Why 2015 is the year mobile payments could finally take off

Smart payments for the masses

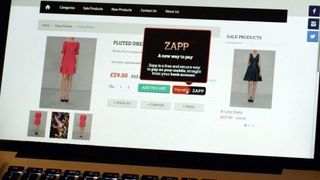

Keenan is eager to emphasise the benefits that Zapp has over the physical payment systems we've come to rely on. While he admits that cash is probably never going to go away completely, there are a lot of benefits to a system that's digital and mobile.

"Obviously for things like remote payments cash clearly doesn't work," he told us. "Online and e-commerce, these are growing parts of the market. Cards were designed very much for a physical world and started in the mid-50s out in the US... perfect for going into hotels and paying for hotels, less good for buying online, less good for billing or any of that."

"The great thing about Zapp is, because we've designed it from the ground up, we've designed it to be primarily for the digital world. In other words, it's got to work across all channels, and we don't use static data."

Static data here refers to the 16-digit PAN code on your credit card: it doesn't change and it's easy to copy, which is why when you make an online payment with a card there are so many security hoops to jump through. Mobile payment systems are much harder to break into because the security tokens change all the time.

It's also a system that works across multiple channels, from your supermarket to your web browser. Upgrading the necessary hardware and software will take time, but it looks like both the customer demand and the back-end technology are now in place, and the banks are taking notice.

"The speed of adoption of new technology is exciting," said Paul Horlock, Nationwide Building Society's Head of Payments in an email to TechRadar. "In July 2014, just 20 months after its launch, we serviced more transactions on our mobile app than on our Internet bank, which has been around since 1997."

"This shows how UK customers are ready to embrace new mobile technology and we expect mobile payments to also prove popular with customers."

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

As well as being involved with Zapp, Nationwide is also signing up with Paym, the peer-to-peer payments system that lets you send money to anyone via a mobile number. This kind of system is much better established, with the likes of Barclays Pingit, PayPal and even Gmail all offering similar person-to-person payment functionality.

Payments on demand

"I think there's great customer appetite and latent demand for technology like Apple Pay and Zapp," says Keenan. "The mobile phone is very much becoming an extension of our lives. We've got our contacts on there, we've got our photographs on there, we've got our email on there, we can phone people on it, now you've got a bank on there."

"[Mobile payments] are just another logical, sensible thing to be able to do with your phone, so I think mobile payments as a category, are really now set to take off," he explained. "The conditions are ripe, both in terms of the customer appetite, but also the merchant readiness. We're at that sort of inflection point now where I think it'll really take off here."

The Zapp CEO is welcoming Apple Pay to the scene too, even if it might be taking customers and transactions away from his company's own ecosystem. "Apple coming into the market helps as well, because up until that point Apple were very much not in the NFC camp... [and] that was putting a big question mark over NFC."

"But Apple joining the party, that's got the whole market now very much lined up behind NFC. So the debate with any retailer now upgrading their terminals is you'd be nuts not to upgrade to an NFC-enabled terminal."

Customer demand, retailer readiness, the arrival of Apple... these are the signs that a mobile payments revolution is almost upon us, though there are likely to be some bumps in the road along the way.

Keenan estimates that around 35%-40% of merchant terminals in the UK are NFC-compatible (ready for contactless credit cards and mobile payments) - in the US, that figure is more like 5%, thanks largely to the out-dated magstripe credit card technology that still dominates there.

Meanwhile, iOS is much more dominant in the US than it is in the UK, which might give Zapp a window of opportunity before Apple Pay arrives. We asked Apple when its payment system would be launching on this side of Atlantic and were directed towards Tim Cook's comment in January: "2015 will be the year of Apple Pay." Before Christmas then, Tim?

Samsung Pay, meanwhile, arrives in the US and Korea this summer, and will then "expand to other regions later, including Europe and China" according to a Samsung spokesperson.

Zapp is launching this summer with a "first wave" of banks and retailers, and then the company hopes to add more partners as time goes on. If it takes hold, we'll at last be able to leave the wallets and purses at home and rely on our mobile phones and wearables – but don't cut up your credit cards just yet.

Dave is a freelance tech journalist who has been writing about gadgets, apps and the web for more than two decades. Based out of Stockport, England, on TechRadar you'll find him covering news, features and reviews, particularly for phones, tablets and wearables. Working to ensure our breaking news coverage is the best in the business over weekends, David also has bylines at Gizmodo, T3, PopSci and a few other places besides, as well as being many years editing the likes of PC Explorer and The Hardware Handbook.

Most Popular