TechRadar Verdict

The fairly average toolset for combating identity theft makes Equifax ID Watchdog a fairly pedestrian choice. One serious hurdle that the need to overcome is Equifax’ well publicized data breach back in 2017 that involved a not small 145.5 million customer records. While that’s hardly the best starting point for new customers, the app itself does provide some good educational info along with a suite of tools to analyze your credit and personal data exposure, although nothing here blazes any new trails.

Pros

- +

Well-designed interface

- +

Lower than usual cost

- +

24/7 direct support

- +

Annual payment discount available

Cons

- -

Average set of tools

- -

Underemphasizes fraud protection

- -

Lacks some support options, such as chat

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

It hardly takes too long to realize that ID Watchdog is a fairly standard, middle-of-the-road theft protection app. It might take a bit longer to realize it is a product of the company Equifax, which announced one of the worst data breaches in recent memory in 2017 with 145.5 million customer records exposed, including names and social security numbers. That much data ended up being a treasure trove for hackers interested in selling personal information on the Dark Web, the cesspool of criminal activity that Equifax ID Watchdog is attempting to provide protection against.

An all too average product, ID Watchdog has an overabundance of the features found in Equifax TrustedID, down to even some of the same pricing plans. What it really boils down to here is that the service is a lead generator for obtaining credit reports to deal with any pesky credit problems, not necessarily the ones caused by criminals on the Dark Web, but rather your own spending. This product offers plenty of tools for dealing with identity theft and tracking issues, but like some other identity theft apps (including a top one, such as Norton LifeLock), ID Watchdog overly focuses on credit reporting, while shortchanging on fraud protection and theft recovery.

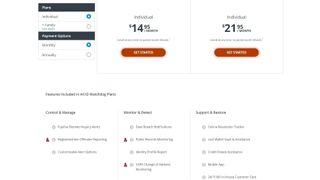

Plans and pricing

Equifax ID Watchdog has an average feature set, but the selling point is the affordable cost. Other products tend to cost around $30 per month for the premium protection package, but ID Watchdog costs a more affordable $21.95 per month for the Platinum plan, and if you pay annually at $220, it works out to only $18.33 per month. At the highest level of tiered plan, you have three different credit bureaus to monitor your credit, a $1 million protection insurance, and $500,000 in protection against 401K fraud. Under the family plan, it costs $34.95/month for protection of your entire family against fraud.

Interface

ID Watchdog strays from the typical dashboard and wizard approach, with the result looking more like a virus-scanning tool. In the main window you can trigger scans for Dark Web monitoring, see alerts about a change of physical address, scan for sex offender registrations in your area, and view all of the credit checks and credit scores, which are the main calling cards here.

Features

So bottom line, is there really anything different here from other identity protection apps? Not really. While the basics are here from the typical monitoring and reporting functions, credit history checks, credit scores, and alerts about a change in address, there is not enough that stands out. Case in point: there is an alert system for sex offenders who move into your area, and there is monitoring for social media, but as with most of these identity theft protection apps, the social media monitoring focuses on your own behaviors, and they don’t tend to alert you for more common scenarios, like abusive comments directed toward you, or when an account gets compromised.

Support is decent, with direct contact via email and phone available 24/7. However, there are no advanced support options, such as chat, whitepapers, or instructional video content; we did find a FAQ.

The competition

Just like the other identity theft protection tools available, ID Watchdog has to compete with the more recognizable Norton LifeLock, but also its own name as customers conclude that Equifax is the parent company, and it’s fairly obvious as at the main ID Watchdog website there’s a notice about Equifax being the parent company prominently under the logo. This translates to a main competitor is really Equifax, and customer’s perception about the protection they currently offer. Through the registration process, the requirement is to provide personal information including social security number, bank accounts, physical address, emails, and a phone number. As this is completed, we imagine that it would cause customers to pause as this data was breached in 2017 and publicized via the headlines.

Along the same lines to how Experian IdentityWorks has to overcome the data breach from 2015 that involves 15 million customer records, it’s an uphill climb for these apps. Let’s start by understanding why they exist. The goal is providing customers with some tools to research their credit history. We certainly think about this when securing a large mortgage as banks want to see a clean record. This also may come up when we apply for a job. We appreciate that these apps exist to help us be proactive over our personal information beyond just credit scores and finances. However, it’s not really helpful as they laser focus on the credit reporting and monitoring aspects- even for subscribers not actively securing a loan.

Final verdict

Equifax's ID Watchdog is a middle of the road identity theft protection app- not the best nor the worst. The most appealing feature is really the low cost, only about $20 per month for the premium package that includes the credit monitoring from these services. The competing identity theft protection apps cost around $30 per month for a similar feature set. Therefore, if you choose one of these apps only on the price, ID Watchdog is really an excellent choice.

Of course, cost is really only one thing to consider when choosing this type of product. On balance, there might not be a higher risk in using an app from a company with a prior data breach as the security holes may be all patched up, and they are more vigilant now, but this really remains an open question. Putting that issue aside, the primary reason that ID Watchdog stays out of the top tier of choices is simply that it lacks anything groundbreaking or novel.

We've also highlighted the best identity theft protection

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.