TechRadar Verdict

Allstate Identity Protection is one of the stronger Identity Theft protection apps we’ve encountered. The integrated social media monitoring alerts you about hacked accounts, watches over your retirement plans and student loans, throws in $500,000 in theft insurance (for both expenses and reimbursements), and also lost wallet assistance. In summary, all of the typical features are here, along with a few extras.

Pros

- +

Solid all around solution

- +

Alerts you about social media hacks

- +

Free trial

- +

Choice of tiers

Cons

- -

Not as well-known

- -

Lower tier plan with only 50k of insurance

- -

Unspecified if credit monitoring is from all three credit agencies

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

It happens suddenly, catching you off guard like a thief in the night. Picture this chilling scenario: you stroll into the local bank, casually swiping your card at the ATM to deposit a check, and your heart sinks as the screen flashes an error — your account is inaccessible. An anxious pit forms in your stomach as you pull out your phone and scroll through your Twitter feed. To your horror, you see that someone has hijacked your account, spewing links to malicious sites to your unsuspecting followers. Panic sets in as you realize the magnitude of the situation.

Determined to regain control, you rush to your bank, where you find a comfortable chair in the office of your banker, hoping for answers. But instead, she delivers the crushing news: your loan application has been denied because your credit score is in shambles. The sense of violation and confusion is overwhelming; where do you even begin to untangle the mess of identity theft?

Identity theft is one of those unfortunate realities of modern life, an experience that makes your stomach drop and anxiety soar. However, there is a silver lining amidst this dark cloud: a reliable name in the insurance industry — yes, that Allstate with the comforting “Good Hands” ads — offers a comprehensive identity theft protection app that shines with remarkably unique features.

Allstate Identity Protection stands out with its proactive approach, providing you with real-time alerts for social media monitoring. If your account is hacked, you receive an immediate notification, enabling you to act swiftly before a small breach becomes a full-blown crisis. With a safety net of up to $500,000 in insurance protection, you can navigate the murky waters of identity theft with a bit of peace of mind (though some competitors offer up to $1 million).

But what sets Allstate apart is its coverage of not just your credit cards or checking accounts, but also your student loans and retirement accounts. This all-encompassing protection shows that they understand the multifaceted nature of modern finances. While it may not boast the most powerful features compared to other identity theft solutions, the value for the price makes it an enticing option. In fact, you'd find it a worthy investment even at a higher monthly fee, granting you the confidence to reclaim your identity and restore your peace of mind. In a world where cyber threats loom large, having Allstate by your side is like having a trusted guardian, ready to protect what matters most: your good name.

Allstate Identity Protection: Plans and pricing

Allstate Identity Protection, which is offered and serviced by InfoArmor, Inc.—a subsidiary of The Allstate Corporation—provides a comprehensive suite of identity protection plans designed to safeguard your personal information and assist in the recovery process in the event of identity theft. With an understanding that each individual and family has unique needs, Allstate Identity Protection offers both individual and family plans available across several tiers, each tailored with distinct features and pricing to cater to a variety of requirements.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

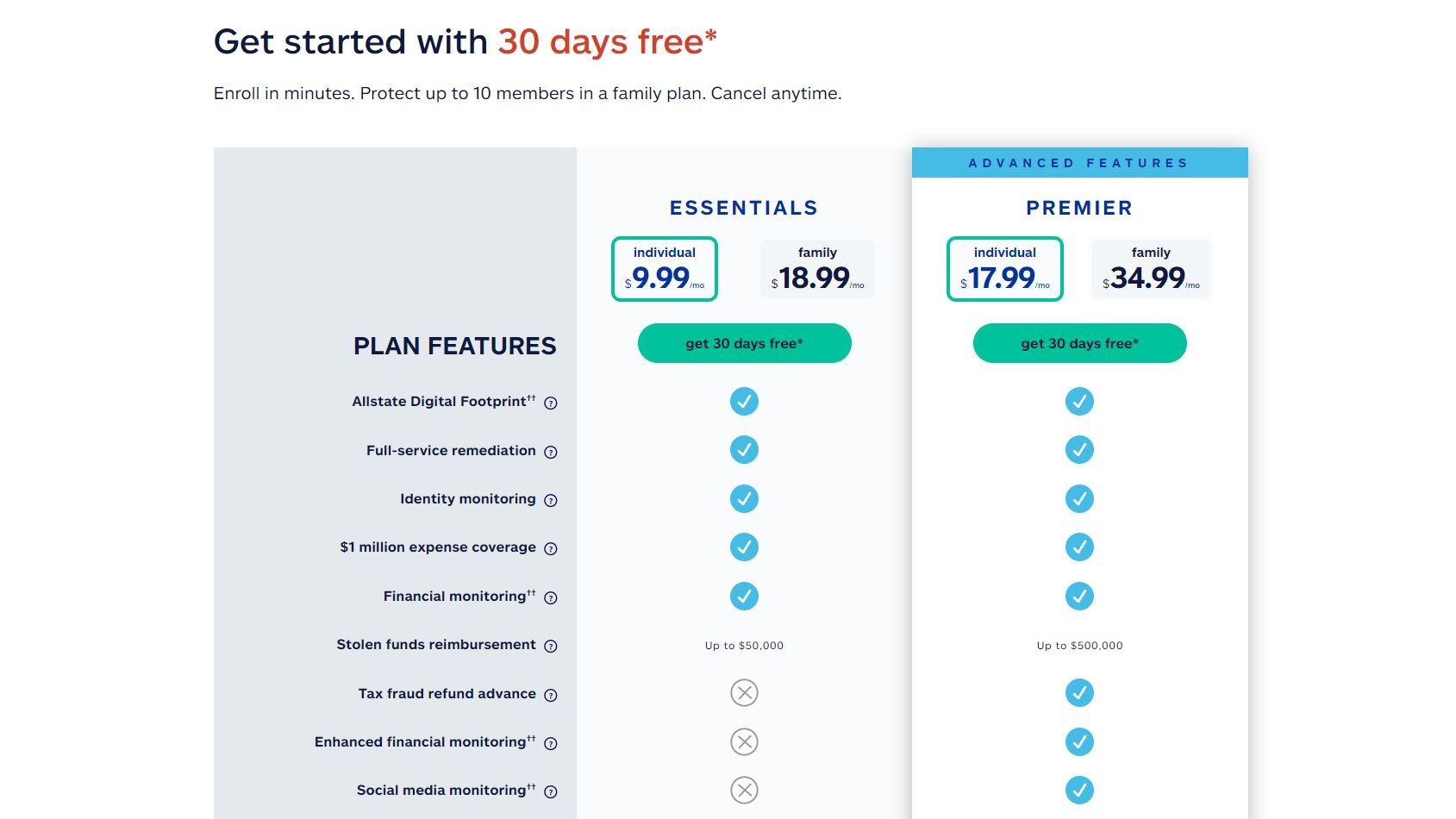

Among the options available, the Essentials Plan is an excellent starting point for individuals and families looking to secure their identities. Typically priced at about $9.99 per month for individuals and $18.99 per month for families, this plan features essential identity monitoring services along with financial fraud protection. Customers benefit from one-bureau credit monitoring and access to 24/7 full-service remediation support, ensuring help is always available when needed. Additionally, the plan includes lost wallet assistance and significant reimbursement coverage, offering up to $1 million in identity theft expense reimbursement and up to $50,000 in stolen funds reimbursement.

For those seeking enhanced protection, the Premier Plan offers a step up with a monthly cost of around $17.99 for individuals and $34.99 for families. This tier builds upon the Essentials Plan by adding features such as financial account transaction monitoring and social media monitoring, which are crucial in today’s digital landscape. Furthermore, users benefit from stolen tax refund advances and increased coverage for stolen funds reimbursement, which can go up to $500,000, giving families added peace of mind.

The most robust option available is the Blue Plan, usually priced around $19 per month for individuals and $36 per month for families. This comprehensive plan includes family digital safety tools and a cybersecurity toolkit featuring antivirus software and a virtual private network (VPN). Additional benefits include robocall and ad blockers, three-bureau credit monitoring with credit lock/freeze assistance, and an amplified stolen funds reimbursement of up to $1 million, as well as up to $1 million coverage for stolen 401(k) funds. Such extensive features make the Blue Plan an exemplary choice for those who demand maximum protection.

All plans share common features designed to provide proactive monitoring and support. Customers receive dedicated 24/7 remediation specialists who can assist with identity theft issues, along with identity theft expense reimbursement and privacy management tools to help individuals maintain control over their personal information.

It's important to keep in mind that discounts may be available for Sam's Club members, and potential price increases may occur after the first year of service. Additionally, these identity protection plans are often offered as employer benefits, making it convenient for employees to access these essential services.

For the most current and accurate information regarding features and pricing, it is always recommended to visit the official Allstate Identity Protection website, where you can find detailed descriptions of each plan and make an informed decision that best suits your identity protection needs.

Allstate Identity Protection: Interface

We hope you have a strong appreciation for the color blue, as Allstate Identity Protection prominently features a deep, calming shade of blue on both their website and mobile app. This color choice not only enhances brand recognition but also conveys a sense of trustworthiness and security, which is crucial in the realm of identity protection.

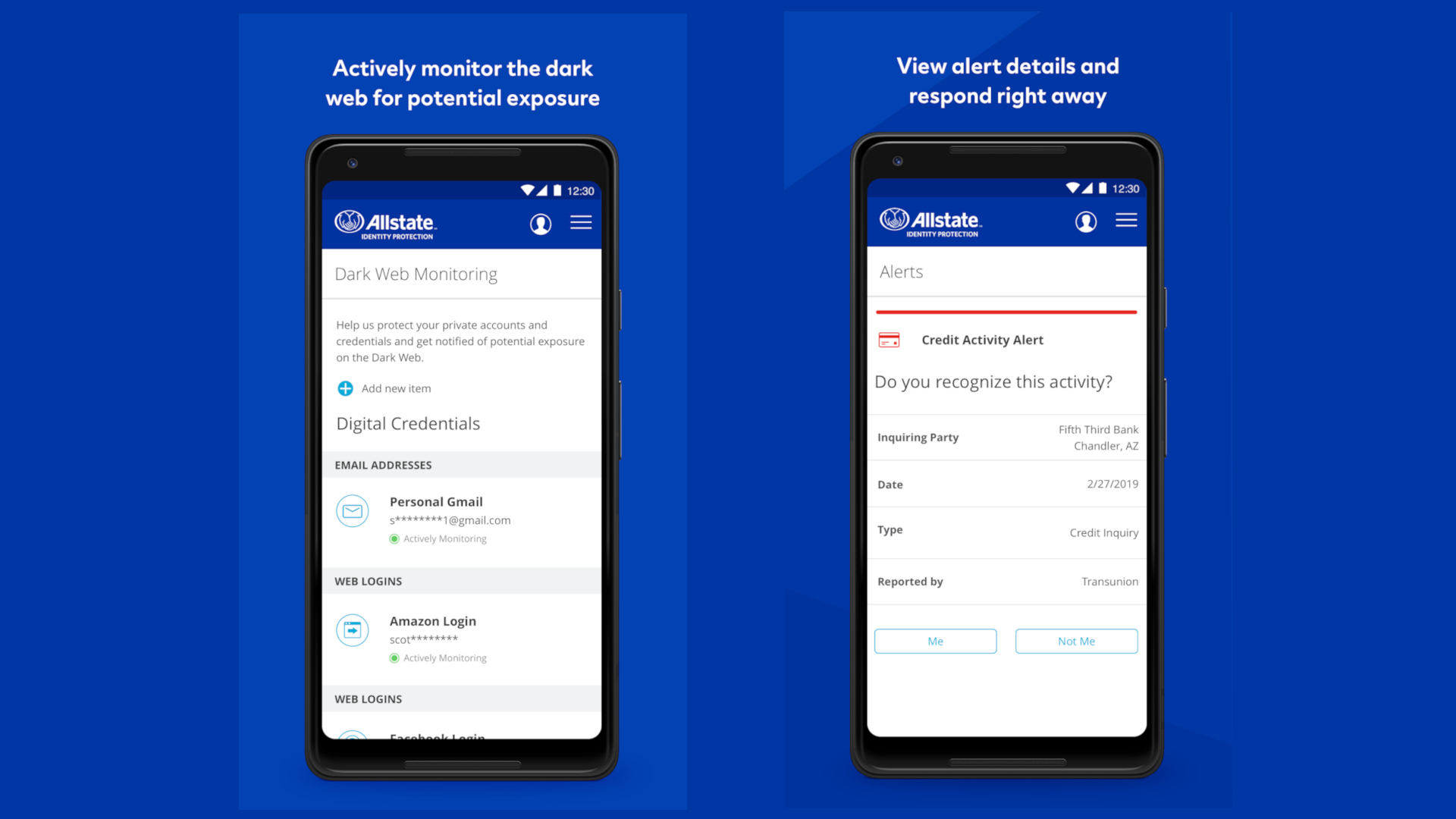

The interface adopts a no-frills approach, reminiscent of TurboTax, prioritizing straightforward navigation over elaborate design. Users will find essential categories such as credit monitoring, Dark Web monitoring, and alerts for financial transactions clearly laid out, making it easy to access the most important features.

The mobile app places a significant emphasis on alerts, actively engaging users with questions about potentially suspicious transactions. This proactive stance is beneficial, but it could be improved. For those unfamiliar with identity protection, the app might benefit from more guided experiences. In contrast, we believe that incorporating wizards and status indicators, similar to those offered by Norton LifeLock, would provide a smoother experience. Such features can help users navigate the complexities of identity protection with ease, offering step-by-step guidance and a clearer understanding of their security status, particularly for beginners.

Overall, while Allstate Identity Protection has a solid foundation, enhancing the user experience with more intuitive design elements and interactive tutorials could make it an even more valuable tool for safeguarding personal identity.

Allstate Identity Protection: Features

The comprehensive identity protection platform, Allstate Identity Protection, provides a carefully designed suite of tools for safeguarding families and individuals against evolving identity theft and cybercrime threats. The sophisticated nature of modern fraud techniques makes having a trustworthy identity protection service essential for everyone.

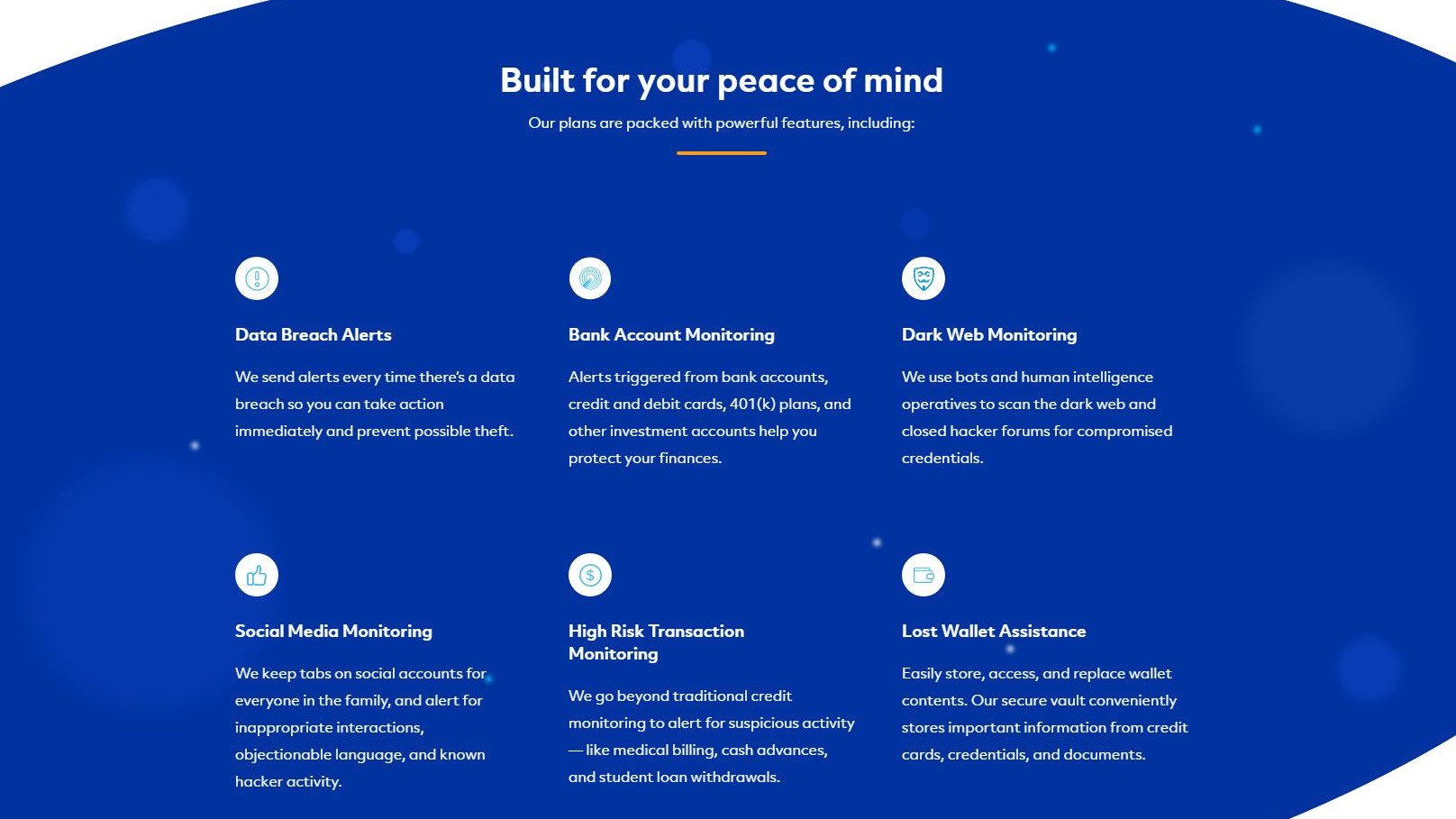

The key benefit of this feature includes Identity Monitoring, which thoroughly examines multiple sources across the dark web along with public databases for your Social Security numbers, driver’s licenses, and financial account information. Through this proactive system, you receive instant alerts when your sensitive information appears anywhere without authorization. Your swift action, enabled by this system, becomes crucial to stop fraud attempts from becoming serious security threats.

The security framework of Allstate Identity Protection includes Financial Transaction Monitoring and Credit Monitoring, which provide constant oversight of bank accounts, credit cards, and credit reports through its higher-tier plans that cover all three major credit bureaus. Such monitoring features enable you to detect quickly any suspicious transactions or unauthorized account openings that indicate potential financial fraud. Through its careful approach, you can easily track your financial condition.

The restoration process for identity theft victims receives full support from Allstate Identity Protection through its Full-Service Identity Restoration service. If identity theft strikes you the company provides a dedicated Privacy Advocate to oversee the complete restoration process. The process involves working with creditors to freeze your credit and resolve any fraudulent accounts that have been opened. The expert management of identity theft recovery processes through the dedicated Privacy Advocate helps you avoid excessive emotional strain while simplifying the recovery process.

The financial security of Allstate customers is strengthened through Identity Theft Expense Reimbursement, which offers coverage exceeding $1 million based on plan selection and Stolen Funds Reimbursement benefits. These essential features protect your out-of-pocket expenses from identity theft incidents by covering legal fees and lost wages during the resolution process and financial losses from stolen funds. Such extensive financial protection ensures you will recover better from identity theft incidents.

The digital environment requires cybersecurity tools, which higher-tier plans provide as essential features that include Virtual Private Networks (VPNs), password managers, antivirus protection, and browsing safety tools. The security resources operate to defend your devices and online actions from malware attacks, phishing attempts, and data breaches, which helps decrease the chances of your information being stolen.

The Family Digital Safety features of Allstate provide web filtering, screen time management, and location tracking tools for family protection. The features prove most beneficial to parents who want to build safer digital spaces for their kids. Parents can use the system to detect cyberbullying and block inappropriate content while having better control over their children's digital activities. Many plans include Senior Family Coverage, which provides specialized support through an Elder Fraud Center because older adults face higher scam vulnerability.

Through Allstate Digital Footprint, you gain the power to see where your personal data exists across the web and how different companies use this information. The available transparency allows you to handle your privacy settings effectively, which enables you to regain control over your online presence while reducing data exploitation risks.

Allstate Identity Protection provides users with multi-layered security through its combination of monitoring and cybersecurity tools, along with expert restoration services and complete financial reimbursement to protect against identity and cyber threats in the modern world. Through Allstate, you gain peace of mind because your personal information now holds greater value than ever.

Allstate Identity Protection: The competition

Allstate Identity Protection operates within a highly competitive landscape, characterized by several strong contenders vying for market share through the provision of robust identity theft protection and comprehensive cybersecurity services. Among the most notable competitors is LifeLock, a subsidiary of NortonLifeLock. LifeLock is well-regarded for its extensive monitoring capabilities, which span across major credit bureaus, the dark web, and various personal data sources. It boasts high insurance coverage limits for stolen funds, often making it a preferred choice for consumers seeking peace of mind. Additionally, LifeLock offers expert restoration services to assist users in rectifying identity theft issues. However, potential customers should consider the pricing structure, which can become steep following introductory offers, making it essential for users to evaluate the long-term cost against the benefits provided.

Another significant player in the identity protection arena is Aura. Aura has carved out a niche for itself with a holistic, all-in-one approach to security. In addition to identity and credit monitoring, it frequently includes features such as a virtual private network (VPN), password manager, and antivirus software, delivering comprehensive protection for digital assets. A standout feature of Aura is its family plans, which can accommodate multiple adults and offer unlimited coverage for children at competitive prices, providing significant value compared to some rivals. Aura also features substantial identity theft insurance, enhancing its appeal for families and individuals alike.

IdentityForce, a company under TransUnion, is another formidable competitor, especially recognized for its advanced fraud monitoring capabilities and dedicated attention to social media risk. Their services encompass exhaustive credit monitoring across all major bureaus, along with comprehensive restoration services that help clients restore their identities. IdentityForce also places a strong emphasis on alerts and proactive measures to minimize risks, making it a wise choice for consumers who lead an increasingly digital lifestyle.

IDShield, often associated with LegalShield, distinguishes itself by offering unlimited consultations with identity theft experts and focusing on legal support in the event of identity theft. This service is particularly appealing for individuals seeking legal guidance and resolution options should their identity be compromised. IDShield is praised for its transparent pricing model and a strong emphasis on social media scanning, ensuring that clients receive vigilant protection across various digital platforms.

Other noteworthy contenders include Experian IdentityWorks. Leveraging its status as a major credit bureau, Experian provides robust credit monitoring features, giving users an added layer of assurance regarding their credit health. Identity Guard utilizes advanced artificial intelligence to deliver enhanced monitoring and alerts, hoping to proactively safeguard users against burgeoning identity theft threats.

In addition, less prominent but still viable options like ID Watchdog Premium cater to those affected by pre-existing identity theft issues, providing specialized assistance in remediation. Zander Insurance is highlighted for its affordability, providing essential identity protection services without breaking the bank.

Allstate Identity Protection: Final verdict

If your primary objective is to find the best identity theft protection app available, regardless of price, then Allstate Identity Protection may not be your top contender. However, when you consider the overall value it provides—especially with added features like social media monitoring and Dark Web oversight, along with comprehensive identity theft insurance—Allstate Identity Protection presents a compelling option.

While it might not eclipse the capabilities of industry leaders like Norton LifeLock or IdentityForce in terms of sheer strength and breadth of features, it still offers a well-rounded package that can effectively safeguard your personal information. Its focus on monitoring social media platforms allows for timely notifications in case of any suspicious activity, while its Dark Web monitoring can alert you to any potential threats lurking online. This holistic approach to identity protection is indeed noteworthy.

Moreover, Allstate Identity Protection includes identity theft insurance coverage, which adds an extra layer of security and peace of mind for users. Even if you ultimately opt for one of the more robust services, trying out Allstate Identity Protection could provide valuable insights into whether you need this type of coverage and what specific features matter most to you.

In summary, while Allstate Identity Protection may not have the power or extensive capabilities of some of its competitors, it remains an attractive option, particularly given its feature set at this price point. It’s a practical choice for individuals who value proactive monitoring and comprehensive support without breaking the bank.

We've also highlighted the best identity theft protection

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.