Your PayPal account just became a fully-featured crypto wallet

PayPal is going all-in on cryptocurrency

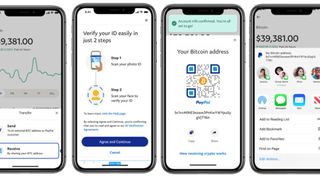

PayPal has announced that it will now support the exchange of cryptocurrencies between users, effectively turning the platform into a fully-featured crypto wallet.

Previously, PayPal users were only able to buy, sell, hold and pay using popular cryptocurrencies - and only in select countries like the US and UK.

But the latest update introduces the ability for US-based users to send and receive cryptocurrencies, transfer coins into PayPal from third-party exchanges and move coins into external wallets.

PayPal goes big on crypto

PayPal first announced its foray into the world of cryptocurrencies back in October 2020, at which point it granted US-based customers the ability to store select crypto tokens (including Bitcoin, Ether and Litecoin) against their accounts.

At the time, the company cited opportunities around financial inclusion as the primary reason for the initiative, as well as an ambition to increase the utility of cryptocurrencies in the context of ecommerce.

In August 2021, the payments giant extended its cryptocurrency offering to users in the UK, following positive feedback from users on home soil.

The latest update perhaps marks an inflection point for PayPal, which had previously attempted to silo its crypto services by limiting the opportunity to shift holdings freely.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

“Allowing PayPal customer the flexibility to move their crypto assets into, outside of, and within our PayPal platform reflects the continuing evolution of our best-in-class platform and enables customers to interact with the broader crypto ecosystem,” wrote Jose Fernandez da Ponte, who leads the crypto initiative at PayPal.

“We’re excited to connect PayPal’s customers to other wallets, exchanges, and applications, and we will continue to roll out additional crypto features, products and services in the months ahead.”

Fernandez da Ponte also announced that PayPal has been granted a full Bitlicense by the New York Department of Financial Services (NYDFS), which he described as a demonstration of the firm’s commitment to all regulatory guidelines that apply to its dealing in the crypto space.

The decision to push further into the industry comes amid a steep drop-off in the price of all major cryptocurrencies, caused in part by the decoupling of multiple stablecoins from their respective pegs, which has wiped out billions of dollars in value. Down from an all-time high of $68,990/unit in November 2021, Bitcoin is currently trading at circa $31,000 per coin.

Joel Khalili is the News and Features Editor at TechRadar Pro, covering cybersecurity, data privacy, cloud, AI, blockchain, internet infrastructure, 5G, data storage and computing. He's responsible for curating our news content, as well as commissioning and producing features on the technologies that are transforming the way the world does business.