Google's big ventures

Google can tell a lot about us by the things we buy, but the reverse also applies: you can tell a lot about Google's priorities by the firms it acquires. In the last year Google has bought price comparison tools, discount coupon services, loyalty card systems, voice recognition and facial recognition technology, and various social media services.

It's a focused selection that's clearly biased towards mobile devices, mobile content, mobile advertising and mobile payments, and it's clear where Google believes its near-future growth will come from.

For the longer term, we need to look at a different bit of Google: Google Ventures. Established in 2009, Google Ventures' mission is to invest some of Google's money in exciting new businesses, businesses that don't necessarily fit with Google's current business strategy.

Google says it doesn't expect firms it invests in to use its products or change their relationship with Google, and it denies that Ventures is "a strategic vehicle to make future acquisitions easier". Nevertheless, some of its investments are in exactly the kinds of companies it likes to buy.

For example, as "the world's leading portfolio of coupon and deal websites", WhaleShark Media would work with Google Wallet and Offers, while VigLink's link tracking system would get on well with Google Analytics. However, while app developers and cloud computing services are well represented, some of its investments are much more ambitious.

Google Ventures investments tend to fall into one of five categories: consumer products, business services, education, green technology and medical science. It's a diverse mix, but they all have something in common: Google hopes to make money from them all.

The first two categories, consumer products and business services, are where you'll find the websites and tools that are closest to Google's existing applications.

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

Google has invested in Kabam, which publishes massively multiplayer social games (MMSGs); Miso, which is for engaging with other people while watching TV; LawPivot, a legal Q&A service for startups; Rocket Lawyer, an online legal advice shop; HubSpot, which makes marketing software; SweetLabs, which brings web apps to the desktop; ShopBot, which tracks the price of products in online shops; SCVNGR, which adds a gaming layer to real-world location data; and Signpost, a crowdsourced deal-spotting service.

Other investments in this category include mobile to-do lists, cloud services for mobile app developers, web data timeline services and anti-malware technology. The educational category includes some interesting sites and services too. For example, there's Airy Labs, which creates educational games for primary school-age children; English Central, a cloud-based language learning system that uses web video to improve users' skills; and Miso Media, whose software helps teach people to play musical instruments.

In the case of Miso Media, Google Ventures is one of several backers, including Justin Timberlake. You can see why Google decided to invest in these firms. They're good ideas, and in many cases they're already doing decent business. The big bets, however, are in green tech and medical science.

Gene genie

It's perhaps fitting that a firm whose mission is to "organise the world's information and make it universally accessible and useful" is interested in the most useful data of all: DNA.

In 2009, Google founder Sergey Brin invested $10million in genome firm 23andme. It wasn't the first time he and his company had helped the startup: Google invested $3.9million in the firm in 2007, and some of that money was used to repay a previous Brin loan of $2.6million.

Google isn't the only investor - others include giant pharmaceutical corporations and venture capital firms - but it's definitely the best-connected: 23andme was set up by Ann Wojcicki, who happens to be Sergey Brin's wife.

23andme's mission is "to be the world's trusted source of personal genetic information", and it takes its name from the 23 pairs of chromosomes that make up the human genome. By combining DNA analysis and web-based tools, 23andme can help trace ancestors or work out whether you're likely to get diabetes. Simply provide some saliva in the kit, send it off, wait a few weeks and then log in to find out all about your genes.

Google has also invested in another DNA analysis firm, Navigenics, which offers genetic analysis and counselling for people who want to know their genetic risk factors or whether their DNA will make some treatments more effective than others.

Everything's gone green

As one of the planet's biggest computer users, Google has long worried about its environmental footprint (not to mention its electricity bill), and has designed its data centres to use as little energy as possible. It says its data centres use 50 per cent less energy than the norm, and that 25 per cent of its energy comes from renewable sources.

That figure is expected to increase next year. Google isn't just interested in its own carbon footprint, though - it's interested in yours too.

The firm has invested millions in renewable energy projects, and Google Ventures also invested in technologies that could reduce energy use further.

It's put money into Transphorm, which creates power modules that eliminate up to 90 per cent of electricity conversions - modules that could be used in air conditioners, hybrid cars and solar panels - and helped Next Autoworks with its plans for a safe, high-quality, fuel-efficient car for the American market, while Silver Spring Networks' smart grid technology is designed to help firms monitor and improve their energy efficiency while reducing their carbon emissions.

Google Ventures is interested in smaller steps, too: it's invested in RelayRides, the world's first neighbour-to-neighbour car sharing service, which could help reduce congestion.

If climate change still ends up cooking the planet, Google still has a role - it's invested in WeatherBill, which provides "technologically advanced weather insurance products".

Smarter search

While Google Ventures is tackling the future, the company continues to look for more ways to make its products pay today. That includes finding ways to improve its core product: search.

The Google algorithm is regularly tweaked to make spammers' and scammers' lives more difficult, but it has much bigger plans. In the near future, expect Google to offer autonomous search - results that appear before you knew you might be interested in them.

Google's head of consumer products, Marissa Mayer, calls it contextual discovery. As she explained at the recent LeWeb 10 conference, contextual discovering means "taking a user's location as a piece of context for finding what they want without them actually searching for anything."

Google may not have the userbase of Facebook, but it has a lot of people using its location-based services - and with half a million Android devices activated every day, it's putting a location-aware OS into millions of people's pockets.

Social networking is a key part of the equation, which is why Google hasn't just given up on social services since it shut Google Buzz. "We really want to get it right this time," Mayer told LeWeb. "That said, we're patient. There's search, mobile, local, and social. We've got three right. We're working on the fourth one."

Google+ is part of that, but there's also Latitude, its location-based social service, and Google Maps. Eric Schmidt explains how these could fit together. "When I walk down the street, I want my smartphone to be doing searches constantly: 'Did you know?', 'Did you know?', 'Did you know?'" he says. "This notion of autonomous search, to tell me things I didn't know but am probably interested in, is the next stage in search."

Viewed in that light, acquisitions like this year's purchase of Pittsburgh Pattern Recognition (PittPatt), make sense. The firm specialises in computer vision technology that can identify objects from camera input, and fits well with the Google Goggles visual search system. Soon, our gadgets might not just know where they are: they'll be able to see where they are, and perhaps recognise who else is there.

By combining that data with location-aware services and social networks, Google will know more about you than you do.

Chinese whispers

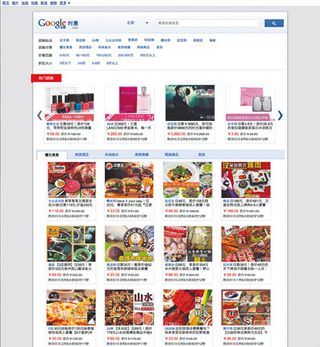

Google is also keen to find a way to operate in China. In 2010, Google publicly closed its Chinese operation in a row over censorship, effectively turning its back on the world's largest market. However, in September 2011, it launched Google Shihui, which translates as "timely benefit".

The site searches deal websites for the best offers, and lets Google to operate in China without compromising its no-censorship principles. As Search Engine Watch reports, "The group-buying market has exploded for China, and there are now approximately 4,000 services in the country. One particular detail may be a bonus for Google: Groupon isn't one of them."

Google has no plans to relaunch its standard search engine in China - the authorities won't budge on their demands for censorship and Google won't budge on its desire for transparency.

Other services may also face a rocky ride - China blocked Google+ within 24 hours of its launch, and Google claims that Chinese censors have tried to block Gmail. However, as Chief Financial Officer Patrick Pichette told the Times, "China has 1.2 billion people. For Google to say 'we're going to live on our mission, but not serve 1.2 billion people' - it just doesn't work. China wants Google."

It may well do, but not as much as Google wants China's eyeballs.

New seekers

When co-founder Larry Page became CEO in January 2011, it represented a significant shift in Google's approach. Page wants Google to act more like a small startup than an enormous corporation, and as a result he's embarked on a process of streamlining that's meant the closure of services including Google Health, Google Powermeter and the Google Labs experiments.

During Google's annual investors' call, Page described his plan as "more wood behind fewer arrows". The policy is clearly a reaction to Apple and Facebook. "Google's success has been equalled by Apple's device successes and Facebook's power in social media," Gartner says. "Page must define, champion and execute on Google's priorities."

It seems that Page agrees: during the Google Zeitgeist conference, he was asked: what's the biggest threat to Google right now? Without missing a beat, Page replied: "Google."

Most Popular