Best Mac personal finance apps

Managing your money doesn't have to be a burden

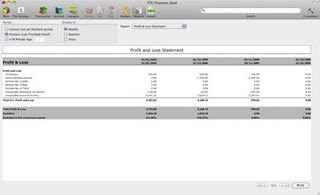

Test Three: Reports and charts

Most financial apps offer very little style and scope for modification when it comes to reports and charts. This is certainly the case with FinanceToGo and Liquid Ledger. It's also true of MoneyWell, though its charts are chosen to help you visualise how well you're keeping within budget.

Reports in iCompta are not the usual tabular summaries, but semi-graphical views of how a budget compares to actual income and expenditure. There are also charts to analyse your transactions and to predict future balance based on past history and regular transactions.

Stash can't create summary reports, but has a few chart types and a control for automatically combining small categories as 'Other'.

Money offers the most flexible options. It has 11 basic report types that you can modify and display or print as tables, charts or both. The look is basic, but if reports matter to you, this is the best and most adaptable app.

Results

Test Four: Budgeting

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

Any finance software can keep track of what you've already spent, but staying out of the red demands planning for what you intend to spend.

MoneyWell is a good choice because budgeting is what it's mainly designed for. Allocate cash to different categories and use the program to track how well you're sticking to those limits. Money also makes budgeting easy and provides a bar graph to show actual versus budgeted amounts.

iCompta is another good choice, with flexible budgeting tools and charts that predict future trends. The double-entry approach of Liquid Ledger and FinanceToGo makes budgeting too complex for home use. It's fine for planning business expenditure, but if balancing the books isn't your strong point then these programs aren't ideal.

Stash is the only app here that doesn't provide explicit budgeting tools. They're planned for an upcoming release. In the meantime you could approximate this in a Stash account.

Results

Current page: Reports & charts, and budgeting

Prev Page Ease of use and UK friendlyness Next Page Regular payments and securityMost Popular