TechRadar Verdict

Although MyFico is a costly product, it provides several useful features for credit reporting and an excellent user experience- from a reputable company as well. A FICO score is the industry standard, and MyFico has a polished look that makes the extra cost worthwhile, particularly if you're defending your identity against fraud.

Pros

- +

Brilliant interface

- +

Excellent simulator

- +

Powerful features

Cons

- -

Expensive

- -

No free trial

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

There is finally an identity theft prevention program worth your time and money among the sea of rivals. This makes some sense considering that MyFico is the consumer arm of the business that created the FICO credit score, which has been "An industry standard for more than 25 years."

MyFico places a strong emphasis on your credit score and credit reporting, offering a variety of educational content in addition to a good number of details about your credit situation. The mobile app delivers information in a vibrant and understandable manner and has a more polished appearance than the majority of the applications we've tried. Although this product typically costs more than others, it satisfies every requirement for a high-quality product.

To begin with, the UI is simple and easy to use. We can't stress this enough because a clumsy and uninteresting UI makes any program difficult to use. Finding the features you require quickly can help you fend off a criminal or hacker attempting to steal your personally identifiable information, which makes identity theft protection all the more crucial. The interesting, colorful display of credit scores from MyFico includes pop-up alerts that warn you of potential risks.

Like other items, the app offers $1 million in identity theft protection, but even some of the more basic competitors include it. A credit score simulator is also available, allowing you to evaluate, for instance, how a new auto loan may affect your credit. The organization that runs MyFico is well-known and reputable. In general, this is a clever and effective product for keeping an eye on your online persona.

<a href="https://aurainc.sjv.io/c/221109/899264/12398?subId1=hawk-custom-tracking&sharedId=hawk&u=https%3A%2F%2Fbuy.aura.com%2Ftechradar" data-link-merchant="buy.aura.com"">Reader Offer: Save up to 50% on Aura identity theft protection

TechRadar editors praise Aura's upfront pricing and simplicity. Aura also includes a password manager, VPN, and antivirus to make its security solution an even more compelling deal. Save up to 50% today.

Preferred partner (<a href="https://www.techradar.com/news/content-funding-on-techradar" data-link-merchant="techradar.com"" data-link-merchant="buy.aura.com"">What does this mean?)

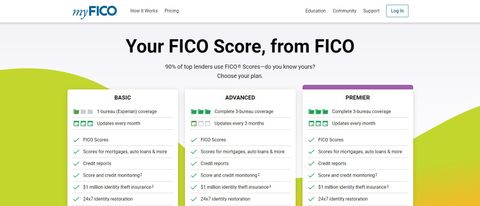

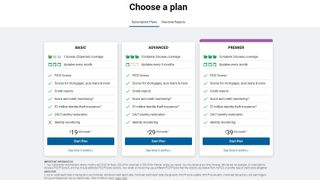

MyFico: Plans and pricing

Like other items, the app offers $1 million in identity theft protection. But even the most basic pricing scheme includes it. A credit score simulator is also available, allowing you to evaluate, for instance, how a new auto loan may affect your credit. The organization that runs MyFico is well-known and reputable. In general, this is a clever and effective product for keeping an eye on your online persona.

The Advanced plan, priced at $29.95 per month, is the next rung up. This is a more comprehensive plan because you can check credit reports from three different agencies, but the updates are at a lower frequency of every three months. The app monitors thousands of websites for personal identity fraud and other credit issues as part of this plan's addition of identity theft protection. The plan otherwise is the same as the bottom one.

The Premier plan, which is the top choice, has the highest price in this software category for identity theft protection. It offers monthly credit reports and updates from all three agencies for a hefty monthly fee of $39.95, making it the most comprehensive coverage. It does not, however, include any extra features to make this more enticing.

We also did not find any annual discounts, or a free trial. While you can cancel at any time, there are no refunds.

MyFico: Interface

MyFico is a standout in the world of identity theft prevention software since many others appear and operate like a clumsy tax program from a decade ago. With a vibrant credit score indicator and a more contemporary style, the mobile app in particular looks quite appealing.

The mobile app's layout is clean and effective, so you can quickly check your credit score, look into issues, or evaluate and address identity theft notifications. The credit score simulator's operation is also commendable; it functions more like a wizard, showing potential outcomes if you decide to purchase a home or a car so you may decide whether it would be wise to do so.

It's worth the higher price tag if the interface's simplicity genuinely enables you to address an identity theft issue or prevent a credit problem as a result of the simulator and how it all functions. Even though the features of other identity theft apps are also impressive, they can be more difficult to find and use because of a cumbersome and antiquated interface.

MyFico: Features

MyFico doesn't create a new wheel or even modify an existing one. Credit ratings, monitoring, and threat detection for your personal information (the app can examine thousands of websites in search of potential identity theft issues) are all quite obvious functions. The American Bankers Insurance Company of Florida underwrites a $1 million identity theft protection insurance policy that is included in all plans. It's all presented in a simple manner that will highlight any issues with your credit history.

Moreover, there is a FICO Score Simulator. Using this application, a user can simulate the effects of certain financial decisions on their FICO credit score, such as borrowing money to buy a car or get a mortgage. Users can investigate up to 24 different financial scenarios and observe the results. In fact, you can even monitor prospective effects on each of the three credit bureaus at once.

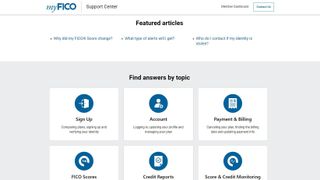

MyFico: Support

Users who are facing problems can get assistance from the MyFico support team. A direct toll-free number is provided, along with what appears to be an email address but, upon selecting it, directs the user to a support portal. The business is open Monday through Friday from 6 AM to 6 PM and on Saturday from 7 AM to 4 PM PST. There are no choices for faxing or chat.

Additionally, there are articles categorized by subjects such as "Why did my FICO Score change?" and professional credit education. A discussion board, ebooks, or video content are not current options.

MyFico: The competition

The cost is the foremost reason that we would be reluctant to suggest MyFico to anyone interested in safeguarding their online identity. Nearly every other low-cost identity theft app we have looked at, including Complete ID and Allstate Identity Protection, costs less than even the MyFico Basic plan at $19.95. When you upgrade to the subscription that offers monthly data from three credit bureaus, you'll discover that the cost is higher than that of Norton LifeLockand most other identity theft protection software currently available. Additionally, we wish there was a method to pay for a single search so that this made more sense for individuals with limited usage who weren't searching for a monthly plan.

MyFico: Final verdict

Having said that, we enjoy the user interface and feature set that are offered. You won't have to wonder which obscure identity theft company is guarding your information and warning you about issues because the company supporting this solution is well-known and well-established. One of the best ways to decide whether you need to check into credit history issues is by using your FICO score.

Additionally, we appreciate that even the entry tiered plan still covers identity theft insurance in the event of fraud. If you need to call and address a problem, MyFico representatives are available all day. Although we think this MyFico solution is good and recommend it, Norton LifeLock and IdentityForce are superior choices because they have more features at a more affordable price point.

We've also highlighted the best identity theft protection

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.