Lease or buy your tech outright? Here's a quick refresher

A plethora of choices

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

In association with PC World

The debate between leasing and buying is very much alive, and rings true especially when you are dealing with hard assets that tend to depreciate rapidly. Here is a reminder of what leasing technology usually entails, buying being the more obvious way of taking ownership of a product.

Many big tech companies (think Dell, Apple or IBM) have their own Financial Services (essentially a bank that they own) that provides with the loan, whether it be outright purchases, hire purchases or leasing.

For some businesses, other than allowing for much lower capital expenditures, leasing provides with an alternative tax efficient option as payments may be deducted from taxable profits, reducing the net cost of leasing the equipment although you should bear in mind that leased equipment is essentially rented.

Leasing improves cash flow, allowing cost of the transaction (remember it is not technically an acquisition) to be spread over three or four years, with fixed payments allowing for a much easier budgeting process regardless of how macroeconomic conditions or market changes.

Just bear in mind though that a lease is a loan, albeit a special type of loan and one that comes with some strings attached. It is likely therefore that the total cost of ownership will be more compared to buying a particular product outright.

In many cases – just like it is the case for most mobile phone contracts, you will be able to upgrade to newer technology if you can afford an early settlement fee, an option that will be attractive if it allows the company to make significant savings elsewhere.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Buying outright on the other hand means that your assets will depreciate over time and technology-related products are probably the ones depreciating the fastest.

As a sweetener, some vendors go as far as giving a cashback, up to 25% in some cases, when the equipment is returned after the lease expires and on the proviso that a new lease is taken. This makes disposing of the assets easier since the onus will be on the original seller to dispose of it responsibly.

In most cases though, companies will be able to purchase the hardware outright, for a nominal fee and many decide to give away the gear to their own staff to boost morale or auction them for charity.

Even small companies can apply for a lease with many offering leasing plans for startups from as little as £3,000. More established companies or multi-nationals are likely to have more complex leasing agreements that run into tens or even hundreds of millions of pounds.

A few reminders about leasing agreements: Make sure you know where you stand when it comes to maintaining the leased products. Who is responsible for the maintenance and insurance? What are the small prints and hidden fees etc?

But what about something as intangible as software? Well, more and more vendors are offering software-as-a-service (or SaaS) options for their software packages.

Sometimes, like Adobe, it is the only option available. You get the same advantages as for your hardware except that very often, you will get bumped to the newest version (or get new features or goodies) for free as part of your package.

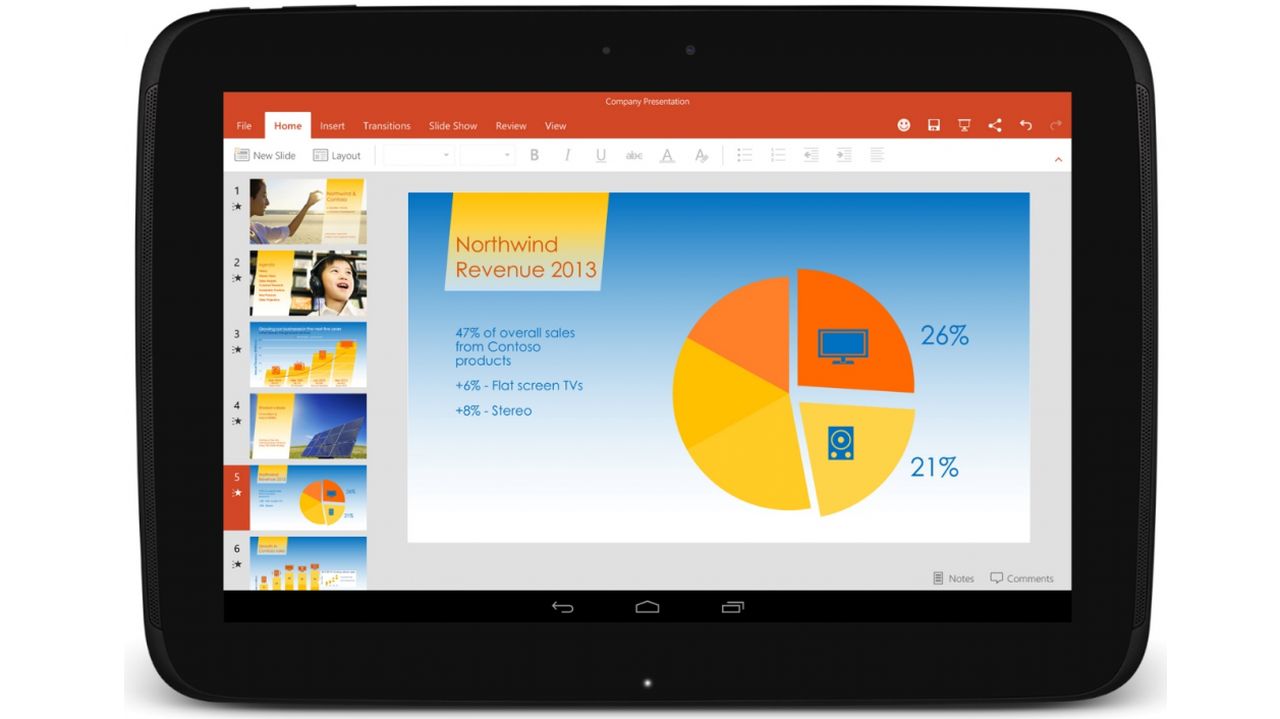

That happens a lot with Microsoft and its popular Office 365 package, which started life as Office 2013 before smoothly transitioning to Office 2016.

But it is not always rosy; sometimes you may not always like the newer features especially if you're not allowed to roll back (hello Google) and when the service provider decides to hike up the monthly subscription costs or suddenly reduce, say an allowance, there is little users can do other than, well, swallow the pill.

On the whole though, SaaS is almost certainly the better way to go forward for software despite the cons and for some niche markets, it might soon be the only way to go soon.