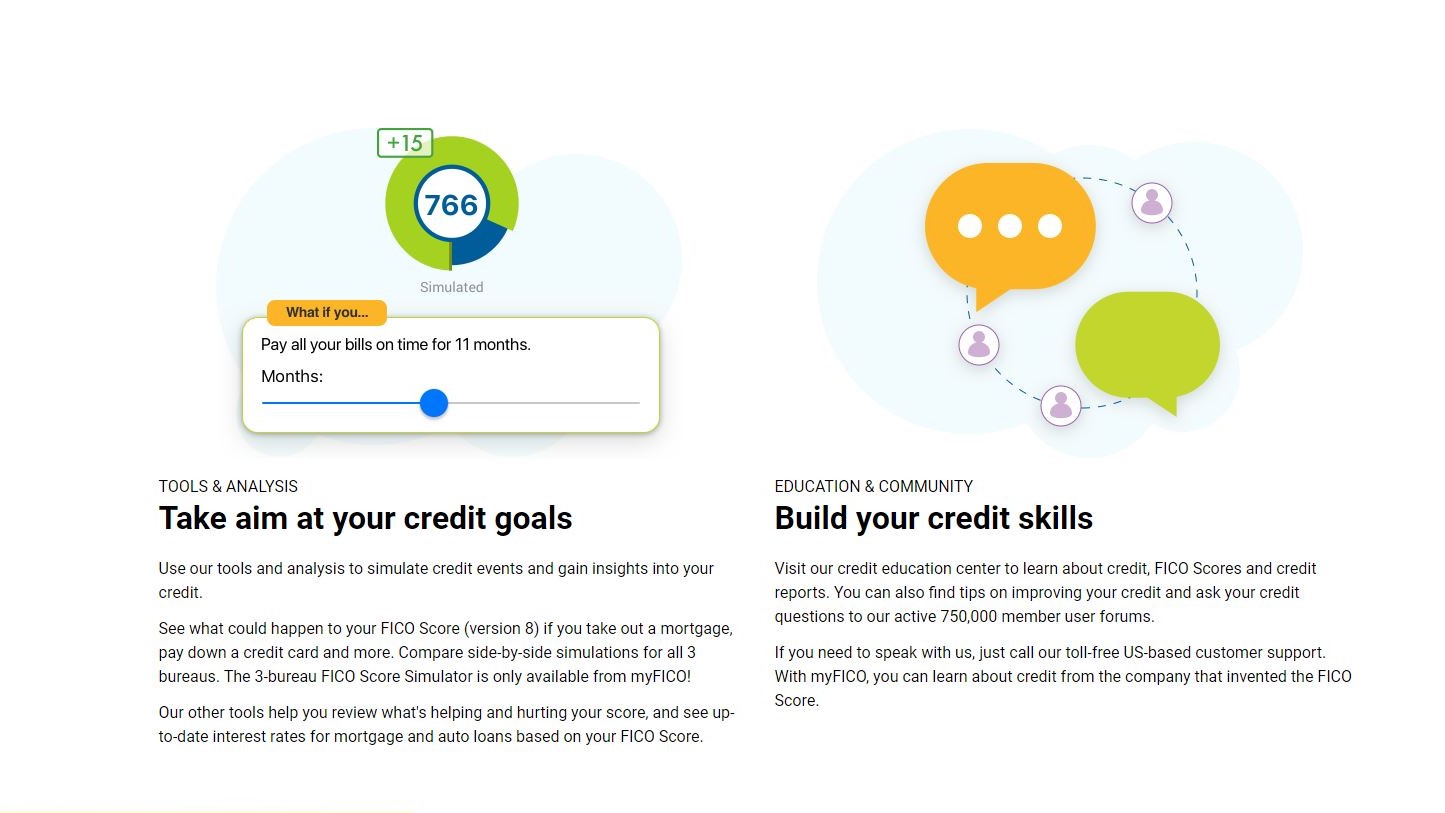

One of the app’s standout components is its credit score simulator. Unlike traditional calculators that offer limited insights, MyFico's simulator operates more like an interactive wizard. It allows users to explore various financial scenarios—like purchasing a home or a car—illustrating how these decisions might affect their credit score. This foresight equips users with the knowledge they need to make informed financial choices, ensuring they can assess whether it’s wise to move forward with significant purchases.

While MyFico comes with a higher price tag than some of its competitors, the simplicity and effectiveness of its interface can be well worth the investment. If this user-friendly design helps you tackle potential identity theft issues or prevent future credit complications, the cost becomes a minor consideration compared to the peace of mind it offers.

In contrast, other identity theft protection apps, although they may offer impressive features, often fall short in usability. Their cumbersome and outdated interfaces can make it challenging for users to locate and utilize these tools effectively. MyFico’s sleek design and robust functionality set it apart, making it a superior choice for anyone serious about safeguarding their identity and maintaining their credit health.

MyFico: Features

MyFICO offers a comprehensive suite of features designed to empower you with knowledge and protection over your credit and identity. With MyFICO, you receive FICO Scores and credit reports from all three major credit bureaus: Experian, TransUnion, and Equifax. This is essential because 90% of top lenders rely on FICO Scores. By reviewing your reports from all three bureaus, you can identify discrepancies and errors that may be negatively impacting your scores.

Additionally, MyFICO provides credit monitoring and alerts, continuously tracking significant changes such as new accounts or inquiries. This allows you to quickly detect potential identity theft or fraudulent activity and take immediate action if necessary. You will also benefit from FICO Score monitoring and a history graph, which visually displays your score's progression over time, helping you understand how your financial decisions impact it.

One particularly helpful tool is the FICO Score Simulator, which enables you to explore "what if" scenarios, such as how paying down debt or applying for a new loan could affect your score. This feature empowers you to make informed financial choices before taking action.

Beyond credit monitoring, MyFICO offers identity monitoring by scanning the dark web and public records for your personal information. If your information is compromised, you will receive alerts. In the unfortunate event of identity theft, you are protected by identity restoration services and up to $1 million in identity theft insurance. This coverage includes 24/7 access to specialists who can assist you in recovery and provide financial protection for related expenses.

Finally, MyFICO provides valuable credit education and customer support to help you understand the complexities of credit and offer assistance whenever needed. Together, these features give you a complete picture of your financial health, proactive protection, and the tools to confidently manage your credit and identity.

MyFico: Support

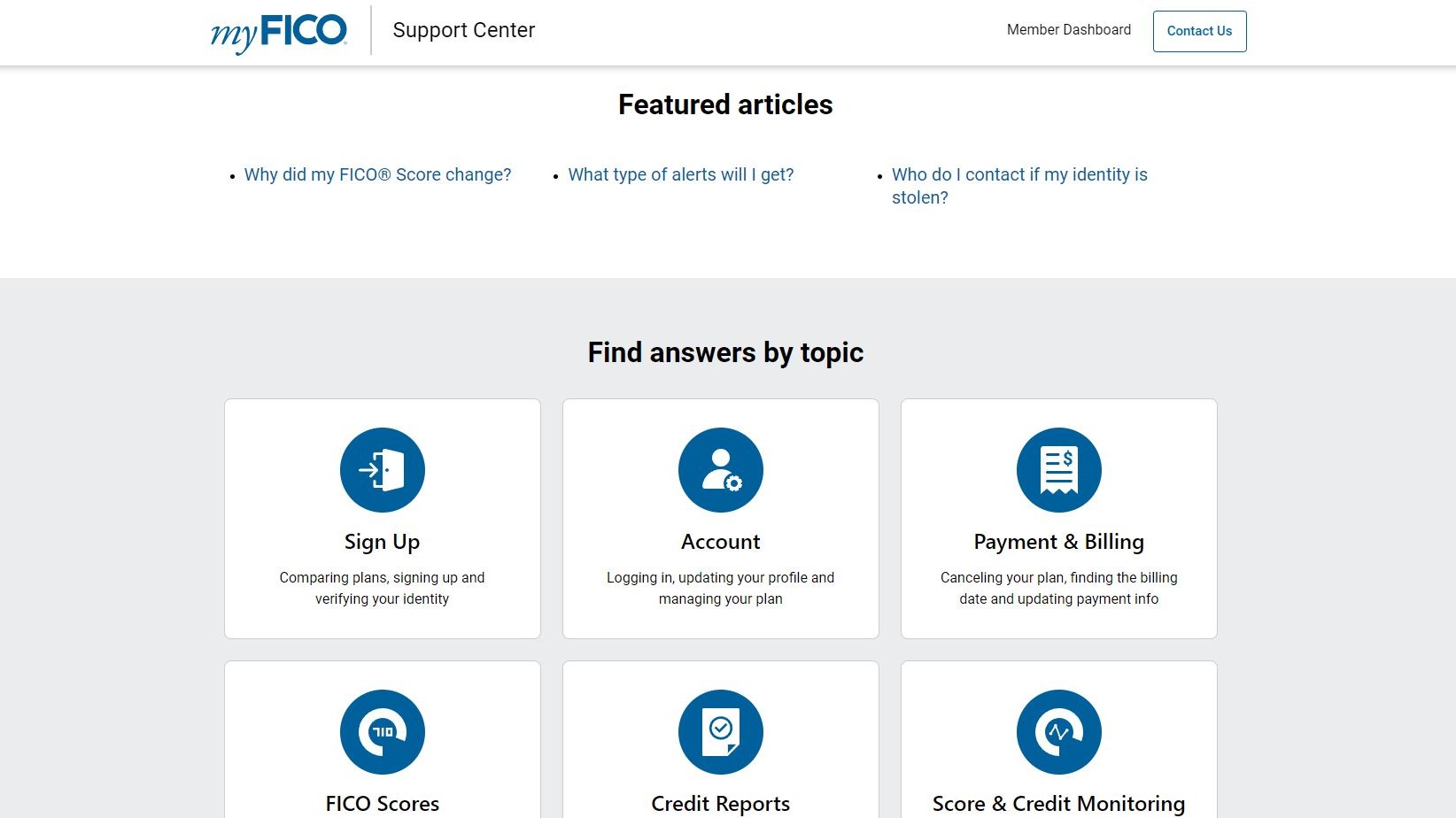

Users who are facing problems can get assistance from the MyFico support team. A direct toll-free number is provided, along with what appears to be an email address but, upon selecting it, directs the user to a support portal. The business is open Monday through Friday from 6 AM to 6 PM and on Saturday from 7 AM to 4 PM PST. There are no choices for faxing or chat.

Additionally, there are articles categorized by subjects such as "Why did my FICO Score change?" and professional credit education. A discussion board, ebooks, or video content are not current options.

MyFico: The competition

While MyFICO is the official consumer division of FICO and offers direct access to the widely used FICO Scores, several strong competitors provide comprehensive credit monitoring services, often with different focuses.

One of the most prominent competitors is Credit Karma, which stands out for offering free credit monitoring services. Unlike MyFICO, which primarily provides FICO Scores, Credit Karma uses the VantageScore® model (generated from TransUnion and Equifax data). Credit Karma also includes features like credit-building tools, financial management resources, and personalized offers for credit cards and loans, making it a popular choice for those looking for free and expansive credit oversight, though it's worth noting they share user data for marketing purposes.

Another significant player is Experian, one of the three major credit bureaus. Experian offers its own free credit monitoring service, providing access to your Experian credit report and FICO® Score. They also have a unique feature called Experian Boost, which allows users to potentially increase their FICO Score by including on-time payments for utilities, phone bills, and streaming services. While MyFICO also offers FICO scores, Experian's direct connection to one of the bureaus and its Boost feature offer a distinct advantage for some consumers.

Beyond these, other services like CreditWise by Capital One (free, offering TransUnion VantageScore and credit report monitoring), SmartCredit (offering three-bureau reports and scores with credit-building tools), Aura, Identity Guard, and LifeLock provide various levels of credit monitoring and identity theft protection. These often bundle credit monitoring with more robust identity theft insurance, fraud alerts, and even digital security features, catering to users who prioritize comprehensive protection beyond just credit score tracking. The key distinction often lies in the specific credit scoring model used (FICO vs. VantageScore), the number of credit bureaus monitored, and the inclusion of additional services like identity theft protection or financial management tools.

MyFico: Final verdict

We have a strong appreciation for the user-friendly interface and the extensive range of features provided by the MyFico service. One of the standout advantages of this platform is the reassurance it offers; you won't have to worry about navigating the murky waters of obscure identity theft companies. MyFico is backed by a well-established brand known for its credibility and trustworthiness, which is a significant advantage in the realm of financial protection.

An effective starting point for monitoring your financial health is by checking your FICO score, as it serves as a crucial indicator of your creditworthiness. Keeping an eye on this score allows you to make informed decisions regarding your credit history and potential discrepancies that may arise.

Additionally, we appreciate that even the most basic plan includes identity theft insurance, providing peace of mind in the unfortunate event of fraud. This proactive approach to identity theft protection is a considerable benefit for individuals looking for comprehensive security. Moreover, if you ever find yourself needing assistance, MyFICO's customer support is available around the clock, ensuring that help is always at hand whenever you may need it.

While we consider the MyFico solution to be robust and reliable, it is worth noting that we believe services like Norton LifeLock and IdentityForce edge it out, as they deliver a wider range of features at a more competitive price point. These alternatives provide enhanced options that cater to varying needs and budgets, making them worthy contenders in the landscape of identity protection.

We've also highlighted the best identity theft protection

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.