The best apps for managing your money

Want to take control of your finances with your smartphone? Look no further than our app guide

It can be difficult to handle all of your financial affairs, especially if you've got multiple accounts, different income streams or a complex family situation – but, thankfully, our smartphones are here to help.

Head to your nearest app store and you'll find dozens of apps that promise to make your financial dealings easier to handle and potentially more lucrative, too.

Start Your New Job Search in Minutes with ZipRecruiter

With over 8 million jobs, ZipRecruiter is the one of the best places to start looking for your next job. Get started for free today.

That's a challenge in itself – so we've sifted through the stores to discover which eight apps you should hunt down if you want some help with your money management. This isn't the end of our practical help, either: head here for our guide to perfecting your morning routine or venture over to our top tips for improving your productivity.

You Need a Budget

Reasons to buy

Reasons to avoid

You Need a Budget – or YNAB – is one of the most popular personal finance apps around, and with good reason.

The app's money management philosophy revolves around four simple rules: assign your cash to different jobs, consistently put money aside to deal with large outlays, stay flexible, and consistently spend less than you earn.

That straightforward plan is bolstered with impressive features. YNAB syncs with your bank account, synchronizes across all your different devices, includes powerful goal-tracking features and delivers extensive, easy-to-read reports on your monthly earnings and spending. It's ad-free, it learns to categorize your cash over time, and it has encryption and 2FA security – so you can be sure your details are safe. It also has lots of educational resources to help users learn about the app.

YNAB has a 34-day free trial, too. Its monthly cost of $14.99 and annual price of $99 are steeper than many other budgeting apps, but YNAB's smart features and slick design make it worth the cash.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

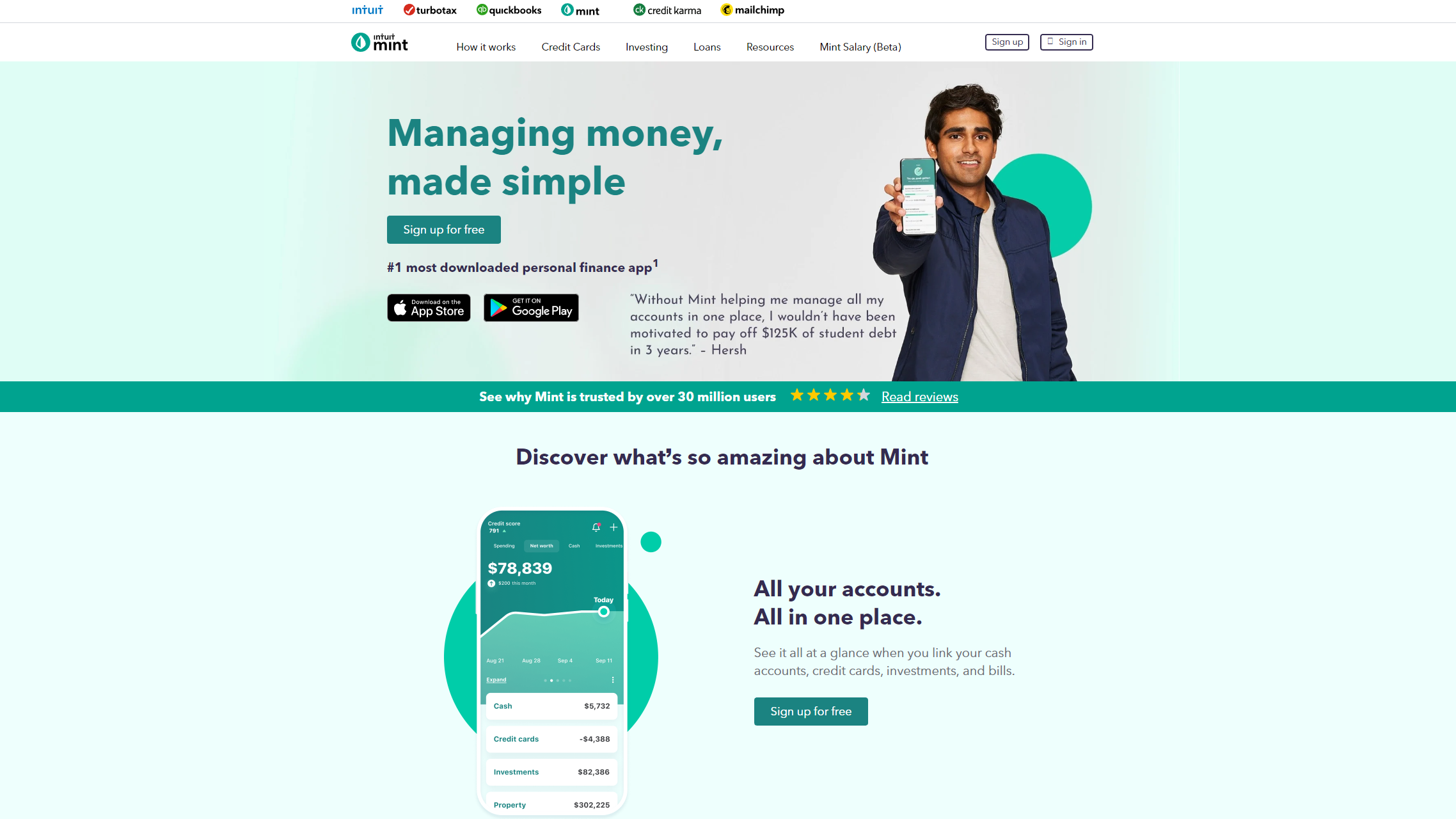

Mint

Reasons to buy

Reasons to avoid

Mint is one of the most popular budgeting apps around, and that's no surprise when you see its range of features: it has bank syncing for all of your accounts, it'll automatically categorize your expenses, and it'll track your bills, help you negotiate better deals and create an achievable monthly budget.

Its features go beyond those conventional banking services. You can use Mint to track your credit score, manage investments, calculate whether you can afford homes or loans, and it also includes an active blog and loads of educational resources. It's very secure, too, thanks to encryption and biometric sign-in options.

Mint is free to use, although that does mean you'll often see adverts in the app. It may also not be the best choice if you want hands-on money management and plenty of forward planning – a big part of Mint's appeal is a hands-off approach and a concentration on tracking past spending.

PocketGuard

Reasons to buy

Reasons to avoid

If you often spend too much cash, PocketGuard could be the best money management app for you. It constantly analyses your accounts and spending so you can quickly see how much cash you've got left after all of your regular expenses, and its clear, graphical interface lets you see where you're spending most of your cash.

You can link bank accounts, investments, loans and credit cards to PocketGuard so you can easily get a view of all of your finances, and the app will also help you negotiate lower bills. It has automatic saving tools and automatic bill reminders. The enhanced PocketGuard Plus service also has debt payoff planning, data import and export, longer transaction histories, and customization options.

PocketGuard is free to use, too, although PocketGuard Plus costs extra – expect to pay £7.99 per month, $34.99 annually or $79.99 for a lifetime membership.

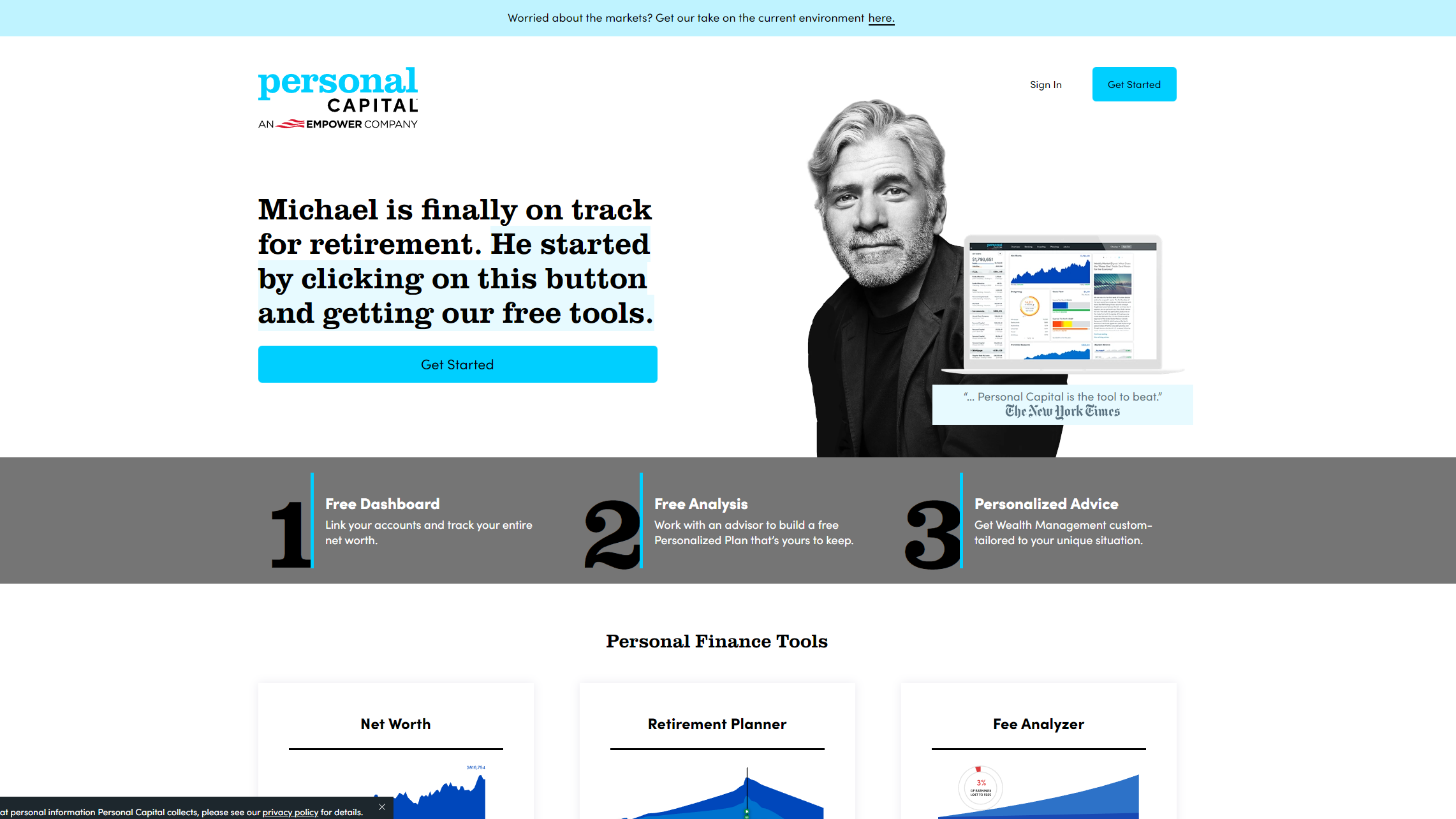

Personal Capital

Reasons to buy

Reasons to avoid

Personal Capital is one of the best options for tracking your cash flow if you're a keen investor. The app's free service allows you to link accounts, track your investments and get a personalized investment plan, and a graph system allows you to easily see your net worth, retirement funds and monthly fees.

Elsewhere, Personal Capital has expense tracking, the ability to create monthly budgets and a module that makes it easy to save for education costs. It's also ideal for monitoring your credit cards, 401ks, mortgages and loans. Encryption, two-factor authentication and fraud protection keeps your data safe, too.

It's free, too, although you'll have to pay fees for extra services that are calculated based on how much wealth you've got invested in the app. Personal Capital may not have the everyday features you'll find elsewhere, but it's a great choice for investors.

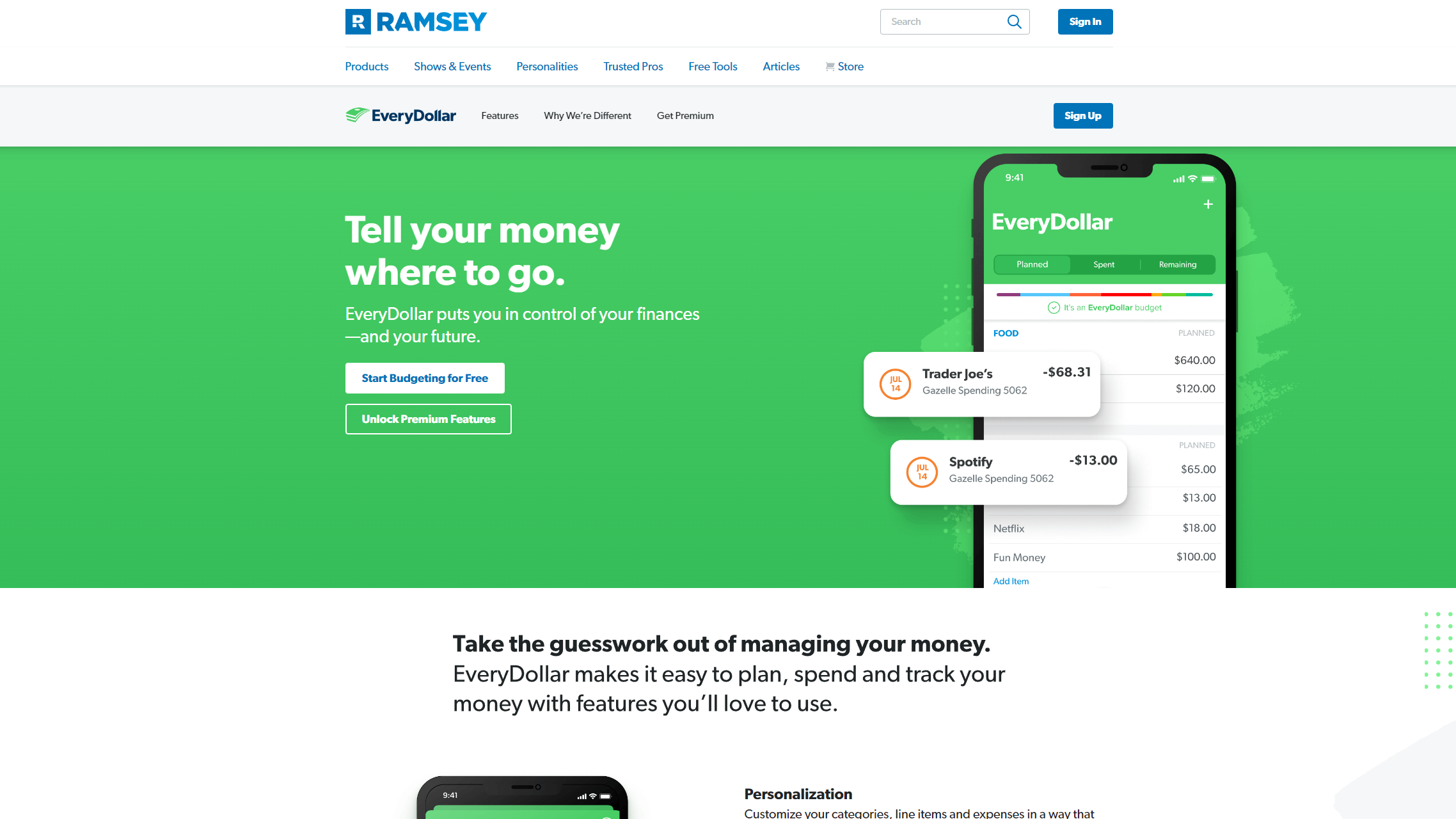

EveryDollar

Reasons to buy

Reasons to avoid

As the name suggests, this app tries to ensure that all of your money is given a purpose – so that no cash is left behind.

That makes EveryDollar a great option if you'd like an app that can take a more holistic view of your finances. Its expense tracker monitors your cash, and you can use savings goals, due date reminders and category personalization to create a customized experience that'll help you stay on top of your financial situation.

EveryDollar is free to use, too, but it's pretty basic compared to other services. If you pay $9.99 per month or $99.99 for the annual plan you'll get more features, including bank account syncing, improved tracking and recommendations and customized reporting.

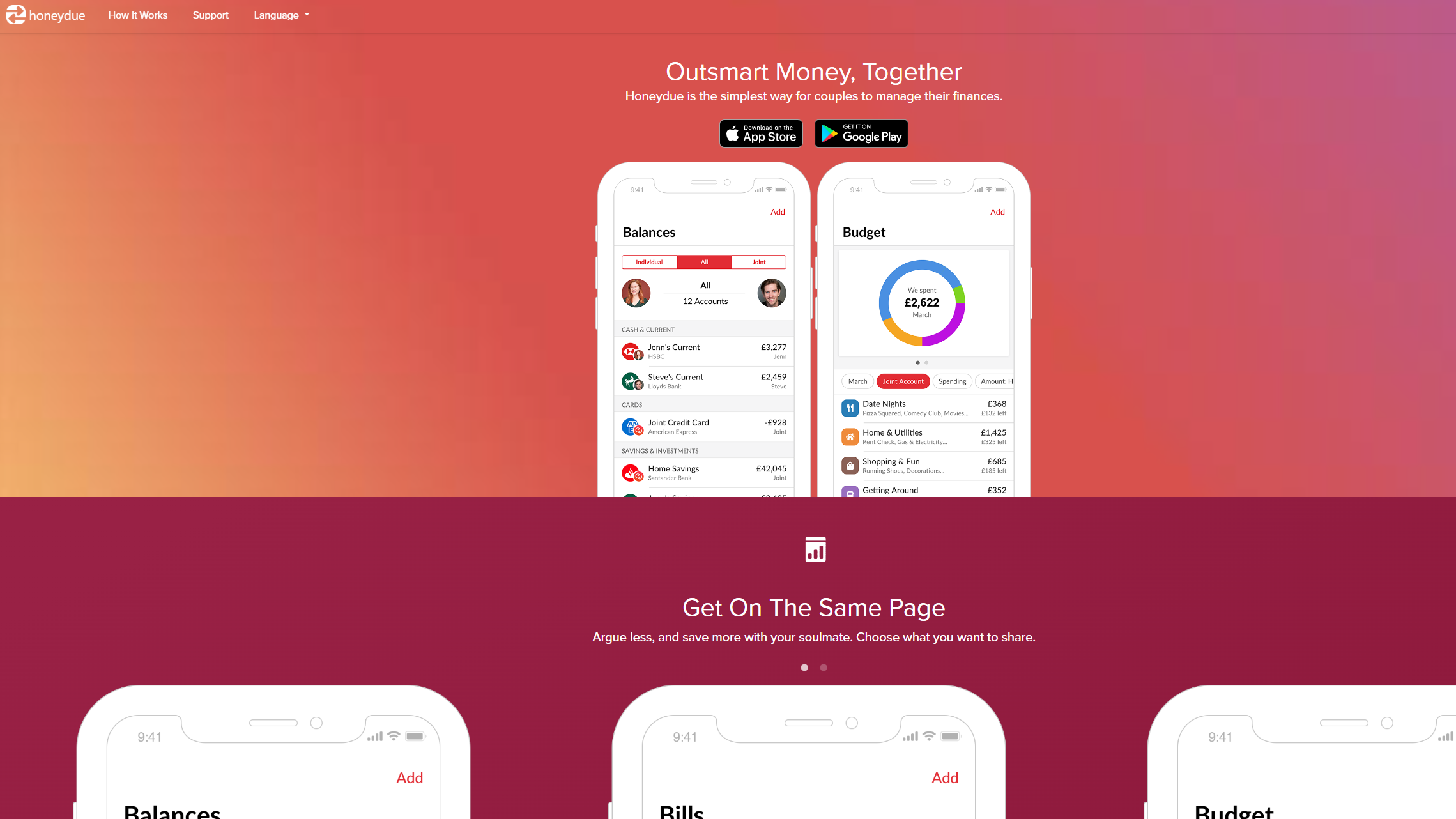

HoneyDue

Reasons to buy

Reasons to avoid

This is the app couples should use if they want to handle their finances together. You can see each other's bank accounts, credits cards, savings and investments and easily monitor what bills are due on which date – and which account the cash is coming from.

A straightforward budgeting module divides your cash into different categories so you can easily see where the money is going, and bill reminders and in-built messaging make it easy to handle financial matters without any stress. Users can create custom categories and set monthly spending limits, too. As with most other financial apps, reliance on encryption and two-factor authentication keeps your data safe.

Impressively, HoneyDue is free, and there's no premium tier that costs money. That's great if you don't want even more outgoings, but it does mean that the feature set is a bit more basic than other apps, especially when it comes to forward planning.

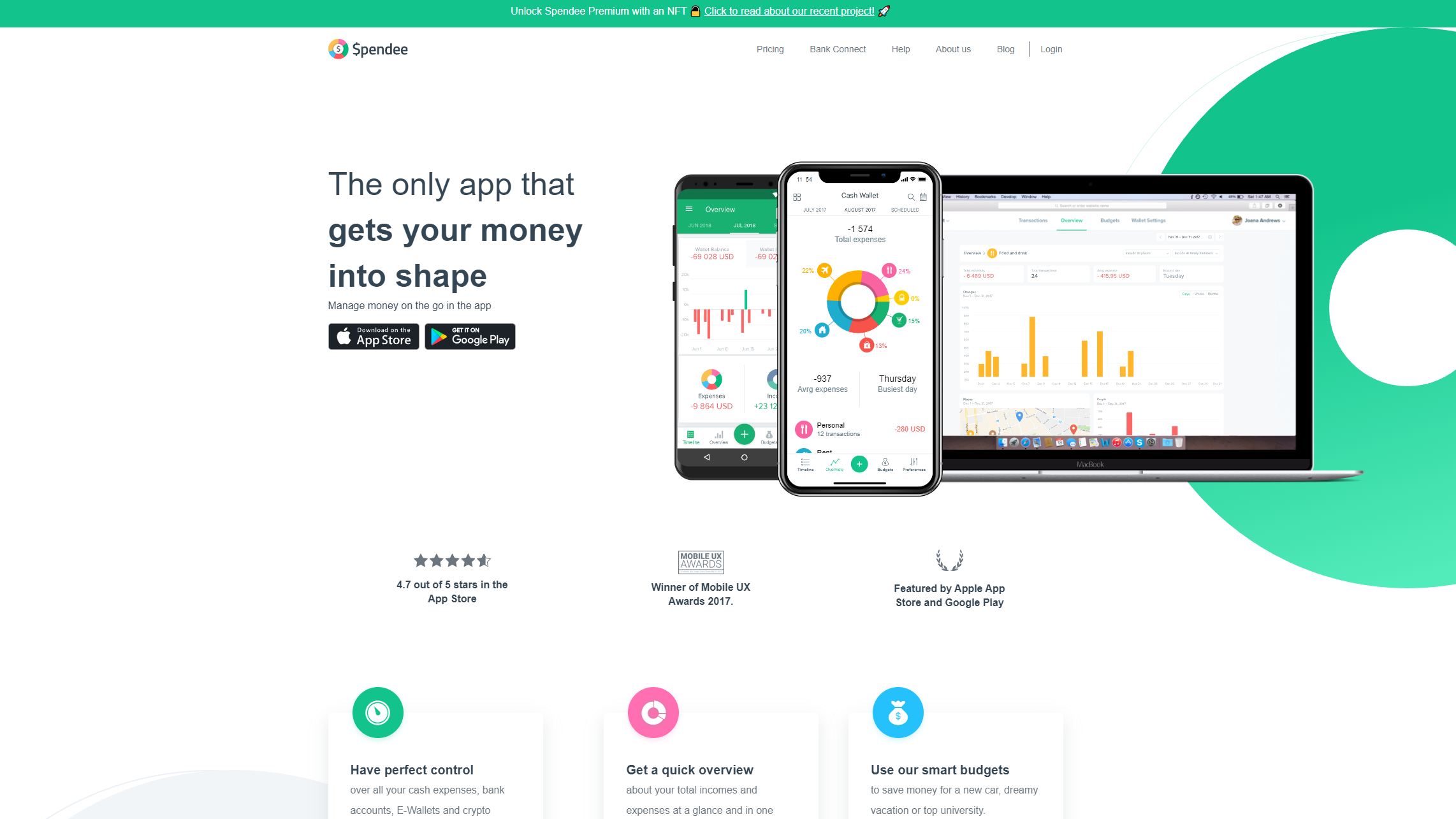

Spendee

Reasons to buy

Reasons to avoid

Spendee is our favorite app for anyone who needs a tool that can help the whole family manage its finances. You can use this tool to create shared wallets and you can connect multiple bank accounts so everyone can see where the money's come from – and where it's going.

A well-designed financial hub allows users to get an overview of their financial situation – indeed, this is one of the best-looking financial apps. If you want to delve deeper there's an in-depth analysis tool, and families can rely on smart budgets, savings tools and support for multiple currencies to take control of many different financial aspects. Spendee syncs across different devices, too.

Spendee's free app includes syncing, secure data and a detailed overview of your accounts, but it doesn't support bank account syncing and only allows for one cash wallet. To get the most out of Spendee you've got to pay $14.99 or $22.99 per year for its Plus and Premium plans – the former allows unlimited wallets and shared wallets, and the latter also adds syncing and more features.

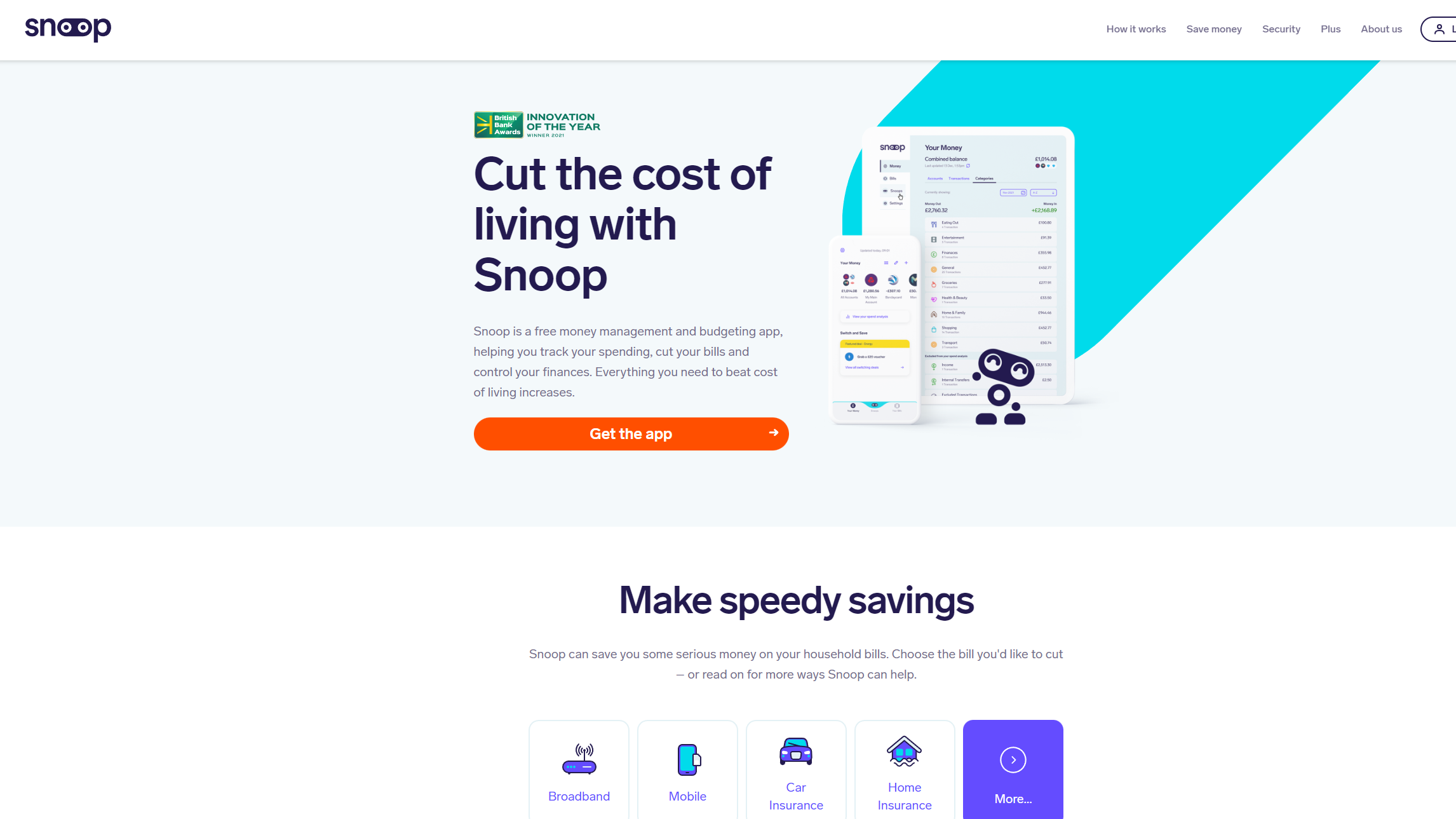

Snoop

Reasons to buy

Reasons to avoid

Snoop is a perfect choice if you want a money app that'll help save you cash on all of your household bills. Its in-built tools can evaluate your bills and see where you could save money by switching to different providers, and users can benefit from special offers and exclusive deals that aren't available elsewhere.

Users can connect bank accounts and credit cards to Snoop to get a solid overview of their financial situation, and the app will deliver automatic saving recommendations and in-depth spending reports. It'll also help you find vouchers, track refunds and spot price rises that you may otherwise not notice.

It's free to use, too, although users who buy the £3.99 monthly plan will benefit from extra tracking and unlimited tracking in all areas of the app – so you won't be restricted, no matter how complex your financial situation.

We've listed the best personal finance software.

Mike has worked as a technology journalist for more than a decade and has written for most of the UK’s big technology titles alongside numerous global outlets. He loves PCs, laptops and any new hardware, and covers everything from the latest business trends to high-end gaming gear.