TechRadar Verdict

While it’s up against plenty of competition in the world of payment transfers Melio makes a good alternative option with its fee-free capability.

Pros

- +

Fee free

- +

No contract

- +

Flexible

Cons

- -

Fee chargeable on delayed card payments

Why you can trust TechRadar

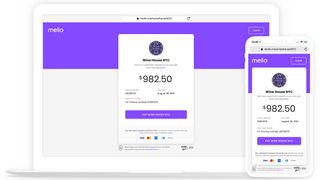

Melio is a free money transfer service for small businesses in the US, which comes with the flexibility of having no sign-up costs or ongoing subscription fees. It’s been designed as a simple and secure digital accounts payable and receivable solution that can help you take care of payments to vendors and suppliers. Useful considering the situation with coronavirus. Devised as a time saving tool, Melio lets you enter a bill manually, upload a picture or document, or connect using QuickBooks and then sync with your vendors or payments.

- Want to try Melio? Check out the website here

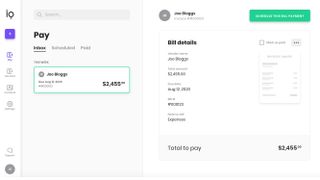

Making a payment via bank transfer is free, even if vendors only accept checks. Melio offers the option to use your credit card (with a 2.9% fee) and defer payment and incentivizes this by offering card rewards. The service works via a basic dashboard that lets you manage all of your payments, and keeping track of money going out and coming in can all be done within the web interface.

Competitor products worthy of investigation include WorldRemit, Azimo, Venmo, Western Union, PayPal and Zelle.

Pricing

For many, the appeal of Melio might be its free-to-use philosophy, which means that you can sign up for the service without having to pay anything, either during registration or through an ongoing subscription fee. Melio also doesn't charge the recipient any kind of fee following a transaction.

Currently, when you send a payment Melio makes its money by charging a 2.9% fee if you pay by credit card and use the option to delay the payment. There's no fee for a bank transfer. Melio explains that this allows the company to fund ACH (Automatic Clearing House) electronic payments, payment delivery and receiving payments for free, whilst also generating revenue for itself obviously.

Features

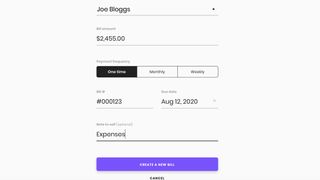

There’s not too much to discover once you’ve signed up to Melio and begin to explore web-based interface. Central to sending and receiving funds is the dashboard area, which has a series of subsections including areas for transferring money and also organizing how to get paid.

There’s an option for adding contacts as well as adjusting settings, such as customizing your profile or tweaking basic preferences. A simple icon at the top left of your screen lets you choose from core functions, including payment, requesting payment and contact options.

It’s also possible to link to accounting software in order to streamline your business tasks, although in our case there was only the option to connect to QuickBooks. However, in the same area were greyed out options for connecting to FreshBooks, Xero, Microsoft Dynamics GP, NetSuite and Sage Live.

Ease of use

Signing up for Melio is pretty straightforward, with a registration page that requires nothing more than a work email and password to get the ball rolling. Melio does give you the option of connecting QuickBooks if you’re a user of that accounting software, simply by adding in your Intuit log-in details.

Once a verification code is sent to your email you can finish the sign-up process by filling in a few details on screen, including your business type and its geographical location. From there you get access to your Melio dashboard and its various tools and functions. Anyone who has used a web-based service before will find it all very easy to understand.

Support

Once you’re inside the main Dashboard area of Melio you’ll notice that there’s a support option in the left-hand side of the menu. Click on this and you get presented with a live-chat style pop-up dialog window, which can be used to put questions and queries to a member of staff. Inside the Settings area of Melio you’ll find additional options for contacting the company, with a phone number and support email address being on offer.

Final verdict

Melio will fit the bill for many small business owners who want a reasonably straightforward option for sending and receiving funds. The service is quick and easy to sign up for, there’s no ongoing contractual baggage to worry about while the credit card fee option can be avoided if you don't need to use it. Melio has also done a decent job with the dashboard and other built-in features, allowing you to process payments without the need for any technical knowledge.

It’s also perfect for setting up regular payments, thanks to the built-in contacts option, allowing you to shave time off paying bills to vendors on a regular basis. There are numerous payment transfer options out there on the market, but Melio makes a decent addition to the ranks.

- We've also highlighted the best money transfer apps

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.

UK government cannot protect businesses and services from cyber attacks, IT pros say

Sony merging with Paramount Plus could be bad news for Netflix – here’s why

Asus has applied big discounts to these 4K gaming monitors that are perfect for PS5 and Xbox Series X - with some reaching lowest-ever prices