TechRadar Verdict

Pocketguard is an invaluable tool for getting a comprehensive and regularly updated overview of your money situation. It works best on mobile devices providing you with an excellent on-the-go budgeting solution.

Pros

- +

A doddle to master

- +

Great Mac and Android apps

- +

Safe and secure

- +

Excellent alert system

Cons

- -

Only for more basic money matters

- -

Some hiccups connecting to banks

- -

Desktop experience less cool

- -

No phone support

Why you can trust TechRadar

Pocketguard is perfect you’re often in the position where you’re feeling a little bit nervous about just how much you're spending and need to do a bit of expense tracking. This is a financial management app, for both Mac OS and Android, plus there’s a desktop edition too and it's particularly useful during the coronavirus pandemic.

However, if you're looking for a handy quick reference guide to your finances at any time of the day, or night, then the mobile edition of this package is certainly one to try.

It’s available for both the US and Canadian markets and allows you to get all of your incomings and outgoings into one convenient place and subsequently get budgeting much more efficiently thanks to its central In My Pocket star feature. It sits alongside other similar products in this area including QuickBooks, Rydoo, Expensify, Hurdlr and Zoho Expense.

- Want to try Pocketguard? Check out the website here

Pricing

Pocketguard comes in a basic edition, which is still pretty well stacked, that comes with no cost attached. If you’re suitably smitten with what it does then you may want to boost the usability by plumping for the Pocketguard Plus model, that comes with a $3.99 monthly subscription cost or it can also be had for a one-off $34.99 annual charge.

Features

Pocketguard gets straight to the point when you first download it with a no-nonsense approach of doing a deep dive into your finances and getting you on the straight and narrow. In a nutshell, it’ll provide you with a one-stop money management solution that lets you track spending and develop a clearer picture of your financial situation.

Highlights include the capacity for tracking your incoming and expenses, seeing just how much you've got spare while it also lets you build up a bigger picture of your money matters over time. Other key features are the options for creating spending limits so you can cap outgoings where needed, as well as the capacity for setting savings goals.

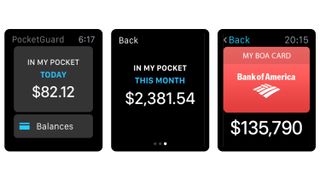

Add it all together and the picture of your finances becomes very clear indeed. Once you’ve got all your data into the software you’ll have an In My Pocket zone, which is the true strength of the app as it gives an instant overview of your money.

Performance

You’ll find that Pocketguard works with zingy efficiency on both the Mac iOS and Android app editions of the software, with a neat and tidy interface that is suitably tap-friendly.

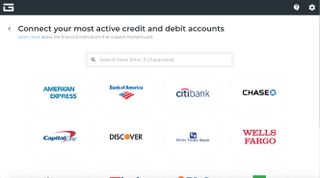

While the web-based variation on the theme is similarly speedy you’ll find that Pocketguard is most able when it’s getting on with business on your mobile phone or tablet. There’s very minimal effort involved in setting up the app to link to your bank accounts and once you’ve got that in place you should find that Pocketguard will work very dependably.

Ease of use

There’s very little to get tangled up with when you’re using Pocketguard. In fact, as finance management and budgeting tools go, this is one of the easiest to master there is.

The developers behind Pocketguard have obviously thought long and hard about how to make money management tools visually interesting and while the app does a lot, it gets the job done in a wonderfully simplistic way. It's hard to make any kind of personal finance or budgeting software interesting, but Pocketguard provides you with a really rather enjoyable way to shuffle through your money matters.

You might find that there are a few hiccups during the initial setup that involves connecting to your accounts, but the Pocketguard engineers have been working hard at making this just as straightforward as the rest of the user experience.

Support

Like most other budgeting software tools you’ll find that Pocketguard comes with a support option, although currently that doesn't seem to extend to calling them up. Nevertheless, if you head over to the Help section on their website you’ll find that it’s provides a cornucopia of information and answers.

And, even if all this information doesn't get to the bottom of your query then there is also the ability to email them and ask a question first hand. Another bonus on the support front is the Pocketguard blog, which delivers a neat additional insight into the way the software ticks.

Final verdict

Pocketguard comes highly recommended if you’re after a budgeting software solution that can stay with you wherever you go. Being able to dip into the app on your phone or tablet gives you a safe and secure overview of money going in and out.

Pocketguard uses 256-bit SSL encoding to safeguard that data, while there’s a neat 4-digit PIN system for keeping sensitive information even more locked down, which makes it ideal for mobile devices.

With a user interface that has been optimized for the mobile environment, this is also a power-packed budgeting package that should reassure you if you regularly fret about what kind of shape your finances are in.

- We've also highlighted the best budgeting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.