TechRadar's Sustainability Week 2024

All sustainability week coverage-

7 smart home tips to help you save energy and reduce waste

Smart home devices don’t just make life easier, they can also help you save energy and minimize waste.

-

-

This Swedish startup made the tech behind the world’s first solar-powered headphones – here’s how it works

Meet the company making gadgets like headphones, speakers and remotes better for the planet with solar power.

-

Sustainability Week 2024

Sustainability Week 2024Acer shows Apple how environmentalism is done with pledge to collect equivalent of 2.5 million plastic bottles with Plastic Bank partnership

Acer is one of the best companies for living up to its green pledges – and it’s now taking on plastic waste.

-

This company is making 35-year-old Game Boys look and work like new and now I'm hooked on Tetris

Retrospekt refurbs hundreds of Game Boys, Polaroid cameras, Sony Walkmans, and other gadgets to keep them in our hands and out of landfills.

-

Brighter, low-energy OLEDs are going into production this year – but they won’t be coming to TVs just yet

New OLED displays could be twice as bright, twice as efficient and last three times longer but the best TVs won't be the first to see this new tech.

-

Explore TechRadar

Reviews

All reviews-

Updated

UpdatedDeezer review

Deezer has a huge library, minimal design and good recommendations – but there’s little to set it apart from its rivals.

-

-

Lomography Lomomatic 110 review: Brand-new 50-year-old technology

The Lomography Lomoatic 110 is a 110-film camera that's simple to load and use.

-

Asus ROG Strix Scope II RX review: a keyboard for the sophisticated gamer

A top-notch keyboard with great performance and a rich feature set, the only thing that lets the Asus ROG Strix Scope II RX down is its lackluster software suite.

-

Nikon Z 40mm f/2 review: this cheap, modern 'nifty forty' has been my everyday lens for over a year and it hasn't let me down

Nikon's cheapest prime is a cost-effective entry-point into the Z mount ecosystem and a great take on the 'Nifty Fifties' of old.

-

Instant Vortex 9-quart Air Fryer with VersaZone technology review: competent, but not flawless

The Instant Vortex Air Fryer with VersaZone technology serves up a large single cooking basket that can be divided into two for fuss-free air frying.

-

Withings ScanWatch Nova review: analog looks with exceptional digital brains

The Withings ScanWatch Nova 2 is an unassuming yet powerful smartwatch and health tracker.

-

JLab JBuds Lux ANC review: budget headphones that are all about that bass

The JLab JBuds Lux ANC are the brand's first 'luxury' over-ear headphones, which offer lots of bass but a few aches too.

-

How TechRadar tests

Product testing for the real world

You need to know that the device or service you’re about to spend money on works as advertised - and that it works in the real world.

- We test properly: objective and subjective testing

- We use experienced experts for our reviews

- We always offer 100 per cent unbiased, independent opinions

reviews

hours' testing

buying guides

Phones

All Phones-

Updated

UpdatedThe best power banks 2024

Here are the best power banks, whether you're after a slim portable charger for phones or a large bank to juice up your tablet.

-

-

This Game Boy-styled MagSafe stand just tickled my retro-gaming synapse – now all I need is a matching controller for Nintendo emulators

This retro Nintendo MagSafe stand has me rushing for Amazon – just take my money.

-

Does closing apps on your iPhone save battery life? The surprising answer is no – here's why

Closing background apps has a negligible impact on your iPhone's battery life and performance – and Apple's confirmed it.

-

Nothing could be working on an enhanced Phone 2a and a new flagship Phone 3

Nothing could be working on two more phones, including a Phone 2a Pro model and a Phone 3.

-

Gemini AI is heading to older Android phones, and could get a new 'conversation' mode

Fresh leaks around the Gemini AI app for Android point to a new mode and support for older devices.

-

Don't miss the Samsung Galaxy S23 Ultra for just $849 at Best Buy right now

Best Buy has cut more than $500 off the Samsung Galaxy S23 Ultra, bringing the price down to just $849.

-

Huge Samsung Galaxy S24 sale: get our best-rated Android phone for a record-low price

Best Buy is running a sale on the Samsung Galaxy S24 range with savings of up to $200 available on all handsets.

-

Laptops & Computing

All Laptops & Computing-

Adobe's next big project is an AI that can upscale low-res video to 8x its original quality

Blurry clips improved by Adobe's VideoGigaGAN AI can display hi-res textures and more making videos look realistic.

-

-

Updated

UpdatedThe best gaming PC 2024

Finding the best gaming PC for you can be tricky, with confusing spec sheets and numerous configurations - but we're here to help.

-

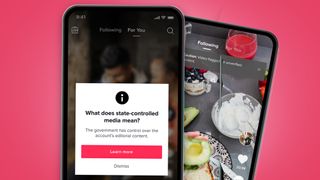

The TikTok ban just got closer – here's what the new US law means and what happens next

TikTok now faces the very real prospect of being banned in the US, unless its owner sells the app. Here's what happens next.

-

AI Explorer could revolutionize Windows 11, but can your PC run it? Here's how to check

AI Explorer is an exciting feature coming to Windows 11, but your PC might not be able to run it. Here's how to check.

-

AMD's flagship graphics card, the RX 7900 XTX, is under $850 for the first time ever

The AMD Radeon RX 7900 XTX, AMD's flagship graphics card, has dipped below the $850 price threshold for the first time ever.

-

Google Maps is getting a new update that’ll help you discover hidden gems in your area thanks to AI - and I can't wait to try it out

Google Maps has an upcoming AI feature that’ll make it much easier to discover new places in your town.

-

Bad news, Windows 11 users: ads are coming to the Start menu, but there’s something you can do about it

Microsoft's optional Windows 11 update introduces ads in the Start Menu, sparking discussion over intrusive marketing tactics and user experience.

-

Apple

All Apple-

Updated

UpdatedThe best cheap tablets 2024

Looking for the best cheap tablet that's actually worth buying? Whether you're after an Amazon, Android, or iPad tab, you'll find our favorite budget options here.

-

-

Updated

UpdatedThe best iPad 2024

Whether you want the best iPad Pro or the best cheaper iPad, a small iPad mini or a thin-yet-powerful iPad Air, you'll find the top options here.

-

Apple sale at Best Buy - I've picked the 8 best deals on iPads, AirPods and MacBooks

Over a dozen Apple deals are now live at Best Buy so I've searched through the sale and picked out 8 of the best ones on iPads, AirPods, MacBooks and iPhones.

-

Report claims Vision Pro sales have ‘fallen sharply’ as Apple struggles to whip up demand

An Apple analyst believes Apple has slashed shipments of the Vision Pro as it has struggled to generate sales.

-

The 11-inch iPad Pro 2024 might be hard to get hold of at launch

Samsung is reportedly having issues making screens for the 11-inch iPad Pro 2024, which could lead to limited supplies.

-

Streaming

All Streaming-

Netflix's Wednesday season 2 cast clicks into gear with Westworld star addition as Apple's Neuromancer series finds its lead

Some top-tier talent just joined some of our most-anticipated streaming shows from Apple TV Plus and Netflix.

-

-

Netflix's official Atlas trailer puts Jennifer Lopez in another generic Terminator clone, but with Titanfall-like mechs

It feels like we've seen and heard a lot of this before. Is Netflix's new Atlas movie more than its obvious sci-fi influences?

-

Prime Video movie of the day: Interstellar is Christopher Nolan's best movie

Nolan's space thriller is epic and personal in equal measure.

-

Netflix movie of the day: May December is a crafty satire of tabloid true stories and, smartly, itself

Built on three amazing acting performances, this film walks the line between comedy and genuine family drama.

-

Netflix subscribers can’t get enough of 2019 spy thriller Anna – watch these 3 skilful assassin movies next

There's plenty of kills, thrills and bellyaches in these three very different spy movies about killers.

-

TVs

All TVs-

-

Best Buy is slashing prices on our best-rated OLED TVs - save over $1,000 while you can

Best Buy is having a huge sale on our best-rated OLED TVs, and I'm rounding up the best deals with over $1,000 from Samsung and LG.

-

Updated

UpdatedThe best indoor TV antennas for 2024

These are the best indoor TV antennas for watching free TV channels at home.

-

How to buy a good secondhand TV, or make your old TV last longer

Buying a secondhand TV is a great way to save money and help prevent waste, but navigating it can be a bit of a minefield - we're here to help with that.

-

Brighter, low-energy OLEDs are going into production this year – but they won’t be coming to TVs just yet

New OLED displays could be twice as bright, twice as efficient and last three times longer but the best TVs won't be the first to see this new tech.

-

JMGO’s new 4K projector has a built-in gimbal so you can place it anywhere in your home

The new JMGO N1 Ultra promises to be the perfect projector for pretty much any space.

-

New Google TV 4K streaming stick tipped to land soon – and it could come with a new remote

Nearly four years after the Chromecast with Google TV 4K launched, there are rumors that a new one could launch soon.

-

Hot deals

Hot dealsThe cheapest OLED TV deals and sales for April 2024

Your guide to the best OLED TV deals with incredible sales from brands like Sony, LG, and more.

-

Audio

All Audio-

-

Updated

UpdatedDeezer review

Deezer has a huge library, minimal design and good recommendations – but there’s little to set it apart from its rivals.

-

'In the beginning I didn't want to – my son persuaded me': why Audiovector's Trapeze Reimagined speaker is a 45-year family affair

Audiovector is a Danish outift that's serious about sound, but it's also the father-and-son heartwarming hi-fi tale you need.

-

Soundcore's new sports earbuds offer a Powerbeats Pro-style customizable secure fit for a fraction of the price

The Sport X20 specializes in customization as you can adjust the hook to fit your ear and tweak its audio output.

-

TechRadar Deals

TechRadar DealsBest Apple Memorial Day sales 2024: date and deals to expect

Your guide to this year's Memorial Day Apple sales event, with key information such as the date and deals to expect.

-

The best wireless earbuds 2024

Here are our picks of the best wireless earbuds for Android, for iPhone, or anything else you want to connect them to.

-

This Android phone for audiophiles offers a hi-res DAC, balanced output and 3.5mm jack – plus a cool cyberpunk look that puts Google and OnePlus to shame

Stylish audio brand Moondrop’s first phone is more of a hi-res digital audio player with OnePlus and Google Pixel features.

-

Sonos' new app is a smarter, slicker music center that's perfect for, say, a pair of headphones

The next-gen Sonos app aims to deliver all your favorite audio in one smart home screen.

-

Health & Fitness

All Health & Fitness-

-

Updated

UpdatedThe best bone conduction headphones 2024

Looking for the best bone conduction headphones to keep you aware of the outside world? Here are our top picks.

-

Wear OS 5: what we want to see, and all the leaks so far

Wear OS 5 could land this year. Here's what we've heard about it and what we want from it.

-

OnePlus Watch 2 Nordic Blue is the Wear OS dive watch I’ve been waiting for

OnePlus Watch 2 gets a dive watch makeover reminiscent of the Samsung Galaxy Watch 6 Classic.

-

Cameras

All Cameras-

-

Updated

UpdatedThe best camera for photography 2024

Our guide to the best camera for photography will help you find the right digital camera for you, whatever your budget.

-

Updated

UpdatedThe best cameras for vlogging 2024

Our guide to the best cameras for vlogging rounds up all of our top picks for on-the-move video creators, at all price points.

-

Lomography Lomomatic 110 review: Brand-new 50-year-old technology

The Lomography Lomoatic 110 is a 110-film camera that's simple to load and use.

-

Updated

UpdatedThe best compact cameras for 2023

Our best compact camera for 2024 guide will help you find the right pocket camera for you, whatever your budget.

-

Home

All Home-

-

Updated

UpdatedThe best vacuum cleaner 2024

These are the fastest, quietest, smartest, most powerful vacuum cleaners for every kind of home.

-

New Google Nest Audio and Nest Hub Max devices could be in the works

Google could be working on new Nest Audio and Nest Hub Max devices, and there's potential for generative AI to be front and center.

-

This company just bioengineered a plant-bacteria combo to clean air better than an air purifier

Neoplants Neo PX is both a plant and an air-cleaning system

-

Instant Vortex 9-quart Air Fryer with VersaZone technology review: competent, but not flawless

The Instant Vortex Air Fryer with VersaZone technology serves up a large single cooking basket that can be divided into two for fuss-free air frying.

-

Buying guides

All Buying Guides-

Updated

UpdatedThe best gaming PC 2024

Finding the best gaming PC for you can be tricky, with confusing spec sheets and numerous configurations - but we're here to help.

-

-

Updated

UpdatedThe best cheap tablets 2024

Looking for the best cheap tablet that's actually worth buying? Whether you're after an Amazon, Android, or iPad tab, you'll find our favorite budget options here.

-

Updated

UpdatedThe best power banks 2024

Here are the best power banks, whether you're after a slim portable charger for phones or a large bank to juice up your tablet.

-

Updated

UpdatedThe best iPad 2024

Whether you want the best iPad Pro or the best cheaper iPad, a small iPad mini or a thin-yet-powerful iPad Air, you'll find the top options here.

-

Updated

UpdatedThe best vacuum cleaner 2024

These are the fastest, quietest, smartest, most powerful vacuum cleaners for every kind of home.

-

Updated

UpdatedThe best camera for photography 2024

Our guide to the best camera for photography will help you find the right digital camera for you, whatever your budget.

-

Updated

UpdatedThe best bone conduction headphones 2024

Looking for the best bone conduction headphones to keep you aware of the outside world? Here are our top picks.

-

Why we're experts

We care passionately about tech

The TechRadar team has a life-long passion for the latest innovations – over 300 years of experience between us, in fact – and we’ve made it our mission to share that combined knowledge and expertise with you.

We’re here to provide an independent voice that cuts through all the noise to inspire, inform and entertain you; ensuring you get maximum enjoyment from your tech at all times. Technology is our passion, so let us be your expert guide.

years' experience

how-tos written

Apple events covered

Deals

All Deals-

-

Deals

DealsMother's Day sales 2024: deals from Walmart, Target, Amazon and more

Your 2024 Mother's Day sales guide with all the best deals from Walmart, Target, and Amazon on gifts, jewelry, flowers, and more.

-

Amazon has a ton of cheap tech gadgets on sale – I've found the 13 best ones

Amazon has a ton of its cheap tech gadgets on sale right now, and I'm rounding up the 13 best ones with prices starting at $19.99.

-

AMD's flagship graphics card, the RX 7900 XTX, is under $850 for the first time ever

The AMD Radeon RX 7900 XTX, AMD's flagship graphics card, has dipped below the $850 price threshold for the first time ever.

-

Apple sale at Best Buy - I've picked the 8 best deals on iPads, AirPods and MacBooks

Over a dozen Apple deals are now live at Best Buy so I've searched through the sale and picked out 8 of the best ones on iPads, AirPods, MacBooks and iPhones.

-

TechRadar Deals

TechRadar DealsBest Apple Memorial Day sales 2024: date and deals to expect

Your guide to this year's Memorial Day Apple sales event, with key information such as the date and deals to expect.

-

Don't miss the Samsung Galaxy S23 Ultra for just $849 at Best Buy right now

Best Buy has cut more than $500 off the Samsung Galaxy S23 Ultra, bringing the price down to just $849.

-

-

-

OnePlus Coupons for April 2024

Use these OnePlus coupons to get a better price on mobiles & accessories from the leading Android smartphone retailer.

-

Keeper Security Promo Codes for April 2024

Look through our Keeper Security promo codes to save on subscriptions to the online password manager and protect your details online for less.

-

Casper Coupons for April 2024

These Casper coupons can help you save big on your next bedding purchase from sheets, pillows, mattresses, and more.

-

Paramount Plus Coupon Codes for April 2024

Our Paramount Plus coupon codes can be added to your subscription to help you save on monthly streaming fees.

-

TechRadar's story

Our mission is unchanged

TechRadar was launched in January 2008 with the goal of helping regular people navigate the world of technology. It quickly grew to become the UK's biggest consumer technology site.

Expansions into the US and Australia followed in 2012 and we are now one of the biggest tech sites in the world.

- We've been covering tech since 2008

- 17 international editions from Mexico to New Zealand

- We're a globally respected brand worldwide

Software

All Software-

-

Adobe's next big project is an AI that can upscale low-res video to 8x its original quality

Blurry clips improved by Adobe's VideoGigaGAN AI can display hi-res textures and more making videos look realistic.

-

AI Explorer could revolutionize Windows 11, but can your PC run it? Here's how to check

AI Explorer is an exciting feature coming to Windows 11, but your PC might not be able to run it. Here's how to check.

-

Google Maps is getting a new update that’ll help you discover hidden gems in your area thanks to AI - and I can't wait to try it out

Google Maps has an upcoming AI feature that’ll make it much easier to discover new places in your town.

-

Bad news, Windows 11 users: ads are coming to the Start menu, but there’s something you can do about it

Microsoft's optional Windows 11 update introduces ads in the Start Menu, sparking discussion over intrusive marketing tactics and user experience.

-

-

-

Buying Guide

Buying GuideBest HDMI cable for PS5 in 2024

This is our definitive guide to buying the best HDMI cable for PS5 no matter your requirements or budget.

-

Buying Guide

Buying GuideThe best monitors for PS5 in 2024

Make the most of your console with these recommendations for the very best PS5 monitors no matter your budget.

-

Updated

UpdatedThe Witcher 4 - everything we know so far about Polaris

The Witcher 4 release date has yet to be revealed, but it is being worked on. Here's what we know so far.

-

Xbox Series S vs Xbox One S: the cheapest Xbox consoles compared

Xbox Series S vs Xbox One S debate offers great entry points into the ecosystem, but one is starting to show its age.

-

Meet Your Experts

Between them, the TechRadar team have 300 years' experience in tech journalism. Here's why you should trust them.

-

-

Over a billion users could be at risk from keyboard logging app security flaw

Most Chinese mobile manufacturers used vulnerable keyboards which relayed keystrokes in plain text.

-

Apple is reportedly developing its own AI servers — could it be gearing up to take on Nvidia and AMD?

Apple reportedly wants to use AI to enhance its own data centers.

-

CDN network cache hacked to spread malware across the globe

Hackers are targeting companies around the world with infostealers hosted in CDN network caches.

-

VPNs explained

VPNs explainedWhat is a VPN? VPN meaning explained in 2024

VPN stands for "Virtual Private Network", a security tool that protects your online privacy and encrypts your traffic. Here's everything you need to know.

-